Pernille Rudlin speaking on navigating workplace harassment and purpose at 24th September event in London

Pernille Rudlin will be speaking (in Japanese) on “Navigating Workplace Harassment and Purpose” on 24th September 2024 16:00 in London as part of a free HR seminar with Centre People and Lewis Silkin. You can use the QR code or email address as below to register.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More

Many other Japanese companies may be adopting similar systems, or just relying more on local managers to run things –

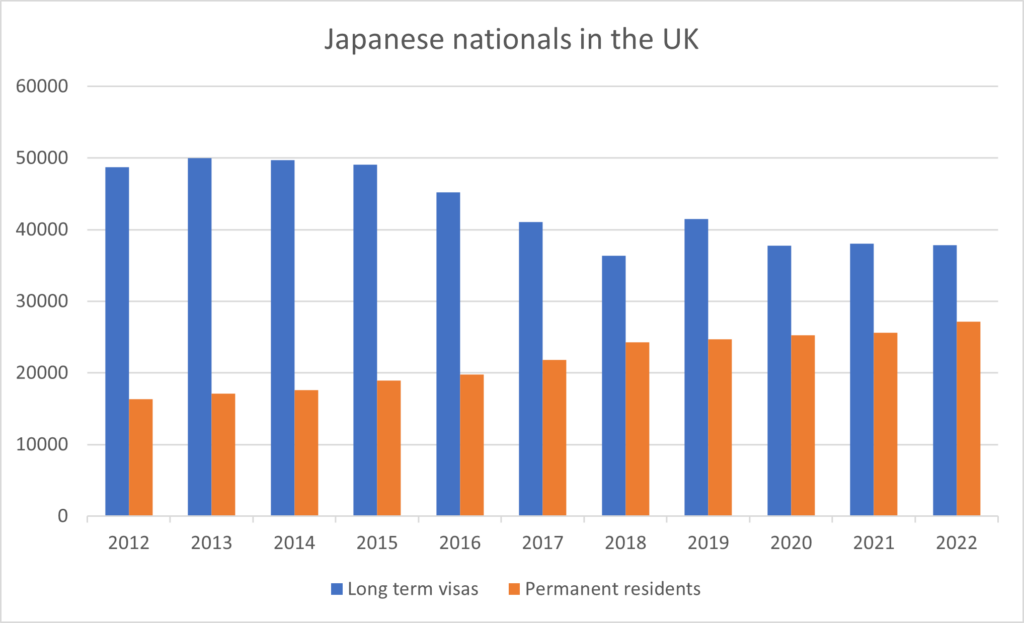

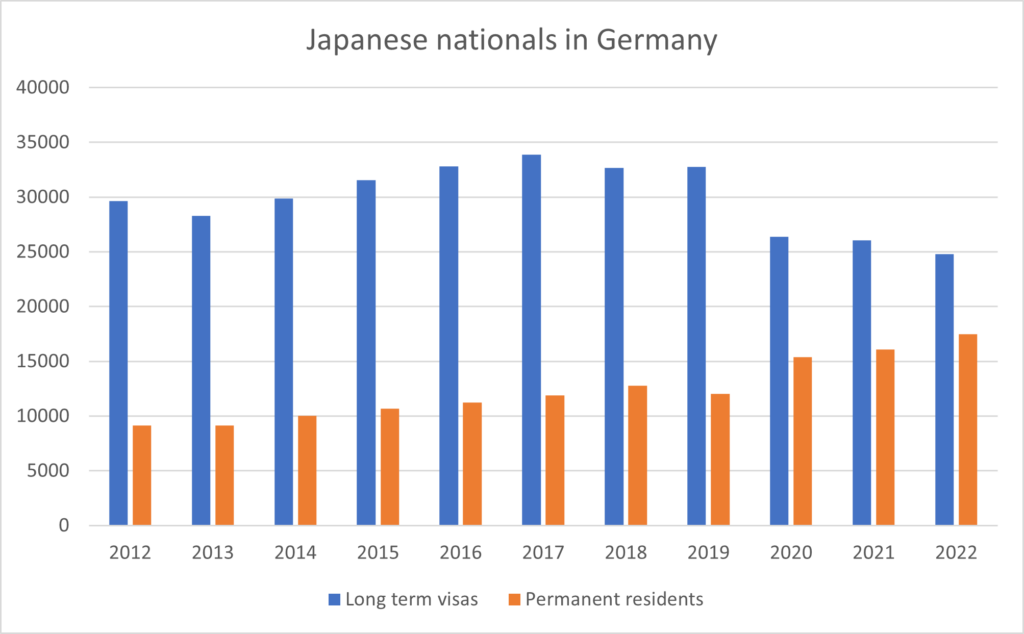

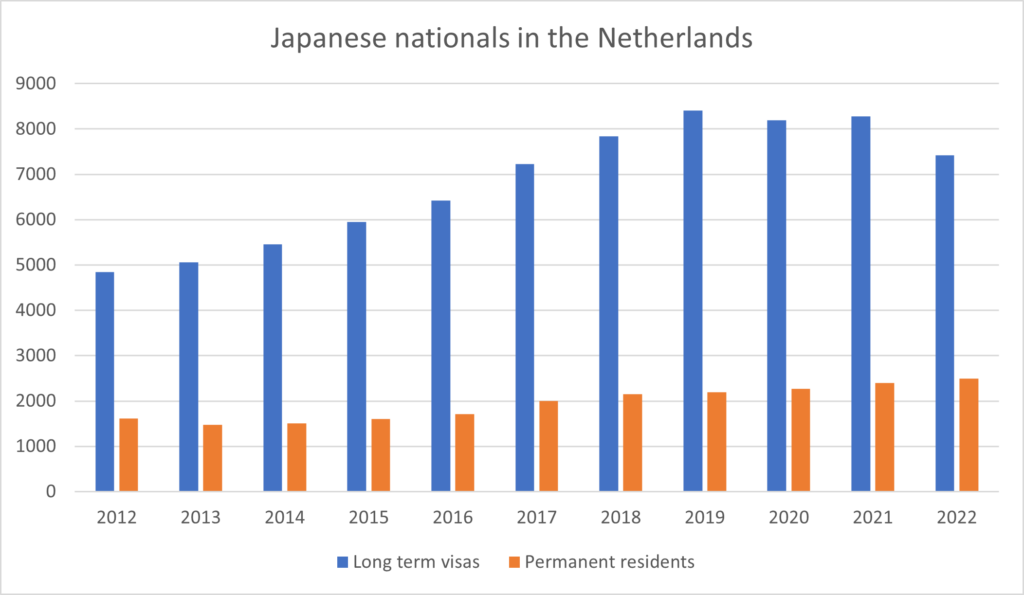

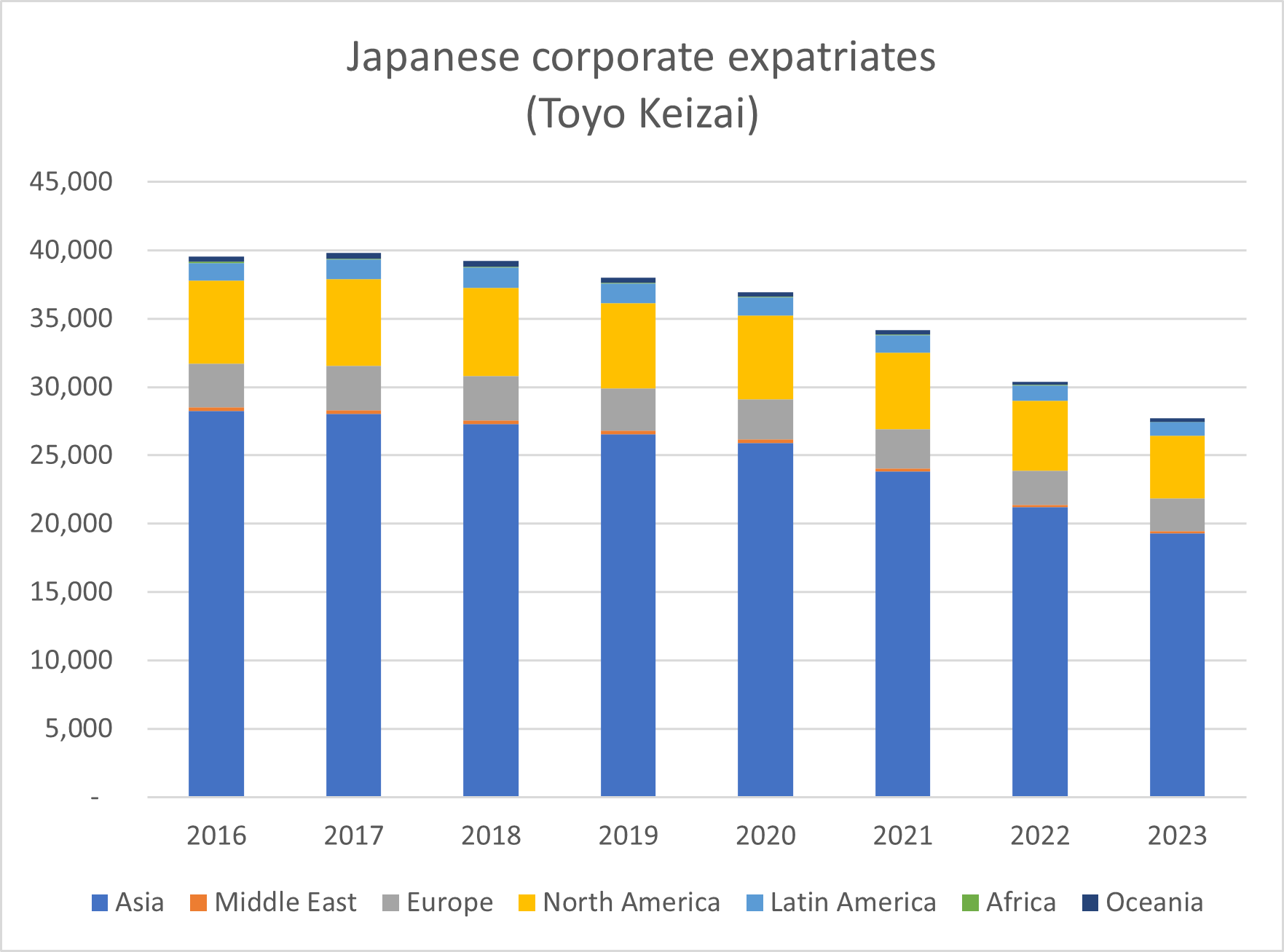

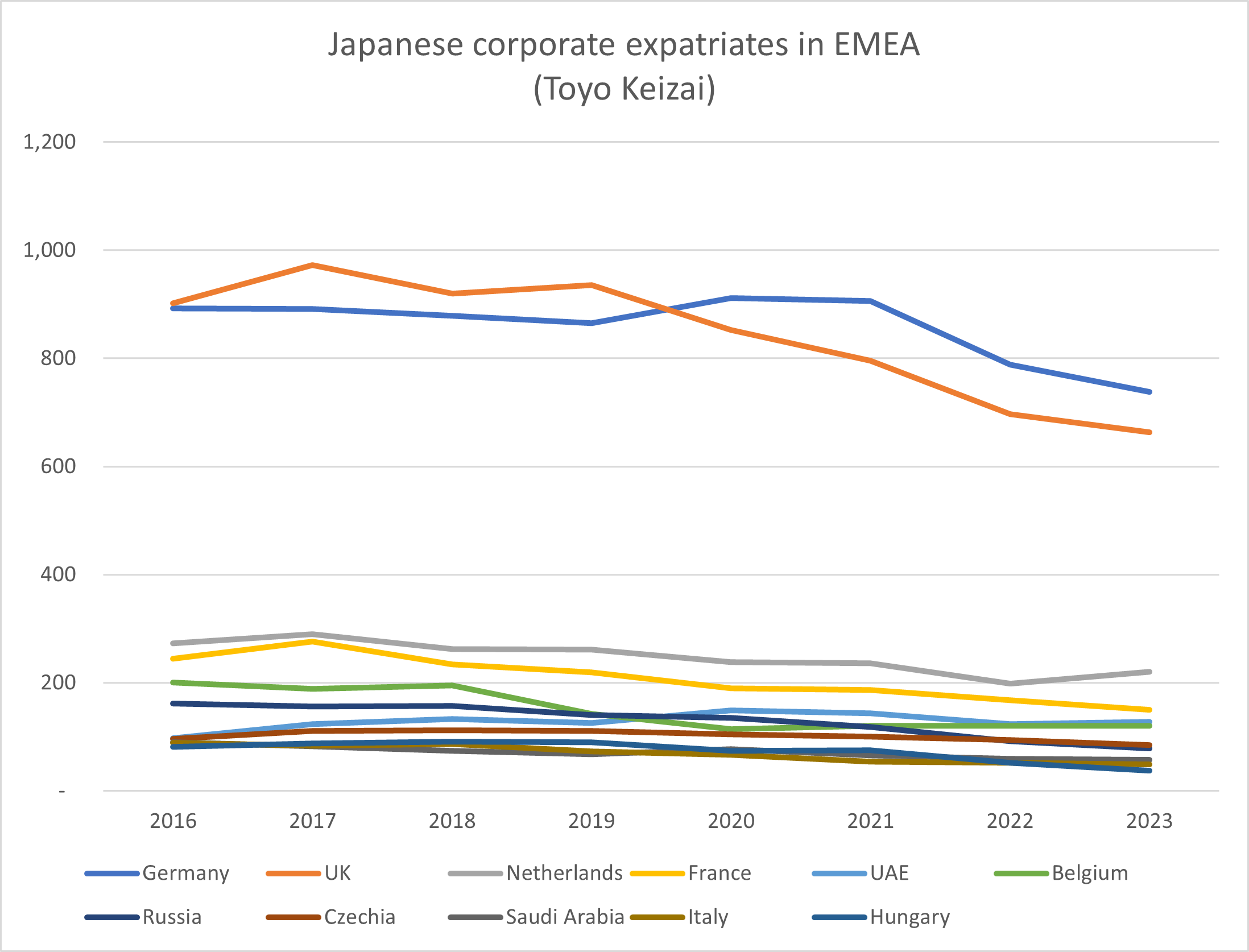

Many other Japanese companies may be adopting similar systems, or just relying more on local managers to run things –  Looking at the Toyo Keizai data for individual countries in Europe and the Middle East shows that the only country to show any positive growth in Japanese corporate expatriate numbers since 2016 is the United Arab Emirates. The fall in Japanese expats in the Netherlands (-19%) was not as steep as elsewhere in EMEA (-27% average, -26% for UK, -40% for Belgium ) and seems to be recovering a bit since the pandemic. The number of expats in Germany also fell by only 17% since 2016, having grown and surpassed the UK in 2019/20, but falling steeply since the pandemic began, with no signs of recovery yet.

