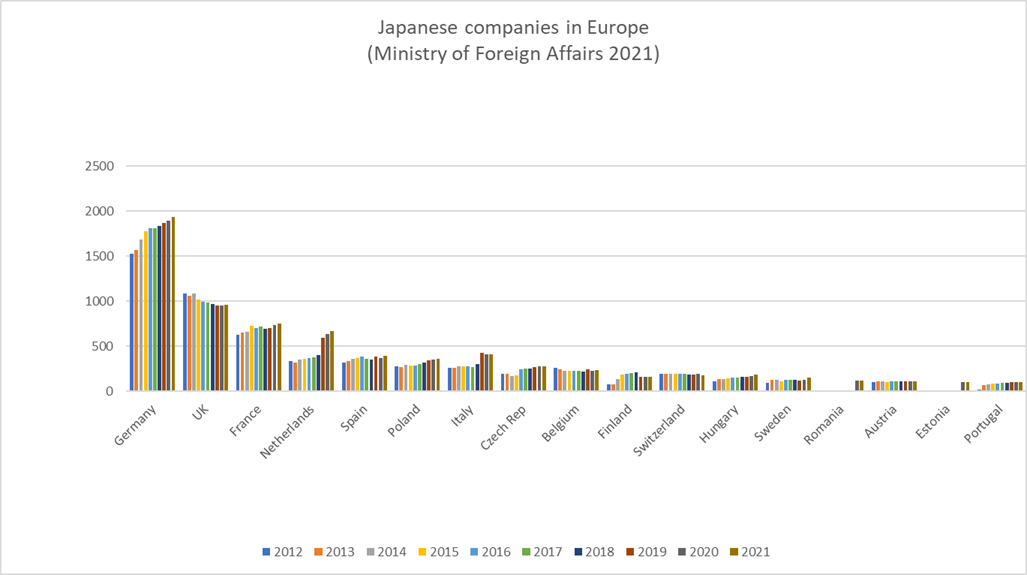

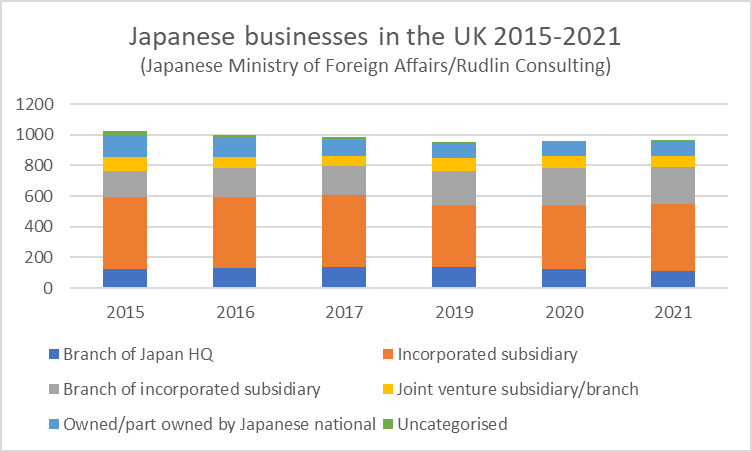

The latest Japanese Ministry of Foreign Affairs data reveal that the number of Japanese businesses in the EU rose a further 2% from 2020 to 2021, to 8,464, up 28% on ten years ago. The only EU country to show any decline was Belgium. The picture for the UK is rather different – an 11% decrease on ten years ago, from 1,083 businesses to 960. There has been a slight pick up in the past two years, from a low of 951 in 2019.

The branchification of the UK

Digging further into the detail – and comparing the UK to other major hosts of Japanese companies such as Germany, France and the Netherlands – reveals some possible factors in this divergence. The numbers of businesses started in the UK by Japanese nationals showed the biggest decline. This could be because the businesses were bought out, the founder retired and shut down the company – or perhaps became British.

There is also a confirmation of a trend we noticed previously, that the number of subsidiaries incorporated in the UK has fallen, but at the same time there has been an increase in the number of UK branches of European subsidiaries of Japanese companies. This probably includes those operations which were incorporated subsidiaries but have now become branches of the European HQ in Germany or the Netherlands – such as Sony, Panasonic, Nikon, Bridgestone and Alps Alpine.

Switching to becoming a branch was partly a reaction to Brexit but in the former two cases may also have been a precautionary measure because of the change in Japanese tax haven laws. As we noted previously, the UK’s 2016 “open for global business” announcement that the corporation tax rate would fall to 17% in 2020 (it didn’t) would have meant that revenue from dividends and royalties received in the UK would be considered as tax avoidance by the Japanese tax authorities.

The decline in Japanese businesses in the UK had set in as early as 2012, long before Brexit, but accelerated after Brexit – it precipitated trends that were already there, and prompted Japanese companies to do some long overdue regional consolidation and tidying up.

