I asked this question just over a year ago and the answer is still yes and no. To which I would add, it’s more a case that Japanese companies aren’t investing in or coming to the UK as much as they used to, replacing the ones that are leaving or downsizing.

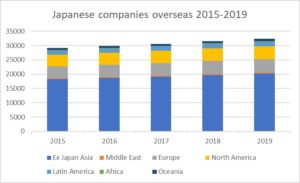

Asia continues to dominate as location for Japanese companies overseas

The number of Japanese companies overseas is, according to Toyo Keizai*, continuing to increase – up 65% from 2008, but the rate of increase has been slowing since 2013. The number of Japanese companies overseas grew 2% from 2018 to 2019, with growth in all regions – higher growth in Africa/Oceania (from a small base) but only 1% growth in Europe compared to 3% in North America and Asia.

63% of Japanese companies overseas are in ex-Japan Asia – up from 62% in 2018 and 69% of the employees of Japanese companies abroad are in Asia. Around 15% of Japanese companies abroad are in Europe and 14% in North America, with both regions having around 11% of employees. As pointed out last year, the obvious factor in why there are proportionately more employees to number of companies in Asia compared to Europe and North America is the greater number of manufacturing operations in Asia, with larger workforces.

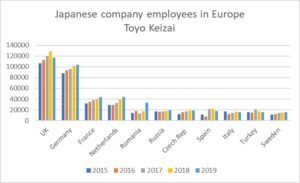

The number of UK employees of Japanese companies has fallen for the first time, by 9%

Within Europe, the number of people employed by Japanese companies rose 18% from 2015 to 2019. Those countries where the number of Japanese company employees has fallen are countries where there has been a rise in populism, civic unrest and political risk. UK employee numbers fell 9% 2018-9 (the first decline since at least 2015), Spanish employee numbers fell 19% 2018-9, Hungary’s fell 18%, Turkey’s 10%, Poland and Italy also showed small decreases in employee numbers.

Within Europe, the number of people employed by Japanese companies rose 18% from 2015 to 2019. Those countries where the number of Japanese company employees has fallen are countries where there has been a rise in populism, civic unrest and political risk. UK employee numbers fell 9% 2018-9 (the first decline since at least 2015), Spanish employee numbers fell 19% 2018-9, Hungary’s fell 18%, Turkey’s 10%, Poland and Italy also showed small decreases in employee numbers.

Countries where Japanese employee numbers are growing are the Netherlands (up 11% 2018-9), France (10%), Germany (2%) and the Czech Republic (2%). Employee numbers in Romania doubled from 2018-9 but this is largely due to Toyo Keizai recording employee numbers at Alcedo (acquired by Sumitomo Corporation in 2011) as being 20,284, having been 318 in 2018. The 2018 number is more in line with other available data.

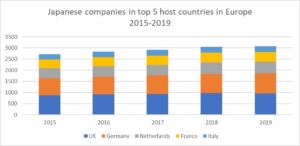

Number of Japanese companies in UK has fallen for first time

The number of Japanese companies in the UK has fallen by 1% 2018-9, from 972 to 966, the first drop since at least 2015, having risen 11% 2015-2018. France also saw a 2% drop in the number of Japanese companies, even though employee numbers are up. Germany attracted a 4% increase in Japanese companies from 2018-9, having risen 13% 2015-8. Netherlands had a 1% increase 2018-9 (13.5% 2015-8) and Italy had a 2% rise in Japanese companies 2018-9, and an increase of 11.8% 2015-8.

The number of Japanese companies in the UK has fallen by 1% 2018-9, from 972 to 966, the first drop since at least 2015, having risen 11% 2015-2018. France also saw a 2% drop in the number of Japanese companies, even though employee numbers are up. Germany attracted a 4% increase in Japanese companies from 2018-9, having risen 13% 2015-8. Netherlands had a 1% increase 2018-9 (13.5% 2015-8) and Italy had a 2% rise in Japanese companies 2018-9, and an increase of 11.8% 2015-8.

It’s hard to work out where Toyo Keizai derives the net drop of 6 Japanese companies in the UK from. Their list of the 7 companies which have closed down in the UK 2019 shows that this was mainly due to reorganization of holding companies or merging of companies rather than full withdrawal from the UK. Of the 8 new Japanese companies in the UK in 2019, 5 were indirect investments into energy companies by Nippon Koei, a civil engineering company and 2 were indirect investments by WDI, a Hong Kong originated Dim Sum chain which is registered in Japan.

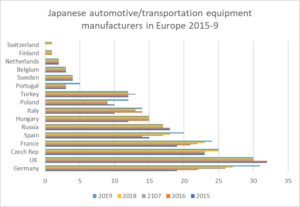

Germany now hosts more Japanese automotive companies than the UK

The Japanese automotive sector is of course the sector being most carefully watched for Brexit impact. Japanese automotive manufacturers are continuing to set up overseas – the total number globally has increased 10% in 2019 on 2015. And “despite” the EU-Japan EPA, 15 more Japanese transportation equipment manufacturers set up in Europe in 2019, a 20% cumulative increase on 2015. Of the 15 new companies, 4 are in Germany, 3 in Poland, 2 in Spain, 2 in Portugal, 1 in France, 1 in Italy, 1 in Slovakia and 1 mystery one. This means Germany now hosts more automotive/transportation equipment companies than the UK – 31 to the UK’s 30.

The Japanese automotive sector is of course the sector being most carefully watched for Brexit impact. Japanese automotive manufacturers are continuing to set up overseas – the total number globally has increased 10% in 2019 on 2015. And “despite” the EU-Japan EPA, 15 more Japanese transportation equipment manufacturers set up in Europe in 2019, a 20% cumulative increase on 2015. Of the 15 new companies, 4 are in Germany, 3 in Poland, 2 in Spain, 2 in Portugal, 1 in France, 1 in Italy, 1 in Slovakia and 1 mystery one. This means Germany now hosts more automotive/transportation equipment companies than the UK – 31 to the UK’s 30.

Japanese acquisitions of UK companies reduced in scale and number

Toyo Keizai’s data is reliant on companies filling in their surveys, so tends to underreport and often misses acquisitions. From my database, I estimate 20 British companies were acquired by Japanese companies in 2019-2020, although some of them were indirect acquisitions through acquiring a parent company with a subsidiary in the UK. Dentsu and Sony continued to acquire UK based companies, and other acquisitions were of British companies in software, gaming, hotels, seafood, recruitment, a manufacturer of drives for electric motors and paper wholesale. The scale is far less than in previous years, both in terms of numbers of acquisitions and value of the deals.

Even adding these acquisitions in shows a 3% drop in the number of people employed by Japanese companies in the UK from 2018/9 to 2019/20 according to my database – the first drop since I started tracking these numbers in 2015.

* Toyo Keizai Data Bank: Directory of Japanese Companies Abroad 2020

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。