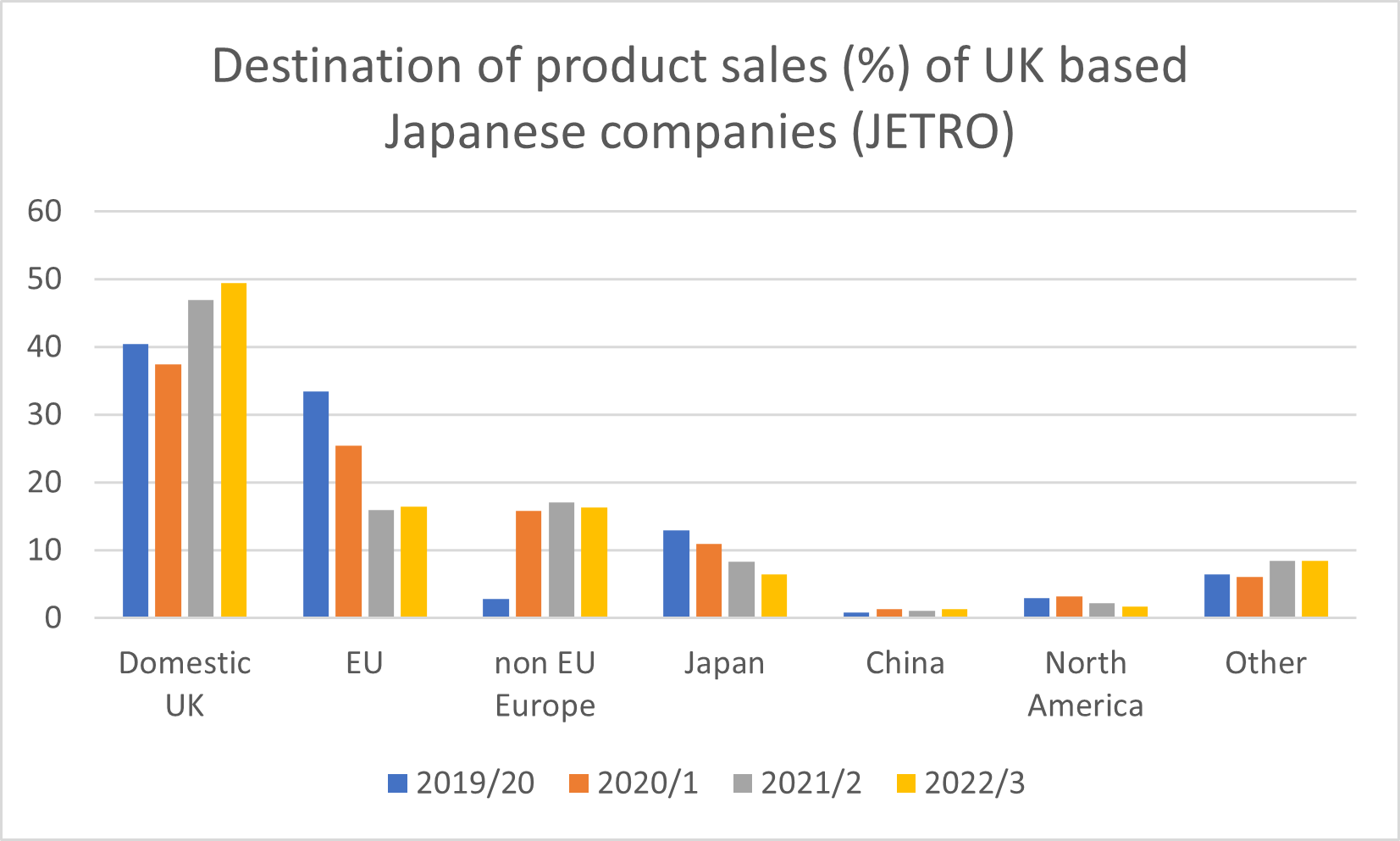

Looking at the Toyo Keizai data for individual countries in Europe and the Middle East shows that the only country to show any positive growth in Japanese corporate expatriate numbers since 2016 is the United Arab Emirates. The fall in Japanese expats in the Netherlands (-19%) was not as steep as elsewhere in EMEA (-27% average, -26% for UK, -40% for Belgium ) and seems to be recovering a bit since the pandemic. The number of expats in Germany also fell by only 17% since 2016, having grown and surpassed the UK in 2019/20, but falling steeply since the pandemic began, with no signs of recovery yet. Japanese companies in the UK are showing an increasing focus on the UK domestic market for their sales, with an average of 49.4% of sales to the UK market, 2.4% up on 2021/2, compared to a European average of domestic sales of 37.7%. UK companies are selling on average 16.5% of sales to EU countries, compared to 37.6% of sales to other EU countries (excluding their own country) for Japanese companies located in the EU. Unsurprisingly, Japanese companies in the UK have become more UK oriented since Brexit, as many of the EU sales and coordination functions have shifted from the UK to the EU – and is now potentially stabilising after the sharp decline over 2019/20 to 2021/2

Japanese companies in the UK are showing an increasing focus on the UK domestic market for their sales, with an average of 49.4% of sales to the UK market, 2.4% up on 2021/2, compared to a European average of domestic sales of 37.7%. UK companies are selling on average 16.5% of sales to EU countries, compared to 37.6% of sales to other EU countries (excluding their own country) for Japanese companies located in the EU. Unsurprisingly, Japanese companies in the UK have become more UK oriented since Brexit, as many of the EU sales and coordination functions have shifted from the UK to the EU – and is now potentially stabilising after the sharp decline over 2019/20 to 2021/2