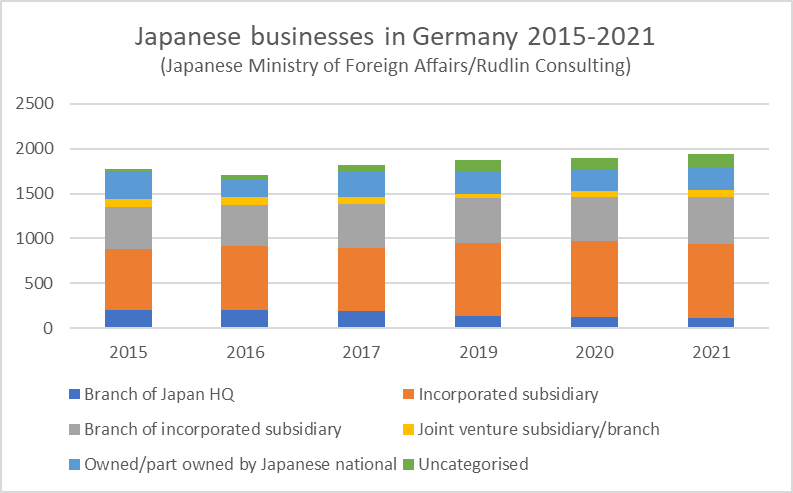

This branchification of the UK and regional consolidation is reflected in the Ministry of Foreign Affairs data for Germany – the number of branches of Japan HQ in Germany has fallen by 45% and the number of incorporated subsidiaries has risen by 21% over the past 10 years. There has also been a significant decline, as in the UK, of the number of businesses started by Japanese nationals resident in Germany.

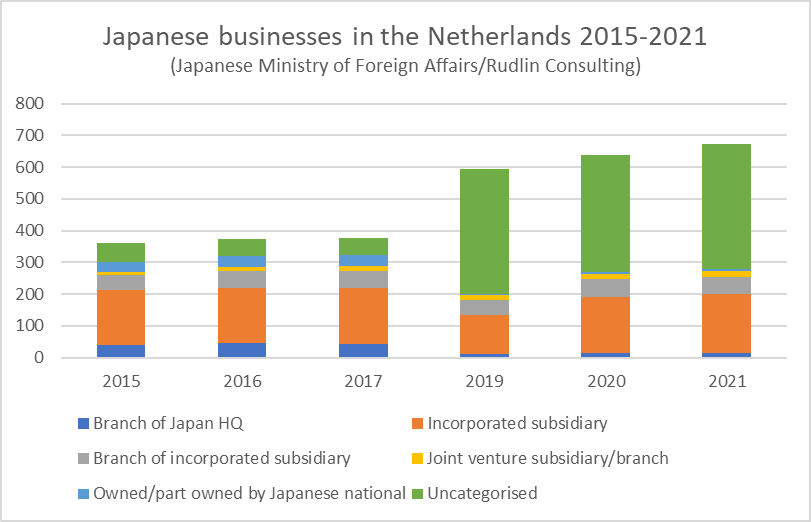

As for the Netherlands, there has been a quintupling of the number of business classified as “uncategorised” from 61 in 2015 to 393 in 2021. These may be brass plate type holding companies. All other categories (incorporated subsidiaries, branches of regional subsidiaries and joint ventures/investments) have increased as well, apart from branches of Japan HQ (which may have now become subsidiaries) and those started by Japanese nationals in the Netherlands. There was an overall rise of 86% of Japanese businesses in the Netherlands since 2015.

As for the Netherlands, there has been a quintupling of the number of business classified as “uncategorised” from 61 in 2015 to 393 in 2021. These may be brass plate type holding companies. All other categories (incorporated subsidiaries, branches of regional subsidiaries and joint ventures/investments) have increased as well, apart from branches of Japan HQ (which may have now become subsidiaries) and those started by Japanese nationals in the Netherlands. There was an overall rise of 86% of Japanese businesses in the Netherlands since 2015.

Cars for cheese?

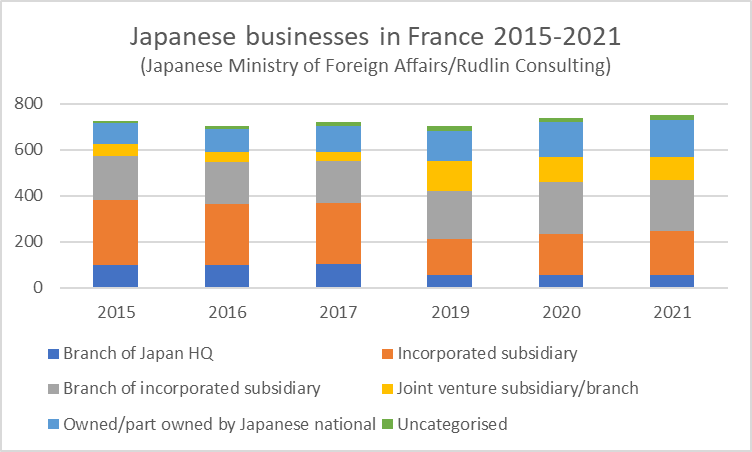

The number of Japanese companies in France only increased by 3% since 2015, but this conceals significant changes in the composition of those businesses – the number of branches of Japan HQ has dropped 45%, the number of incorporated subsidiaries has also fallen, by 31%, whereas there has been a significant increase in joint ventures and part investments, as well as businesses started by Japanese nationals in France. This is particularly marked since 2019, when the EU-Japan Economic Partnership agreement entered into force. Perhaps the “cars for cheese” deal encouraged Japanese nationals to set up food exporting businesses in France.

* Some notes on the Ministry of Foreign Affairs data: “Companies” include branches of the Japanese parent company, subsidiaries incorporated in Europe, branches of those subsidiaries, companies started overseas by Japanese nationals and joint ventures/investments of 10% or more equity stake. There is no detailed break down by type of organisation for 2018, when MoFA changed their methodology.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。