Clear trends from less data on Japanese companies in Europe

The latest data on the numbers of Japanese companies around the world from the Japanese Ministry of Foreign Affairs was published over the summer. It’s back down to one spreadsheet, in normal sized font, where the only colours used are to highlight the title of each region. The number of spreadsheets published had mushroomed from 1 to 5 between 2013 and 2018, and even with (or maybe because of) the copious use of tabs, freeze frames and various shades of yellow, orange, green and purple, the whole thing was extremely difficult to navigate.

I used to imagine the moans of the junior civil servants putting in long hours to compile this, the sighs of the middle management having to check its accuracy, and then the teeth grinding of the general managers who wished for the older, simpler days of a printed out hard copy. In the new stripped down MoFA world, the only data disclosed is the total number of Japanese organisations in each country. There are no longer any categories regarding whether they are public limited companies, joint ventures or branches. The data on Japanese nationals resident overseas used to be combined with the data on organisations, but is now published separately.

In a way less data* is less transparency, but perhaps usability is more important than the sheer volume. This seems to have been the decision that Hitachi has made too. The number of pages of its most recent integrated report has been halved from 106 to 53. In Hitachi’s case this can be excused by the sheer size and complexity of the organisation – 320,000 employees working in a huge variety of businesses. What led to the cull was that those writing the report – the investor relations department – were also the users, who talked through the report with investors. They themselves felt it was hard to explain, and feedback from the investors also pointed to usability concerns. Hitachi has won awards for its reports, so this was a bold decision to make.

According to a survey of 881 companies by KPMG, the average integrated report in Japan had 75 pages and 66% of all surveyed companies had 61 pages or more. This ratio has increased by 4 percentage points from two years ago, thanks to the increasing obligation felt to report on ESG metrics.

