Daikin continues to expand in Europe with new heat pump plant in Poland

Daikin has started construction of its new heat pump factory in Poland, its fourth plant in Europe. It will create 1,000 jobs by 2025 and 3,000 by 2030.

Daikin’s European headquarters, in Belgium, announced last year that sales of heat pumps had increased 170% on the previous year, thanks to a push to reduce dependency on Russian gas. It will also increase production in Belgium and Czech Republic.

Daikin has over 11,000 employees in the EMEA region, making it the 24th largest Japanese corporate group in EMEA, up from 27 a year ago.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More LinkedIn

LinkedIn YouTube

YouTube

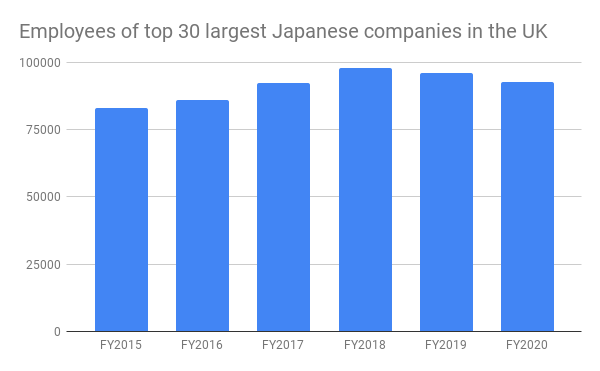

The total number of UK employees of the top 30 Japanese company groups fell 2.6% from 2019/20 to 2020/2021 – a strengthening of the downward trend in employee numbers since 2018/9. The peak of employment by the 30 largest Japanese company groupings in the UK was 97,827 in 2018/9 and this has now fallen by 5,000 to 92,851 employees. The top 30 represent around two thirds of the 137,000 people employed by 1,200+ Japanese companies in the UK.

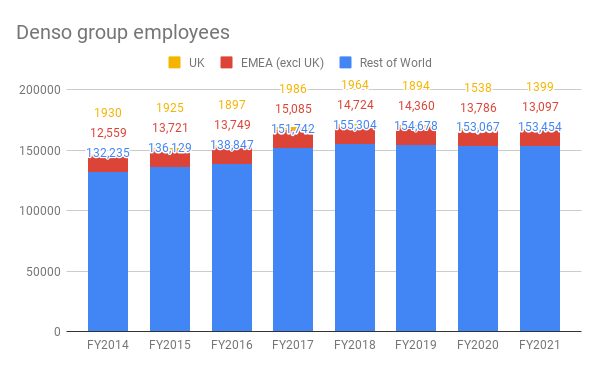

The total number of UK employees of the top 30 Japanese company groups fell 2.6% from 2019/20 to 2020/2021 – a strengthening of the downward trend in employee numbers since 2018/9. The peak of employment by the 30 largest Japanese company groupings in the UK was 97,827 in 2018/9 and this has now fallen by 5,000 to 92,851 employees. The top 30 represent around two thirds of the 137,000 people employed by 1,200+ Japanese companies in the UK. Konica Minolta acquired various UK companies before Brexit, but since Brexit has shrunk down and consolidated its operations in the UK and is focusing more on their European HQ in Germany and also the Czech Republic. The longer term trend of shifting away from manufacturing in the UK, to manufacturing elsewhere in Europe is seen at Denso, the Toyota group automotive parts manufacturer – UK employee numbers peaked in FY2018, and have been falling since, and are now 27.5% below the FY2014 level, whereas employment in the rest of the region is up 4.3% and global employee numbers, excluding UK, have risen 16% since FY2014.

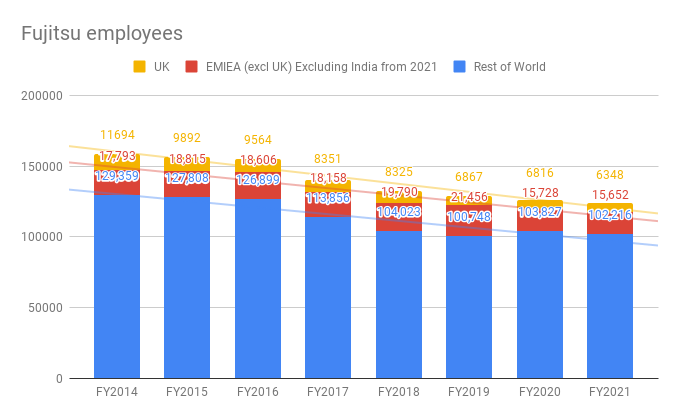

Konica Minolta acquired various UK companies before Brexit, but since Brexit has shrunk down and consolidated its operations in the UK and is focusing more on their European HQ in Germany and also the Czech Republic. The longer term trend of shifting away from manufacturing in the UK, to manufacturing elsewhere in Europe is seen at Denso, the Toyota group automotive parts manufacturer – UK employee numbers peaked in FY2018, and have been falling since, and are now 27.5% below the FY2014 level, whereas employment in the rest of the region is up 4.3% and global employee numbers, excluding UK, have risen 16% since FY2014. Five years’ ago, Fujitsu was the largest Japanese corporate group in the UK, with 9,892 people. It has lost 3,000 employees since, and was the fourth largest Japanese group in the UK in FY2020. As of FY2021, Fujitsu has 6,348 employees in the UK, 45% down on FY2016, compared to a 21% decrease globally, excluding the UK. Growth at Fujitsu has been in India (and Fujitsu’s CTO is Indian) and in its global delivery centres in countries such as Poland and the Philippines.

Five years’ ago, Fujitsu was the largest Japanese corporate group in the UK, with 9,892 people. It has lost 3,000 employees since, and was the fourth largest Japanese group in the UK in FY2020. As of FY2021, Fujitsu has 6,348 employees in the UK, 45% down on FY2016, compared to a 21% decrease globally, excluding the UK. Growth at Fujitsu has been in India (and Fujitsu’s CTO is Indian) and in its global delivery centres in countries such as Poland and the Philippines.