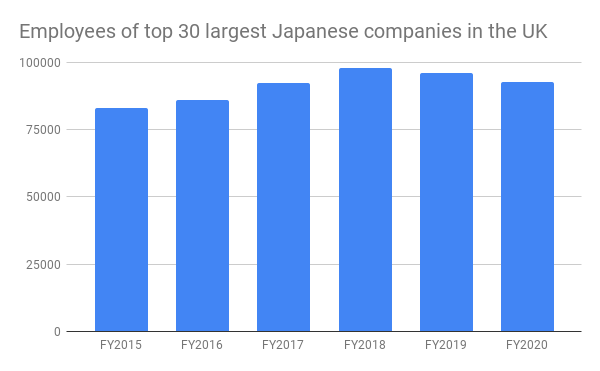

The total number of UK employees of the top 30 Japanese company groups fell 2.6% from 2019/20 to 2020/2021 – a strengthening of the downward trend in employee numbers since 2018/9. The peak of employment by the 30 largest Japanese company groupings in the UK was 97,827 in 2018/9 and this has now fallen by 5,000 to 92,851 employees. The top 30 represent around two thirds of the 137,000 people employed by 1,200+ Japanese companies in the UK.

The total number of UK employees of the top 30 Japanese company groups fell 2.6% from 2019/20 to 2020/2021 – a strengthening of the downward trend in employee numbers since 2018/9. The peak of employment by the 30 largest Japanese company groupings in the UK was 97,827 in 2018/9 and this has now fallen by 5,000 to 92,851 employees. The top 30 represent around two thirds of the 137,000 people employed by 1,200+ Japanese companies in the UK.

It’s taken longer than usual to compile the top 30 Japanese companies in the UK for FY 2020, because some of the biggest employers have been very late in filing their accounts at Companies House. Like their Japanese parents, most Japanese companies in the UK run their financial year from April to March. We are defining the financial year as the year in which the majority of trading took place. So if FY2020 ended in the first half of 2021, companies then have nine months to file with Companies House, which would mean filing at the beginning of 2022. Some companies (we are looking at you NEC) did not file until the beginning of 2023, however. In most cases this seem to have been due to a mixture of the impact of the pandemic, coinciding with major acquisitions and restructuring.

2020/21 was the first year after the UK left the EU, on January 31 2020, so it may seem too early to assess the impact of Brexit. But as has been noted in this blog many times before, Japanese companies are risk averse, long term planners, so actually many of the plans were already in place and in progress, largely based on worst case scenarios. There is also a longer term trend of a shift from manufacturing (particularly automotive manufacturing) to services, in terms of who is in or out, or up or down the top 30.

Who’s shrinking

The company groups with above average decreases in employee numbers were MUFG (-21.91%), Konica Minolta (-20.13%) and Denso (-18.8%). MUFG Bank is a branch of MUFG Bank Europe NV, however, so there is no official figure for the number of employees in London. The decrease is largely based on the reports that MUFG offered 500 managers of its 1500 staff redundancy in 2019 and that this would have fed through by FY2020. It’s perfectly possible, however, that MUFG were simultaneously hiring more staff in other areas. There are another 670 or so employees at MUFG Securities, which is incorporated in the UK and shares an office with MUFG Bank. There are a further 250 so in a separate London office housing Mitsubishi UFJ Trust, Trust and Banking and Asset Management. MUFG usually says it has “around 2000” employees in London.