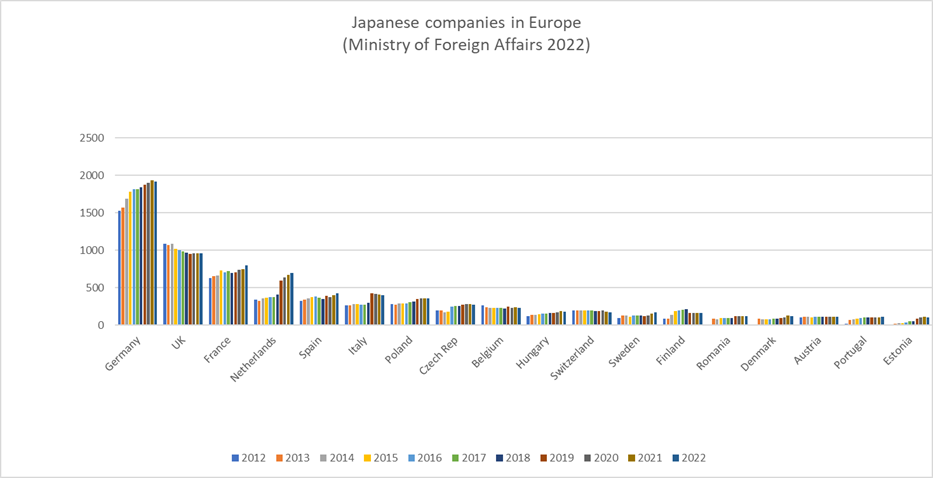

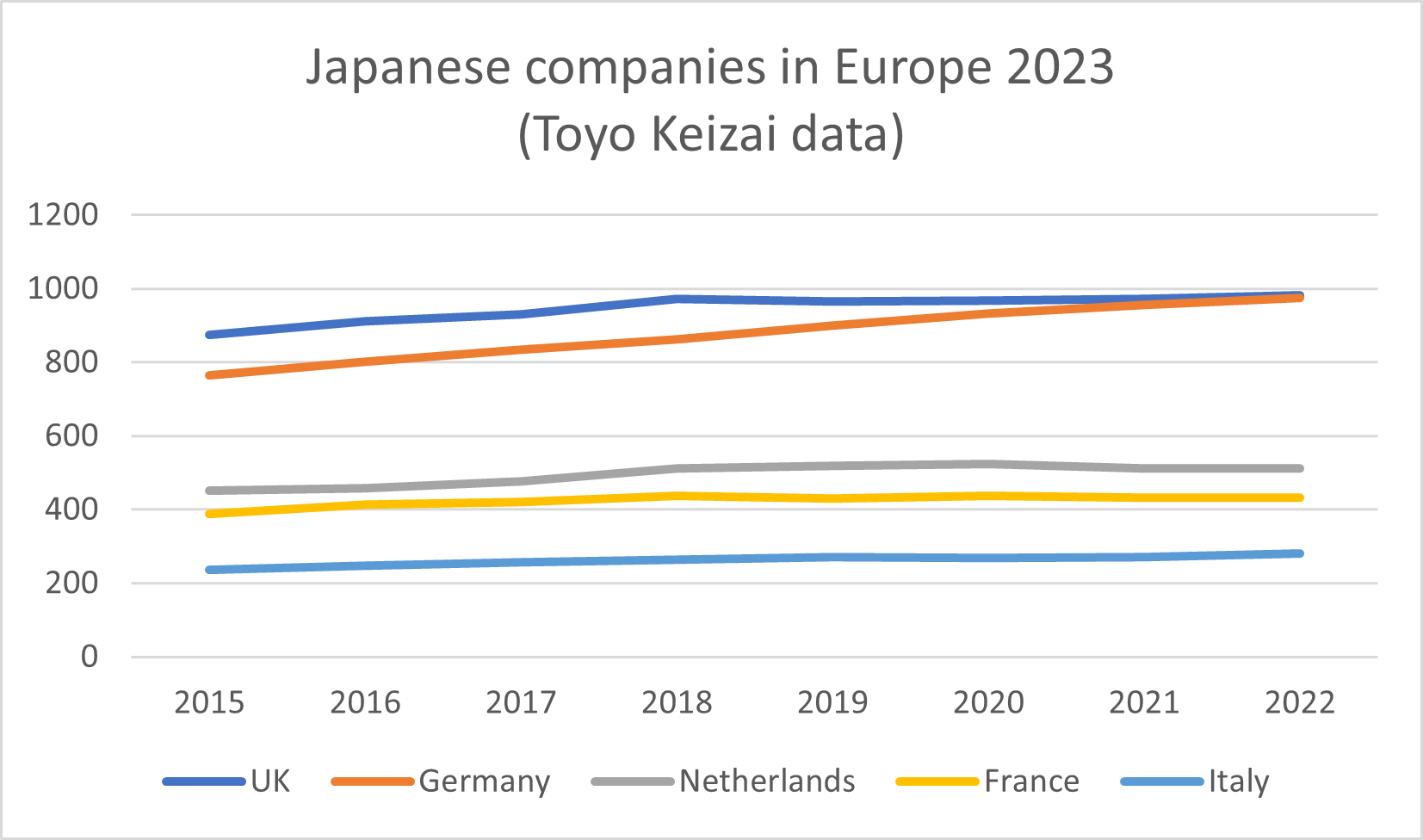

Anyway, the new simplicity means there is only one chart we can produce from the MoFA data, for countries with more than 100 Japanese companies in Europe, as below:

And yes, it does make certain trends very clear.

- Germany still dominates as a host of Japanese companies, but there seems to be a tailing off of growth (+22% since 2013)

- Conversely, the numbers of Japanese companies in the UK has fallen (-10% since 2013), but now stabilised.

- France continues to grow as a host of Japanese companies (+21% since 2013), with quite a jump in the last year. This may be as a result of the 10 or so acquisitions made of French companies by Japanese companies 2020-2022

- There was a significant leap in the numbers of Japanese companies hosted by Netherlands and Italy in 2019. It’s difficult to know whether this due to the “hard” nature of Brexit becoming clearer in 2018-9 or some change in the way MoFA was categorising its data.

- Eastern European countries, probably due to automotive and other manufacturing costs and existing skills, have become popular – Poland, Hungary, Romania, Czechia

- Smaller, more service sector oriented countries in the Nordics and Baltics are also becoming more popular such as Estonia, Denmark, Sweden

- The above has meant that Switzerland, Belgium, Finland and Austria have dropped down the rankings

*Grammar pedants may recoil from the use of “less” with “data” here. Sorry. This may reassure.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More

