Japanese boards in Europe should reflect their customers, employees and community

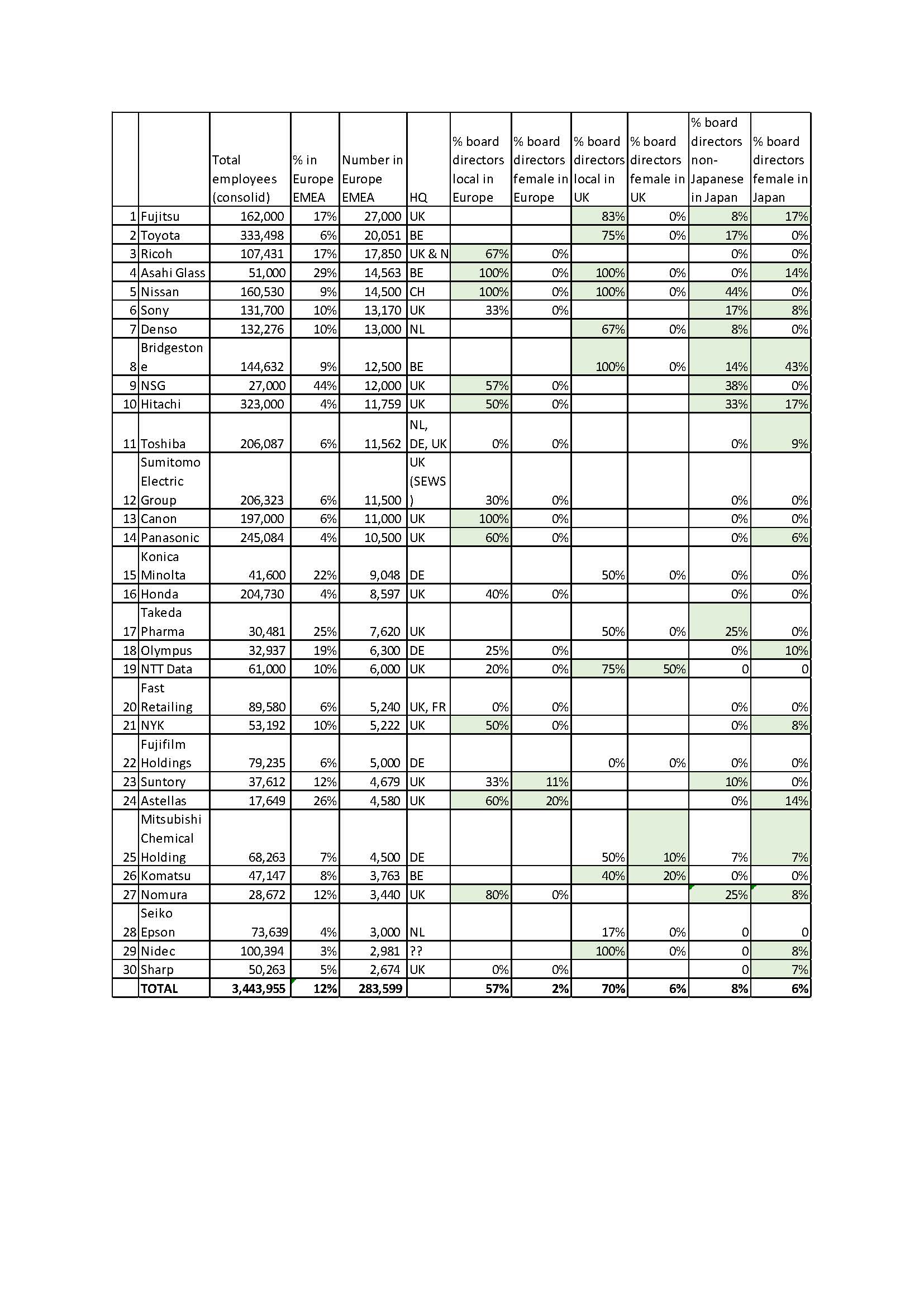

I have just completed the first phase of research into how diverse the European subsidiary boards of the biggest Japanese companies in Europe are, both in terms of the nationality mix of Japanese and European directors, and also the number of women on the board.

More boards in Japan had women on them than in Europe, which is surprising if you were expecting boards to reflect the employee mix – particularly the pipeline of managers coming through the ranks of an organisation – as there are without doubt more women employees and proportionally more women managers in Japanese companies in Europe than there are in Japan.

The proportion of directors with European nationalities on the board of Japanese subsidiaries varied wildly from none in the case of Toshiba, Sharp and Fast Retailing (the Uniqlo subsidiary in the UK), through to 100% in the case of Asahi Glass, Bridgestone, Canon and Nidec. So national diversity does not seem to be influenced by which industry the company is in. This also means that what to me is the most compelling case for a diverse board, that it should reflect the customers it is serving, is not the key factor I thought it would be.

20 years’ ago, becoming less reliant on Japanese customers abroad as well as in Japan, was the driving force for many Japanese companies embarking on “kokusaika” (“internationalization”). Canon was a pioneer then in appointing Europeans to senior positions in overseas subsidiaries and does as a consequence appear to have fared better than other companies in the consumer electronics sector, both in Japan and in Europe.

The current favoured path to globalization for Japanese companies is through M&A rather than growing international businesses and executives internally, and the major acquisitions of the past decades account for the diverse boards of Asahi Glass (who acquired Glaverbel) and other companies that still have a high proportion of European directors such as Fujitsu (International Computers Ltd), Nomura (Lehman Brothers) and NSG (Pilkington).

There is some sectoral influence. For example, the financial services industry is under intense scrutiny by European regulators who have the power to approve board appointments. They expect directors to have deep understanding and experience of local markets – something which not many Japanese executives can claim.

Both Fujitsu and Hitachi have substantial public sector oriented businesses in the UK (government services, nuclear power and rail) which means that they not only need to meet the diversity requirements of government purchasing but also gain acceptance of the communities in which they operate. For example, the board of a Japan-owned UK utility recently advertised for a director, with a requirement that applicants be a customer of that utility.

For smaller Japanese companies, or those which are just starting in Europe, it is tempting to stick with a small board with just a couple of non-resident Japanese directors, but as boards come under pressure to have greater transparency and better governance in Europe, appointing local directors from the start should lead to better relations with regulators, customers and employees.

(This article first appeared in Japanese in the Teikoku Databank News in December 2015 and also appears in Pernille Rudlin’s new book “Shinrai: Japanese Corporate Integrity in a Disintegrating Europe” – available as a paperback and Kindle ebook on Amazon.)

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More

For as long as I’ve been working in or for Japanese companies (25 years…) I’ve been surprised by how behind they are in using IT, considering how much Japanese people love the latest technology, much of it developed by Japanese companies themselves. Like so many paradoxes of Japanese corporate culture, the roots may lie in the post war system of life time employment, generalist track careers and seniority based promotion.

For as long as I’ve been working in or for Japanese companies (25 years…) I’ve been surprised by how behind they are in using IT, considering how much Japanese people love the latest technology, much of it developed by Japanese companies themselves. Like so many paradoxes of Japanese corporate culture, the roots may lie in the post war system of life time employment, generalist track careers and seniority based promotion.