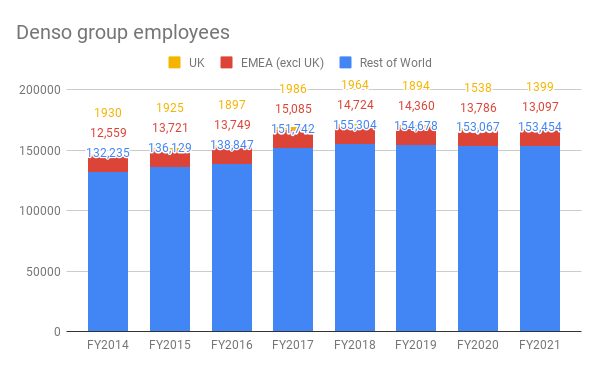

Konica Minolta acquired various UK companies before Brexit, but since Brexit has shrunk down and consolidated its operations in the UK and is focusing more on their European HQ in Germany and also the Czech Republic. The longer term trend of shifting away from manufacturing in the UK, to manufacturing elsewhere in Europe is seen at Denso, the Toyota group automotive parts manufacturer – UK employee numbers peaked in FY2018, and have been falling since, and are now 27.5% below the FY2014 level, whereas employment in the rest of the region is up 4.3% and global employee numbers, excluding UK, have risen 16% since FY2014.

Konica Minolta acquired various UK companies before Brexit, but since Brexit has shrunk down and consolidated its operations in the UK and is focusing more on their European HQ in Germany and also the Czech Republic. The longer term trend of shifting away from manufacturing in the UK, to manufacturing elsewhere in Europe is seen at Denso, the Toyota group automotive parts manufacturer – UK employee numbers peaked in FY2018, and have been falling since, and are now 27.5% below the FY2014 level, whereas employment in the rest of the region is up 4.3% and global employee numbers, excluding UK, have risen 16% since FY2014.

Who’s growing

Company groups with the strongest growth over FY2019/20 to FY2020/21 were SoftBank, Mitsubishi Electric and Panasonic. SoftBank was fulfilling its promise to the Takeover Panel to double its UK workforce to 3,500 people in the UK after acquiring ARM in 2016, but it has recently become clear that it has since lost 40% of those it hired and there are now around 2,800 people at ARM in the UK. This will not be reflected until the 2021/22 reports.

Mitsubishi Electric is also, like MUFG, a branch of a European HQ in the Netherlands, so the employee total is an estimate, but it employs nearly 1,500 people at its air conditioning company and factory in Scotland, which is a UK incorporated company. Air conditioning has been a high growth area for several Japanese manufacturers in Europe.

Panasonic‘s growth is due to the acquisition of American software company Blue Yonder, which has around 300 employees in the UK. The bulk of Panasonic’s employees are in Panasonic UK and Panasonic Business Support Europe, which are both branches of Panasonic Marketing Europe in Germany – in Panasonic UK’s case since 2011. The European HQ was moved from the UK to the Netherlands in 2018 and it has not been disclosed what the trends in employment in these UK operations has been since then. The website says it employs over 400 people in its Bracknell offices, which is considerably lower than the 1,389 employees it had in 2018/9. If these figures can be regarded as comparable, then Panasonic has actually shrunk in the UK over the past few years, despite the Blue Yonder acquisition.

The top 3

Less significant changes in employee totals have resulted in a reshuffle of the top 3. The Hitachi group was the largest employer in the UK in FY2020, taking over from Nissan, which dropped to #3. Itochu moved up from #3 to #2. In Hitachi’s case, the growth was at Hitachi Energy (the recently acquired ABB power grids business), Hitachi Solutions and what was Hitachi Capital. The latter may have to be dropped from the total in future years as Hitachi now only owns 27% of it, and it has been renamed Mitsubishi HC Capital. Similarly 51% of Hitachi Construction Machinery is being sold to Itochu and Japan Industrial Partners, so it will leave the Hitachi group.

Itochu has considerable presence in the UK thanks to its acquisition of Kwik-Fit, with over 5,000 employees in FY2020 and Stapleton’s Tyres, with over 1,000 employees. There were rumours that Itochu was considering the sale of Stapleton’s and Kwik-Fit in 2020, but nothing seems to have developed since.