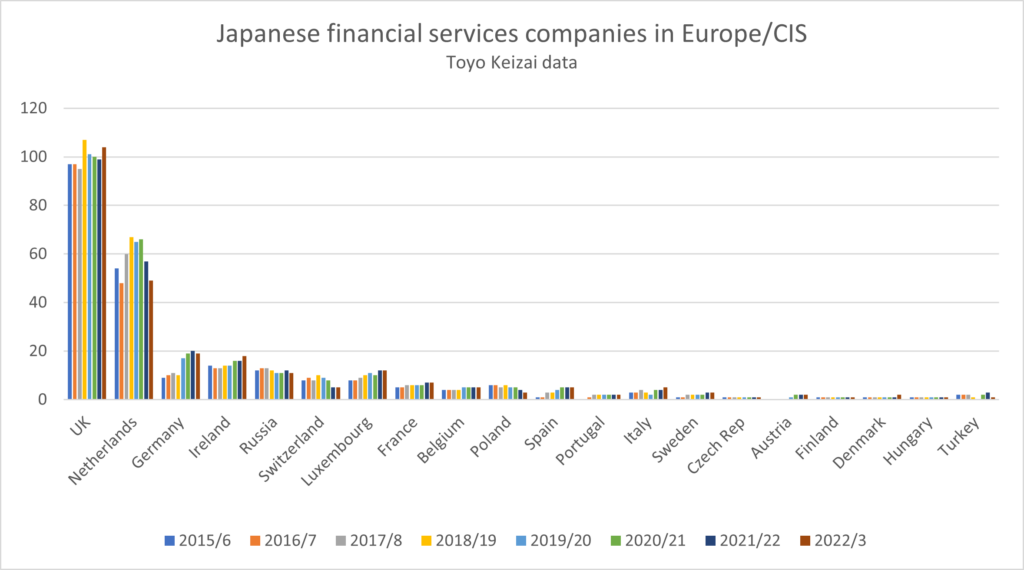

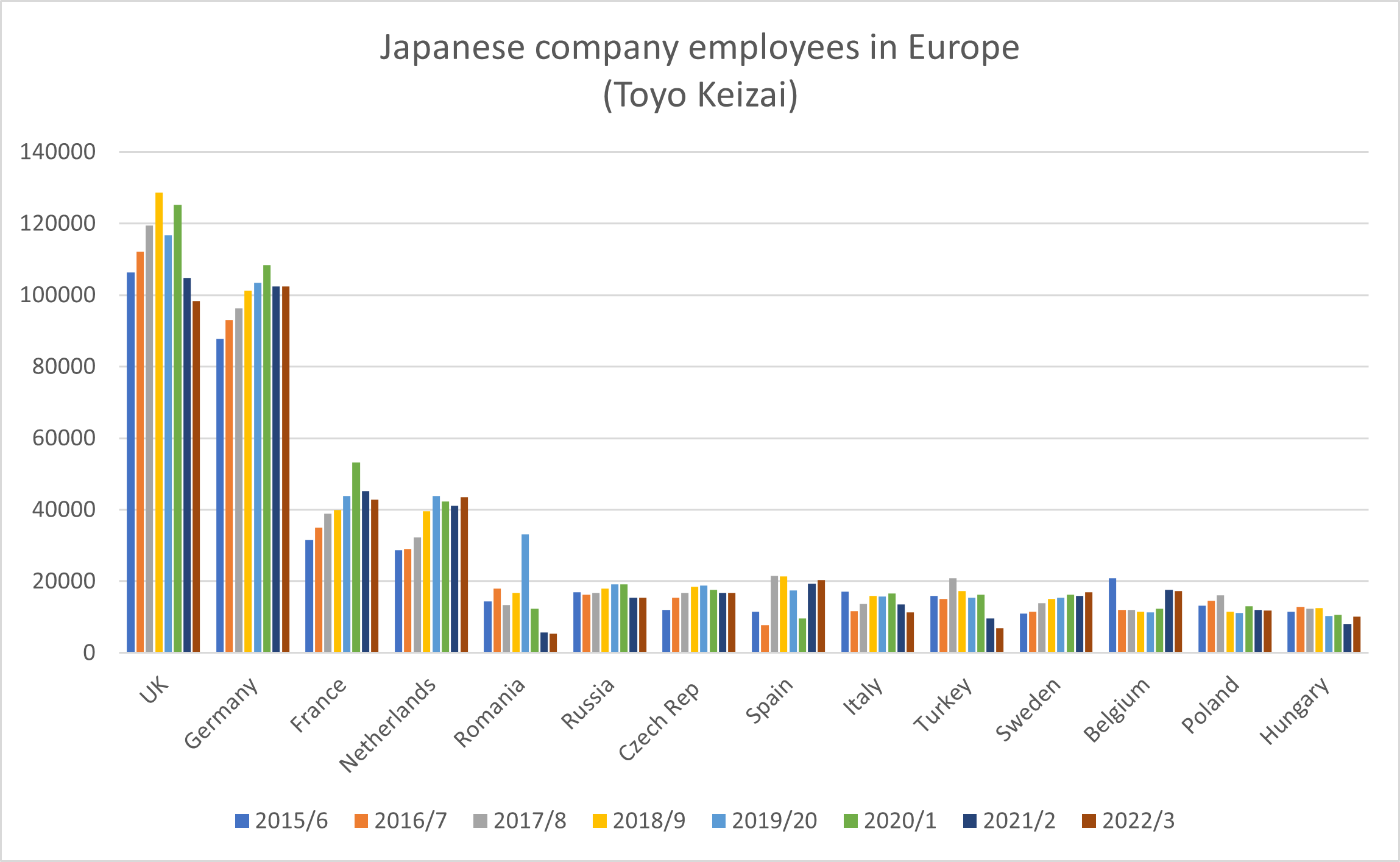

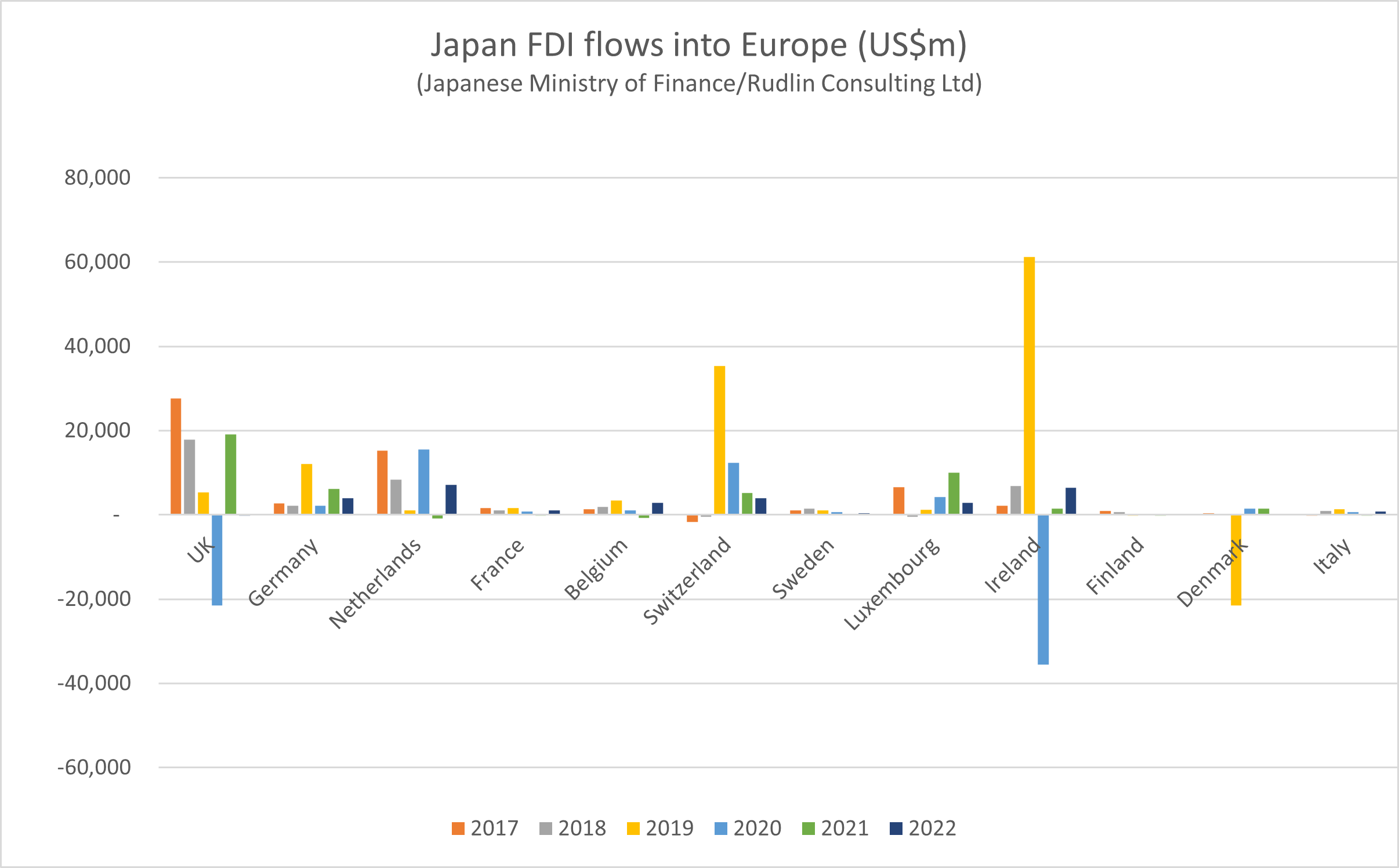

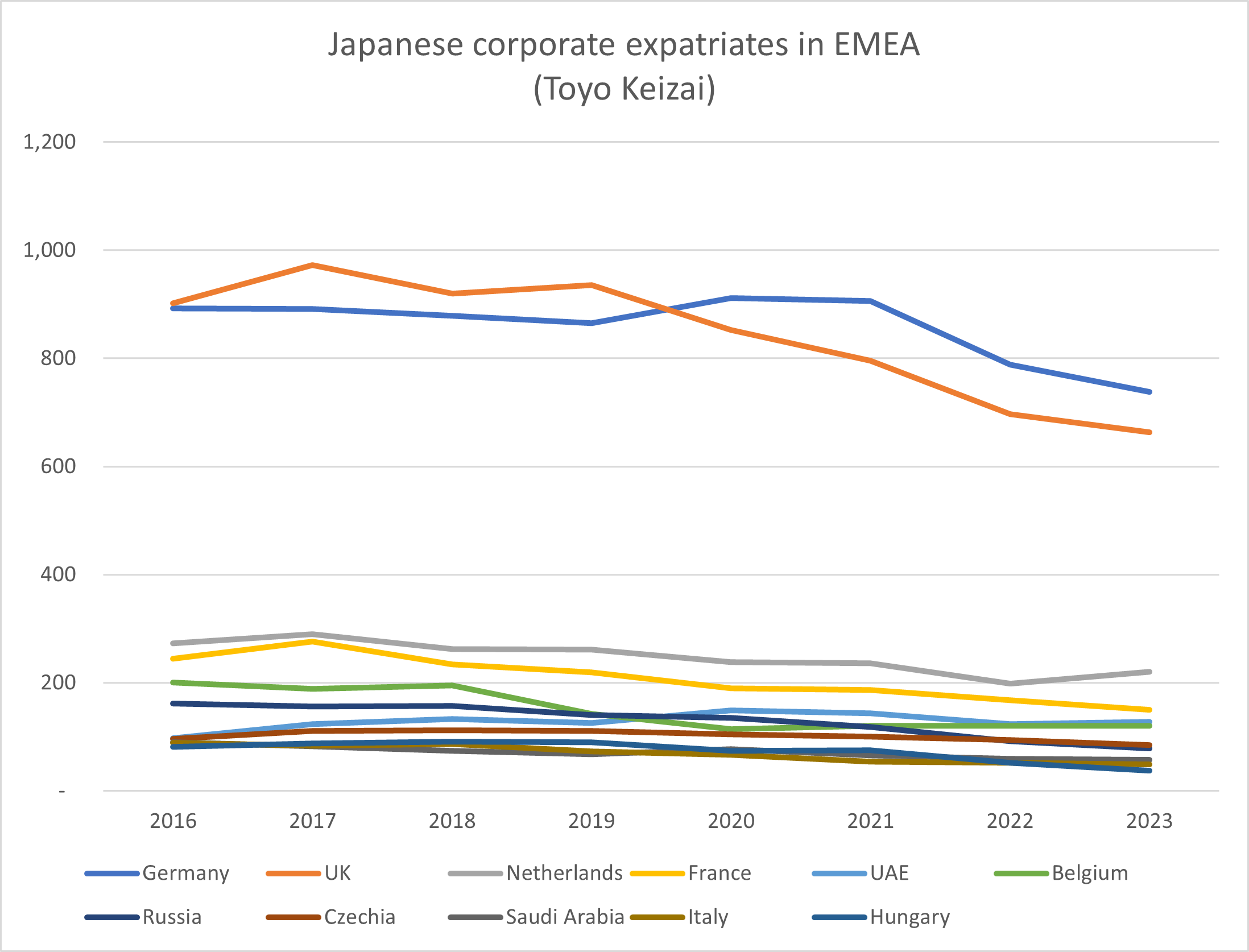

The other issue raised by the two pieces of research are whether other EU cities have benefited from any additional growth, which the UK has missed out on. As can be seen from the chart, Toyo Keizai data shows that there was an overall upward trend in the number of Japanese financial services companies in the European region, of around 12% from 2015/6 to 2022/23. The UK still dominates as a host, and the numbers of companies hosted rose 7% – so below trend. Germany doubled the number of Japanese financial services companies it hosted over the period. The numbers rose sharply in the Netherlands and then dropped. Just as Dr Hall’s research suggests, Ireland, Luxembourg and France seem to have benefited, albeit from a much smaller base.

