Reflections on the past forty years of Japanese business in the UK – what’s next? – 1

Pernille Rudlin gave a talk in Japanese to the Jiji Top Seminar on November 22nd 2024. She took look at 40 years of Japanese business in the UK, how it has evolved and what the future might hold.

Through the lens of her own career working in and with Japanese companies, she traced the fortunes of the British and Japanese companies who supported the 1985 “Japanese Miracle” conference at Oxford University which she helped with as a student. She covered the impact of the “Big Bang” in 1986, the bursting of the Japanese economic bubble, the Asian financial crisis, the dotcom bubble and crash, the global financial crisis and Brexit. The shifts in balance between manufacturing, services and European coordination were also analysed, with some thoughts on what the new Labour government might mean for Japanese companies in the UK.

This is a summary in English of the talk – each slide will be a separate post.

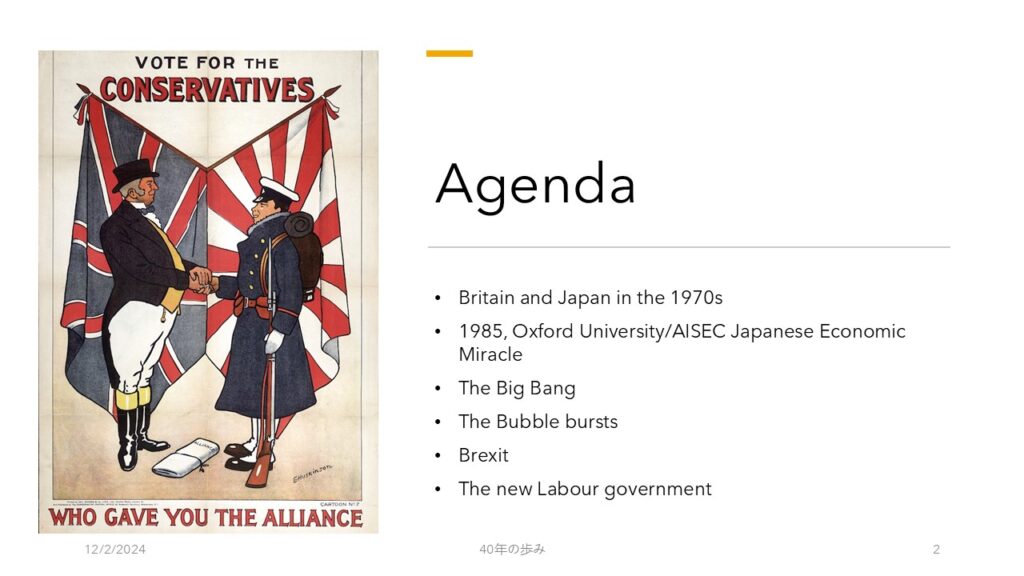

Slide 1: In researching this topic, I came across the poster you can see here. It’s from the 1906 General Election, and as you can see it was issued by the Conservative Party. The alliance that they refer to was the 1902 Anglo-Japanese alliance. Both countries were worried by the the threat from Russia, and then in 1904-5 Russo-Japanese War, Japan defeated Russia, the first time in modern history that an Eastern nation had defeated a Western one.

The British government praised the Japanese for their victory and the British public were also admiring of Japan’s “pluck” but the alliance was not a vote winner for the Conservatives, who lost badly to the Liberals. The 1906 election also saw the rise of the newly renamed Labour Party, headed by Keir Hardie. Our prime minister, Keir Starmer’s parents named their son after Keir Hardie – evidence that Starmer very much came from a Labour supporting household.

When I first saw this poster, it set me thinking whether we were about to see an Anglo-Japanese Alliance 2.0.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More