If you can’t find a counterpart in Japan HQ, you might need a window

I concluded in my previous article that Japanese headquarters looking to coordinate effectively with their European subsidiaries needed to consider “people” in addition to having clear communication processes and ensuring there are shared vision and values about how the company should behave.

In the past, many multinationals, not only Japanese companies, relied on a network of expatriate staff to disseminate corporate culture and keep the headquarters informed about what was happening abroad.

Now, Japanese companies are finding that they do not have enough ‘global jinzai’ (globally experienced personnel) at senior levels who are capable of managing their overseas operations, so are having to rely on locally hired senior executives.

These locally hired senior executives often become very frustrated if the communication processes are not clear, and the values and vision are not shared. They find themselves answering the same questions over and over again from multiple divisions in Japan and begin to feel they are not trusted. They are unable to make decisions or propose change and yet do not know who in Japan to ask for support or how to ask them.

This problem does not occur so frequently in Western multinationals because the compliance, authorisation and reporting processes are usually made very clear from the moment a company is acquired or set up. Also, the organisation of people tends to be similar across most Western companies. It’s therefore easy for a manager in an overseas subsidiary to work out who their counterpart is, or who the key decision maker might be.

In the European marketing department of one of the Japanese companies I worked for, we had a proposal that needed us to identify and build relationships with many different people in Japan to gain support. In a Western company this would have been easy – there would have been a marketing department, headed by a senior executive (probably EVP level) in the headquarters who would have responsibility for the strategy, vision and brand of the company.

However in this Japanese company there was no recognisable marketing department. The corporate brand office was more like the compliance part of the PR department – checking that the logo was used correctly. The advertising department simply did whatever each business unit told it to. There was a corporate strategy department but it did not seem to have any relation to the kind of marketing strategy that Europeans are used to.

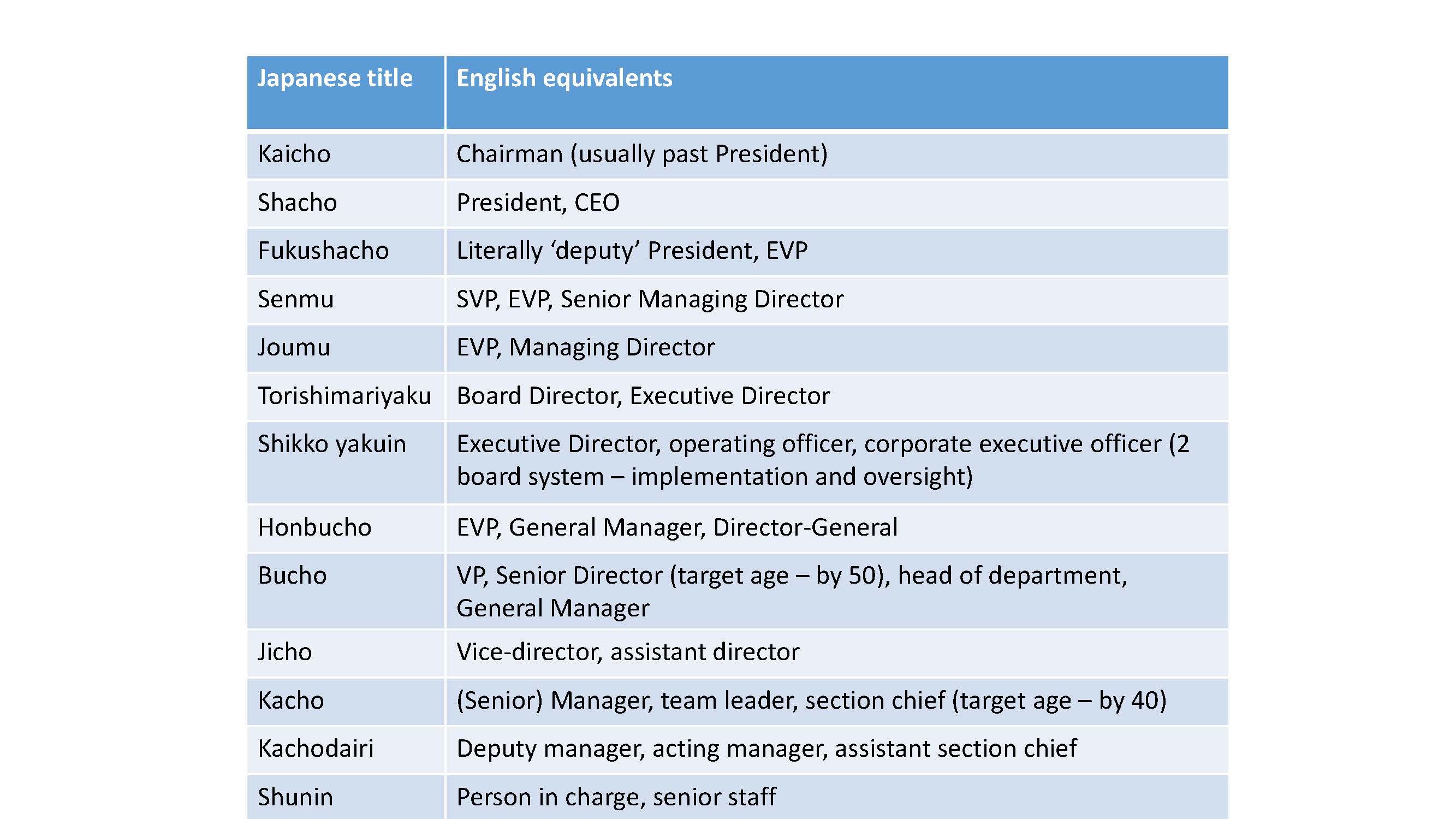

I hesitate to say that my conclusion is that Japanese companies have to reorganise their headquarters along Western lines in order to succeed globally, but I do recommend that plenty of attention is given to finding counterparts and making it explicit what the tantousha (person in charge of the daily work) and madoguchi (window into an organisation, single point of contact) concepts mean, and identifying who those people should be in the headquarters. This should help reduce the burden of requests going to the local managers and help them build trusting relationships with key people in Japan. Once that is done, attention can be paid to shared values and communication processes.

This article was originally published in Japanese in the Teikoku Databank News and appears in Pernille Rudlin’s new book “Shinrai: Japanese Corporate Integrity in a Disintegrating Europe” – available as a paperback and Kindle ebook on Amazon.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More