The other issue raised by the two pieces of research are whether other EU cities have benefited from any additional growth, which the UK has missed out on. As can be seen from the chart, Toyo Keizai data shows that there was an overall upward trend in the number of Japanese financial services companies in the European region, of around 12% from 2015/6 to 2022/23. The UK still dominates as a host, and the numbers of companies hosted rose 7% – so below trend. Germany doubled the number of Japanese financial services companies it hosted over the period. The numbers rose sharply in the Netherlands and then dropped. Just as Dr Hall’s research suggests, Ireland, Luxembourg and France seem to have benefited, albeit from a much smaller base.

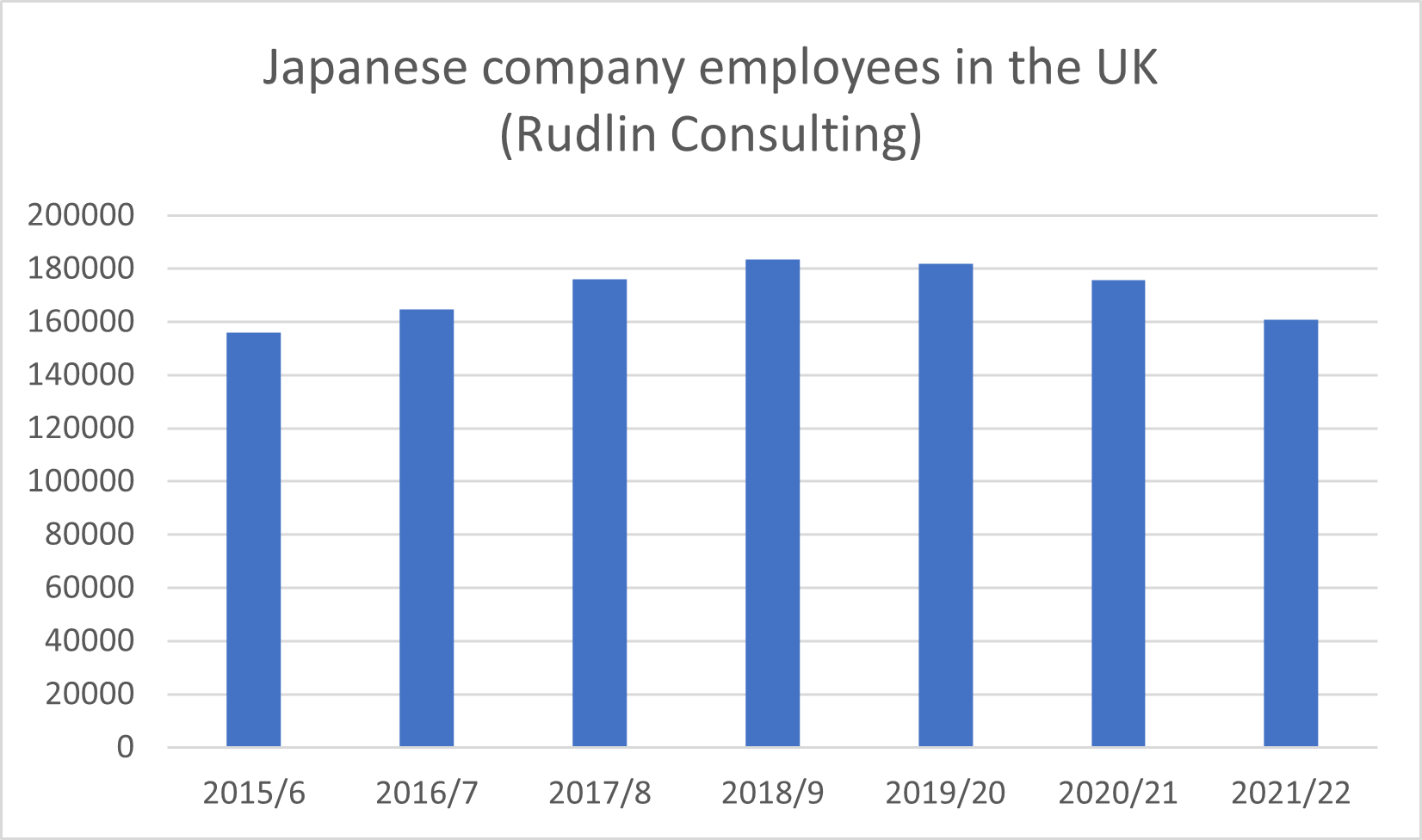

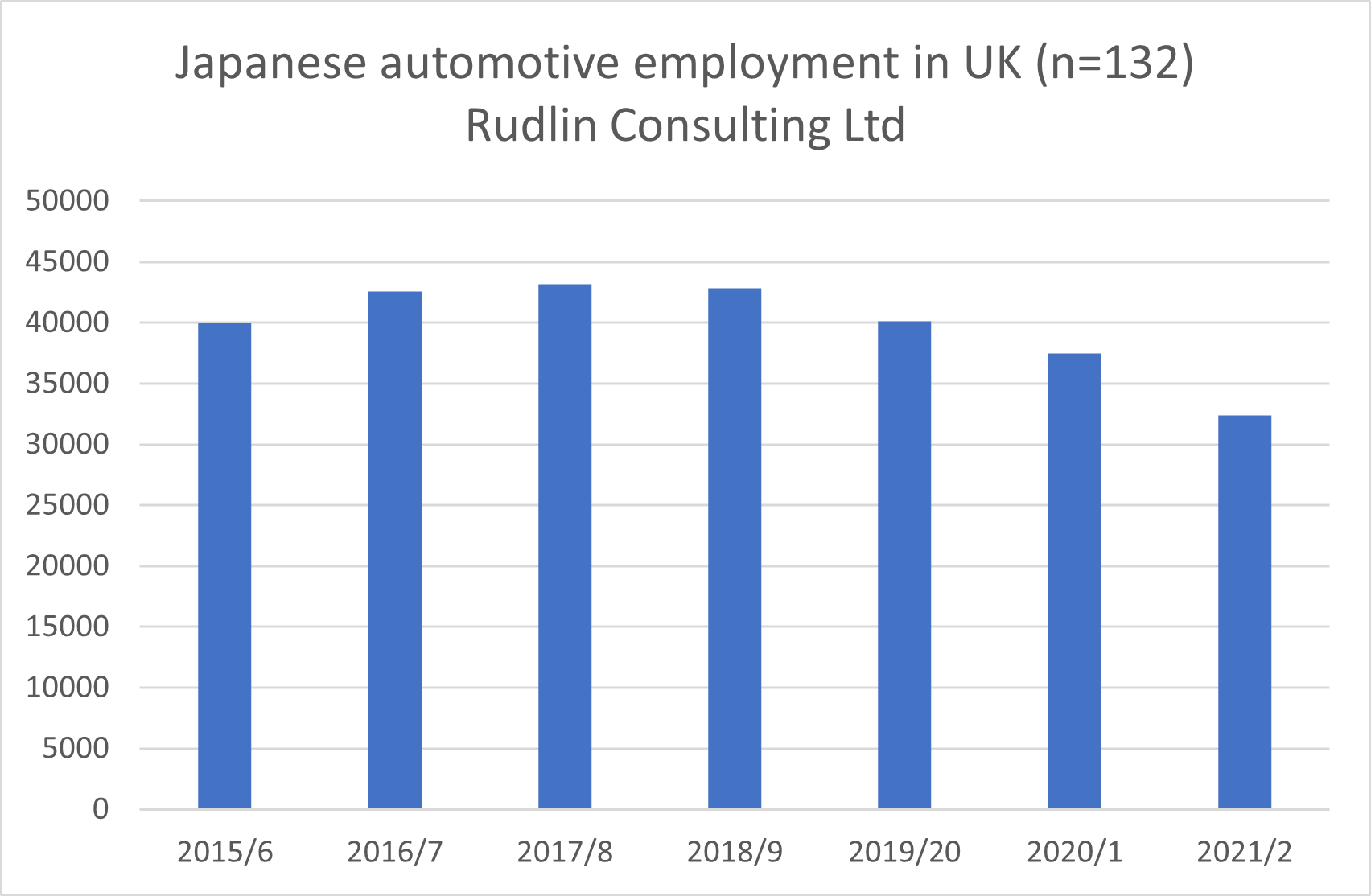

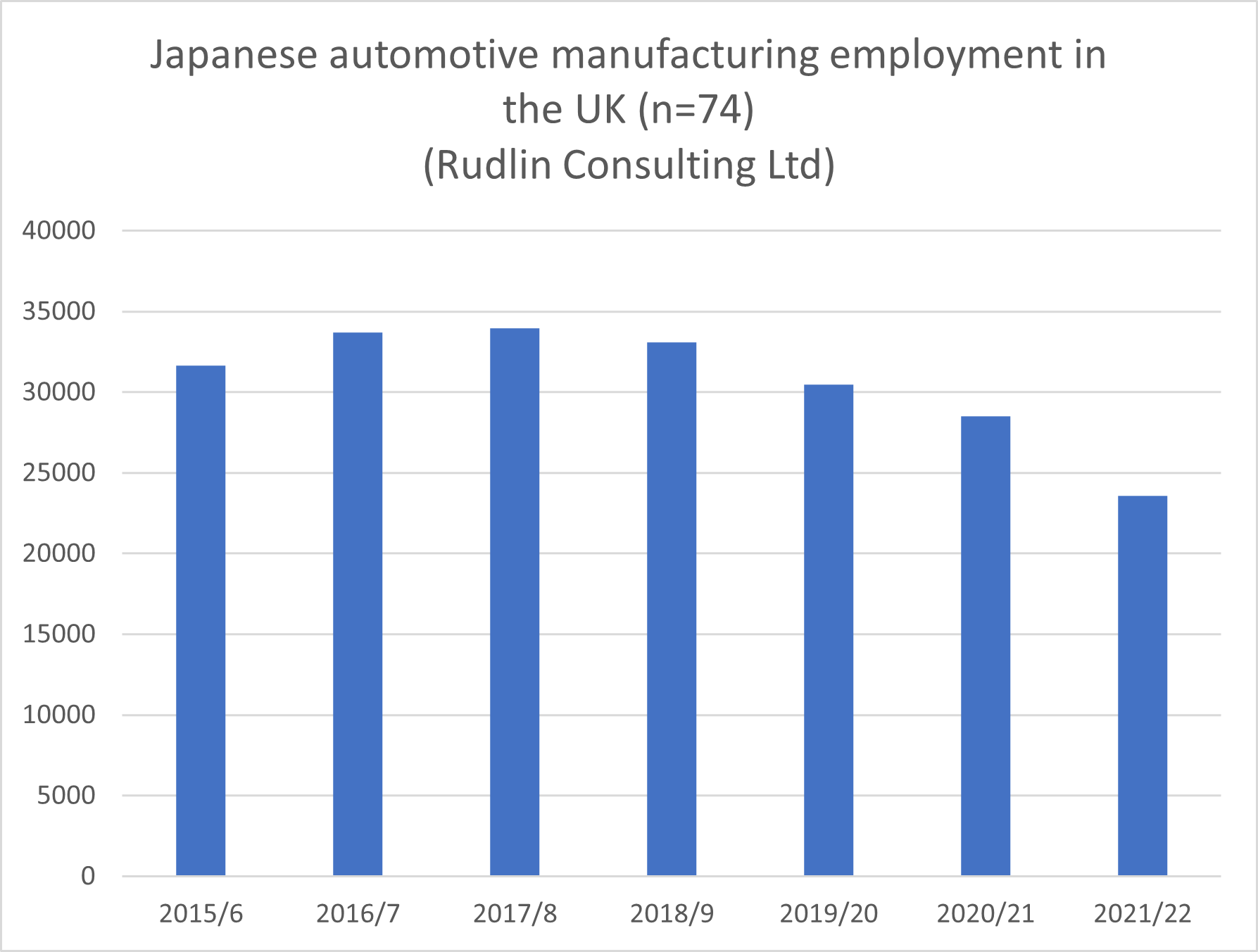

If we just focus on Japanese companies with production in the UK, there was a 26% decline in employment over 2018-2022 – unsurprisingly close to the overall trend – as around 74% of all Japanese automotive employees in the UK are employed in manufacturing operations.

