I love Japan but I don’t want to work in a Japanese company

I’ve done a screencast (around 11 minutes long) of my talk at the Centre People Appointments HR seminar earlier this year, on why people love Japan, but don’t want to work for a Japanese company, and what Japanese companies can do about it.

If you want to know more about working in a Japanese company, you can find our Japan Intercultural Consulting e-learning modules on Teachable, starting from £39 https://japan-intercultural-emea.teachable.com/

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More

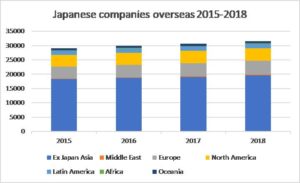

Growth in the number of Japanese companies overseas has been more muted in the past 4 years – a 7.9% increase 2015-2018. But the increase in the number of Japanese companies in Europe was above average – at 12.5%. The increases in companies in Asia (7.6%) and Latin America (5.6%) were below average – so there was a boom in Japanese investment in developing countries during the 2008-2014 period, but this died down in the past 4 years.

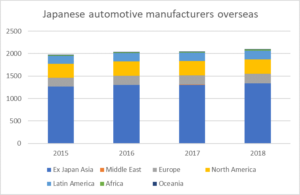

Growth in the number of Japanese companies overseas has been more muted in the past 4 years – a 7.9% increase 2015-2018. But the increase in the number of Japanese companies in Europe was above average – at 12.5%. The increases in companies in Asia (7.6%) and Latin America (5.6%) were below average – so there was a boom in Japanese investment in developing countries during the 2008-2014 period, but this died down in the past 4 years. So how about investment in automotive manufacturing – the sector that has made the most noise in Brexit UK? The number of Japanese companies overseas in the “transportation machinery manufacturing” category that Toyo Keizai uses (which presumably corresponds to automotive manufacturing) rose 6% 2015-2018, so significantly slower growth than overall. Again, Europe showed above average growth of 13%, but only represents 10% of transportation machinery manufacturers overseas operations. Over 64% of automotive manufacturer sites are in ex-Japan Asia. So although Japanese automotive companies are not pulling out of Europe – rather the reverse – the major part of Japanese automotive investment is and continues to be in Asia. So no surprises really that Honda and others are choosing to focus on Asia for electric vehicle development – that is where the largest ecosystems and supply chains are based.

So how about investment in automotive manufacturing – the sector that has made the most noise in Brexit UK? The number of Japanese companies overseas in the “transportation machinery manufacturing” category that Toyo Keizai uses (which presumably corresponds to automotive manufacturing) rose 6% 2015-2018, so significantly slower growth than overall. Again, Europe showed above average growth of 13%, but only represents 10% of transportation machinery manufacturers overseas operations. Over 64% of automotive manufacturer sites are in ex-Japan Asia. So although Japanese automotive companies are not pulling out of Europe – rather the reverse – the major part of Japanese automotive investment is and continues to be in Asia. So no surprises really that Honda and others are choosing to focus on Asia for electric vehicle development – that is where the largest ecosystems and supply chains are based.