This post is also available in:

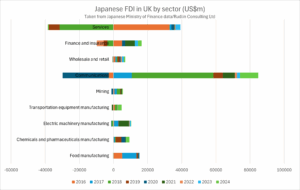

Something has been puzzling me for a few years about Japanese foreign investment in the UK. The net investment by Japanese companies in the British “communications” sector since 2016 is US$55bn, over three times more than the next largest net investment, which was in the food manufacturing sector.

There have been various acquisitions and investments over the past few years in British food manufacturers that I am aware of; Zensho acquiring Taiko Foods and Yo! Sushi, Mizkan acquiring various British food brands and factories for Branston, Haywards and Sarsons, Calbee acquiring Seabrook Crisps and various acquisitions in fish processing.

But what Japanese “communications” companies could have invested billions in the UK? The Japanese term used by the Ministry of Finance for the communications sector is 通信業 (tsuushingyou) and the main players in Japan in this sector (perhaps in the UK we would use the term telecommunications) are considered to be NTT, KDDI and SoftBank. NTT and KDDI have been investing in data centers in the UK in recent years, and NTT placed its global non-Japan HQ in London, but surely this would not have cost tens of billions. Which leaves SoftBank.

SoftBank spent US$6.5bn on acquiring ARM in 2016, which may account for the amount shown in 2017. But what about the $10bns thereafter, and the large withdrawal of over US$20bn in 2020? I am guessing this must be money moving in and out of SoftBank’s Vision Fund, which is headquartered in London and managed by SoftBank Investment Advisers.

Another puzzle is what is going on in the services sector – US$33bn was invested in Britain 2016 and then a disinvestment of US$32bn in 2018, leaving a net investment of only US$661m. “Services” is a very large umbrella, and may have covered the shifting of European logistics, warehousing and headquarter services functions out of the UK and the capital to go with it, to the EU in preparation for Brexit.

There were disinvestments in the finance and insurance sector in 2018, 2019 and 2022 but overall a net investment of US$6.7bn. Judging by the dates, the net positive total is “despite” Brexit and the Truss budget.

Transportation equipment manufacturing, which would include car manufacturing saw a few instances of disinvestment, primarily related to Honda closing Swindon in 2021 and some of its suppliers shutting up shop in the UK. Overall, despite some tough years, the sector is $3bn in the black, in terms of net investment since 2016, helped by a $2bn investment in 2024. Japanese net investment in almost all other sectors apart from services has outstripped this, however.

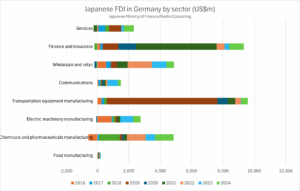

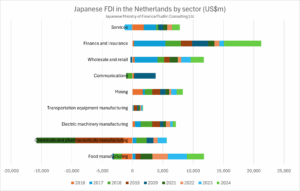

For comparison, the charts for the main investments in Germany and the Netherlands are given below:

Comparing by sector, in finance and insurance, the Netherlands has yet again been the clear beneficiary of Brexit, receiving around US$21bn in net investment, with Germany receiving around around US$9bn, compared to US$6.7bn for the UK.

For transportation equipment manufacturing, Germany is the clear winner with US$9.5bn net investment 2016-2024, compared to US$3.7bn to the UK and US$1.75bn to the Netherlands – even though Germany does not host any Japanese OEM car manufacturing.

The investment by Japanese companies into the UK “communications” sector at US$55bn dwarfs the US$2.8bn invested in the Netherlands and US$1.5bn invested in Germany – which does reinforce the view that this is a SoftBank Vision Fund driven figure, rather than any actual investment in the British telecommunications infrastructure. You might have expected to see comparable investments from NTT in Germany and the Netherlands if it had been a business decision rather than an investment fund decision.

Overall, the comparative advantages in trade and investment between the three economies, in Japanese eyes is clear – Britain – digital, services and communications (despite the SoftBank reality distortion effect), Germany – automotive and chemical related manufacturing and corporate banking and the Netherlands – continuing to be strong in food manufacturing, but now also seen as an EU base for financial services headquarters – effective from a tax perspective, but not needing as many employees as manufacturing.

For further insights on Japanese foreign direct investment in the UK and EMEA financial services sector, our Japanese Financial Services in the UK and EMEA 2025 report and directory can be purchased and downloaded here.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。