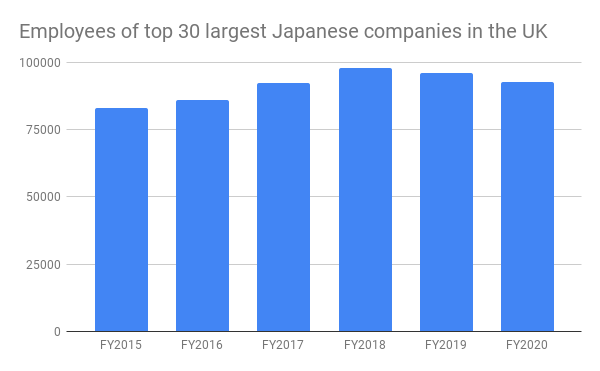

If we just focus on Japanese companies with production in the UK, there was a 26% decline in employment over 2018-2022 – unsurprisingly close to the overall trend – as around 74% of all Japanese automotive employees in the UK are employed in manufacturing operations. The total number of UK employees of the top 30 Japanese company groups fell 2.6% from 2019/20 to 2020/2021 – a strengthening of the downward trend in employee numbers since 2018/9. The peak of employment by the 30 largest Japanese company groupings in the UK was 97,827 in 2018/9 and this has now fallen by 5,000 to 92,851 employees. The top 30 represent around two thirds of the 137,000 people employed by 1,200+ Japanese companies in the UK.

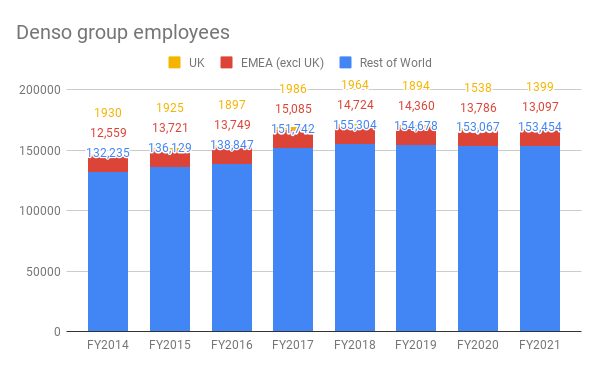

The total number of UK employees of the top 30 Japanese company groups fell 2.6% from 2019/20 to 2020/2021 – a strengthening of the downward trend in employee numbers since 2018/9. The peak of employment by the 30 largest Japanese company groupings in the UK was 97,827 in 2018/9 and this has now fallen by 5,000 to 92,851 employees. The top 30 represent around two thirds of the 137,000 people employed by 1,200+ Japanese companies in the UK. Konica Minolta acquired various UK companies before Brexit, but since Brexit has shrunk down and consolidated its operations in the UK and is focusing more on their European HQ in Germany and also the Czech Republic. The longer term trend of shifting away from manufacturing in the UK, to manufacturing elsewhere in Europe is seen at Denso, the Toyota group automotive parts manufacturer – UK employee numbers peaked in FY2018, and have been falling since, and are now 27.5% below the FY2014 level, whereas employment in the rest of the region is up 4.3% and global employee numbers, excluding UK, have risen 16% since FY2014.

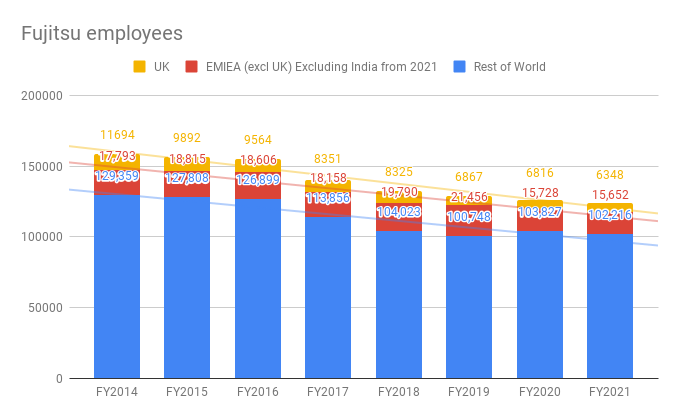

Konica Minolta acquired various UK companies before Brexit, but since Brexit has shrunk down and consolidated its operations in the UK and is focusing more on their European HQ in Germany and also the Czech Republic. The longer term trend of shifting away from manufacturing in the UK, to manufacturing elsewhere in Europe is seen at Denso, the Toyota group automotive parts manufacturer – UK employee numbers peaked in FY2018, and have been falling since, and are now 27.5% below the FY2014 level, whereas employment in the rest of the region is up 4.3% and global employee numbers, excluding UK, have risen 16% since FY2014. Five years’ ago, Fujitsu was the largest Japanese corporate group in the UK, with 9,892 people. It has lost 3,000 employees since, and was the fourth largest Japanese group in the UK in FY2020. As of FY2021, Fujitsu has 6,348 employees in the UK, 45% down on FY2016, compared to a 21% decrease globally, excluding the UK. Growth at Fujitsu has been in India (and Fujitsu’s CTO is Indian) and in its global delivery centres in countries such as Poland and the Philippines.