Key changes compared to FY2015

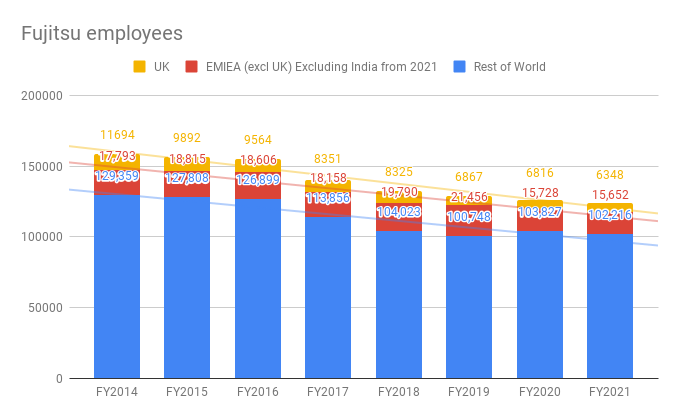

Five years’ ago, Fujitsu was the largest Japanese corporate group in the UK, with 9,892 people. It has lost 3,000 employees since, and was the fourth largest Japanese group in the UK in FY2020. As of FY2021, Fujitsu has 6,348 employees in the UK, 45% down on FY2016, compared to a 21% decrease globally, excluding the UK. Growth at Fujitsu has been in India (and Fujitsu’s CTO is Indian) and in its global delivery centres in countries such as Poland and the Philippines.

Five years’ ago, Fujitsu was the largest Japanese corporate group in the UK, with 9,892 people. It has lost 3,000 employees since, and was the fourth largest Japanese group in the UK in FY2020. As of FY2021, Fujitsu has 6,348 employees in the UK, 45% down on FY2016, compared to a 21% decrease globally, excluding the UK. Growth at Fujitsu has been in India (and Fujitsu’s CTO is Indian) and in its global delivery centres in countries such as Poland and the Philippines.

Honda was at #3 in FY2015 and had already fallen to #5 by FY2020 – before Swindon closed in July 2021. The closure of the Swindon plant will mean that Honda drop out of the top 30.

Companies that have dropped out of the top 30 since FY2015 include Calsonic Kansei, which is now Marelli, since merging with Italy’s Magneti Marelli, with KKR as the main shareholder. KKR is American, but it is KKR Japan that has the stake. Marelli has over 1,700 employees in the UK, so maybe we should keep it in the top 30. The Marelli website indicates the global headquarters is in Japan – but the management team has plenty of non-Japanese on it. It’s another example of how it has become increasingly complex to define what a Japanese company is.

Another automotive company to drop out of the top 30 is Yazaki. It had 1,345 employees in the UK in FY2015, and now has 890. Olympus has just dropped out of the top 30, not due to shrinkage so much (it had 1,362 employees in FY2015 and now has 1,389) as other companies growing more. JTI (Japan Tobacco International) has also dropped out of the top 30, since the closure of its Gallaher factory in Northern Ireland in 2017.

Newcomers to the top 30 over the past five years are:

- NTT following their acquisition and consolidation of many IT services companies including Dimension Data, itelligence, Everis and Keane

- Outsourcing, who have acquired various recruitment and outsourcing companies in the UK

- NEC, who acquired Northgate Public Services

- Mizuho – who expanded organically – but total employees are an estimate, as Mizuho Bank is a branch of Japan

Predictions for 2021/2

Around two-thirds of the 1200+ Japanese companies in the UK have filed their annual reports for 2021/2. The data from these reports suggests a further 10,000 drop (-7.6%) in employment numbers, from 137,000 to 126,000. 4,000 of this will be due to the closure of Honda’s Swindon plant, and a further 750 or so due to the closure of related automotive companies. For the top 30, there looks to be an overall decline in employee numbers, apart from Toyota.

There have been no major acquisitions in the past couple of years so we do not expect there to be any new entrants to the Top 30. The shift to services will continue, as will the increasing lack of transparency as to how many people are actually employed in the UK by Japanese companies, thanks to many of the UK operations becoming branches, with the shift of the regional headquarter functions to the EU.

Click the link below for a pdf of the Top 30 Japanese employers in the UK:

DOWNLOAD OF TOP 30 JAPANESE EMPLOYERS IN UK

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。