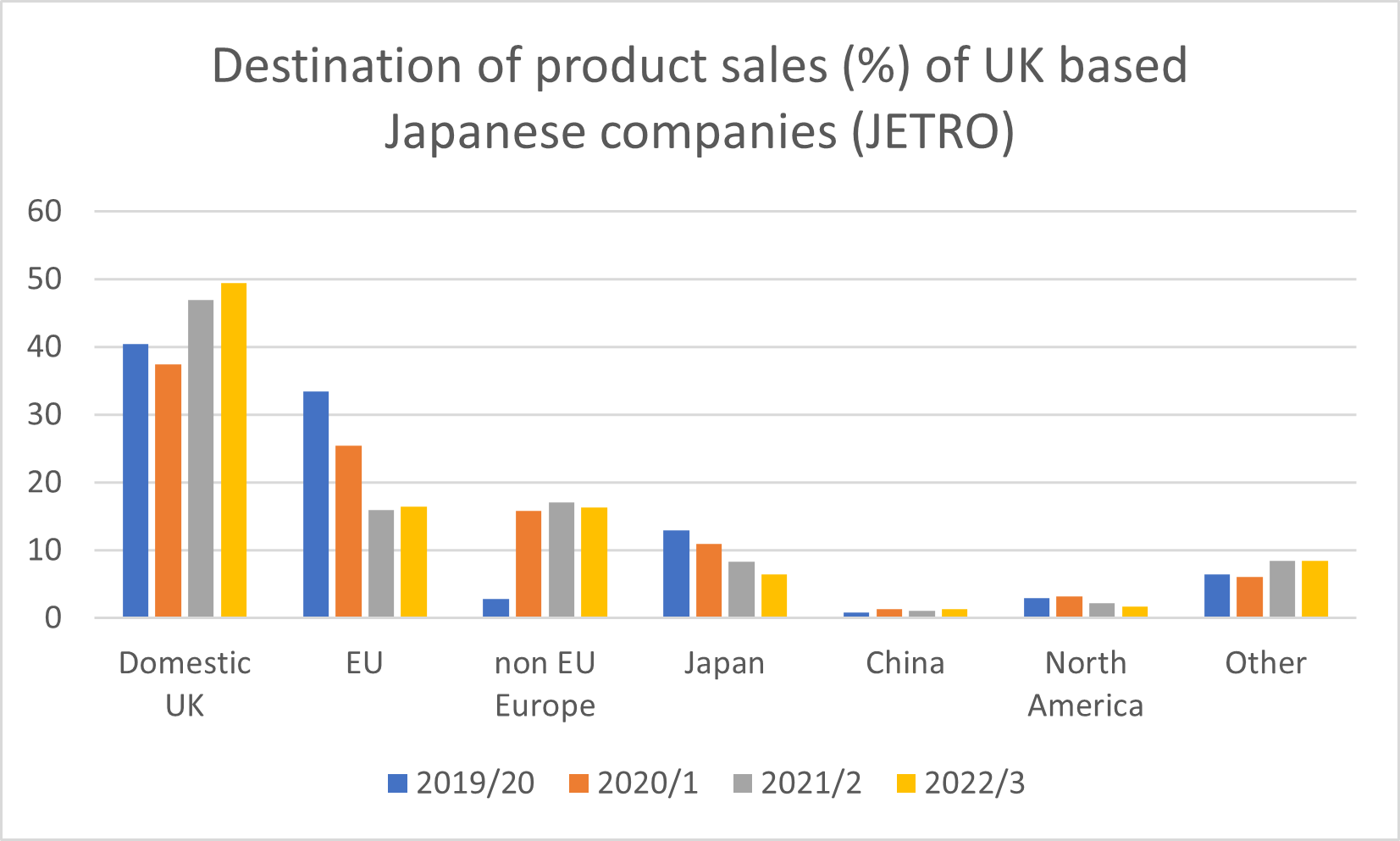

Five years’ ago, Fujitsu was the largest Japanese corporate group in the UK, with 9,892 people. It has lost 3,000 employees since, and was the fourth largest Japanese group in the UK in FY2020. As of FY2021, Fujitsu has 6,348 employees in the UK, 45% down on FY2016, compared to a 21% decrease globally, excluding the UK. Growth at Fujitsu has been in India (and Fujitsu’s CTO is Indian) and in its global delivery centres in countries such as Poland and the Philippines. Japanese companies in the UK are showing an increasing focus on the UK domestic market for their sales, with an average of 49.4% of sales to the UK market, 2.4% up on 2021/2, compared to a European average of domestic sales of 37.7%. UK companies are selling on average 16.5% of sales to EU countries, compared to 37.6% of sales to other EU countries (excluding their own country) for Japanese companies located in the EU. Unsurprisingly, Japanese companies in the UK have become more UK oriented since Brexit, as many of the EU sales and coordination functions have shifted from the UK to the EU – and is now potentially stabilising after the sharp decline over 2019/20 to 2021/2

Japanese companies in the UK are showing an increasing focus on the UK domestic market for their sales, with an average of 49.4% of sales to the UK market, 2.4% up on 2021/2, compared to a European average of domestic sales of 37.7%. UK companies are selling on average 16.5% of sales to EU countries, compared to 37.6% of sales to other EU countries (excluding their own country) for Japanese companies located in the EU. Unsurprisingly, Japanese companies in the UK have become more UK oriented since Brexit, as many of the EU sales and coordination functions have shifted from the UK to the EU – and is now potentially stabilising after the sharp decline over 2019/20 to 2021/2