Japanese companies positive on growth and profitability in Europe, Africa and Middle East, but facing labour shortages

JETRO’s 2023 global survey has been published but as always, in Japanese only. 7,632 Japanese companies responded during August – September 2023, from 82 countries and regions. An English translation will no doubt follow in due course, but for the time being, here are the key highlights as relate to the Europe, Middle East and Africa region:

- The outlook for Japanese companies in Africa and the Middle East is more positive, compared to a deteriorating view of performance and predictions for profitability and growth for China, and also Hong Kong, Vietnam, South Korea and Singapore

- Profit – Proportion of companies in the major economies of the EMEA region expecting to be profitable in the coming year:

- South Africa 86%

- UAE 76.5%

- France 75.7%

- Netherlands 72.6%

- UK 71.4%

- Germany 68.2%

- Growth – Japanese companies in Europe are showing stronger than global average intention to expand. Japanese companies in South Africa particularly cited increased exports to neighbouring countries such as Zambia, Namibia and Congo. Japanese companies in Germany cited a number of reasons – increased exports to Central and Eastern Europe, Africa, Turkey, etc, the expansion of the EV market, growth of the semiconductor market within Europe and increased demand due to environmental regulations (large companies, chemical products, petroleum products). The percentage of companies expecting business to expand in the next 1 – 2 years:

- South Africa 57.7%

- Germany 54.9%

- UAE 53%

- France 51.4%

- Netherlands 51.2%

- UK 43.9%

- Labour shortages – Over 50% of Japanese companies are facing human resource shortages. The proportion is particularly high in large manufacturing companies. Labour shortages are being faced by more than 60% of companies in North America and Europe. The issue is particularly acute in the Netherlands, the United States, Germany, and France.

- Japanese companies in the EMEA region note that trying to recruit internally first or rotating staff within the region can help with hiring. For retention, offering the ability to work from home and ensuring a steadily increasing salary in line with inflation have helped with motivation.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More

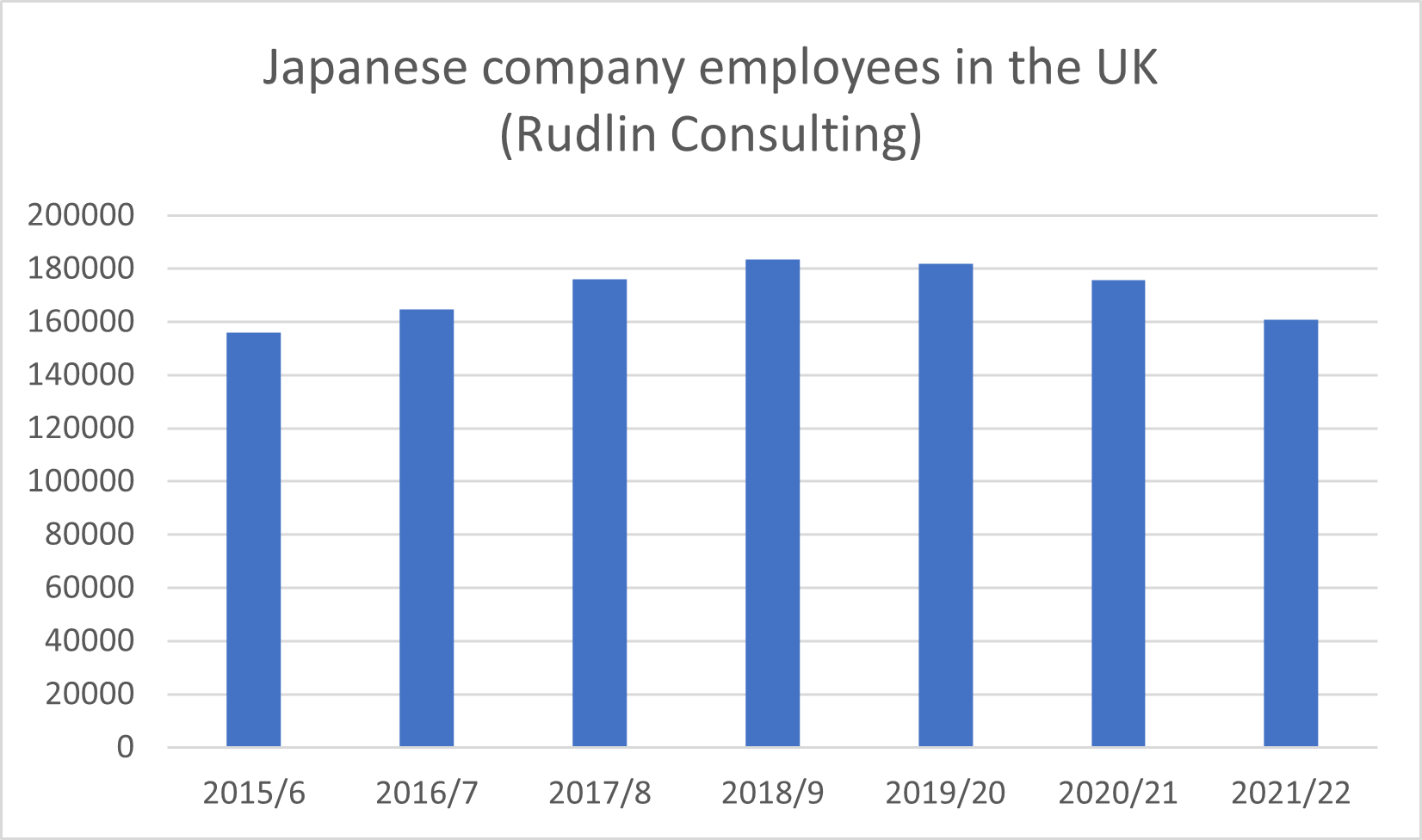

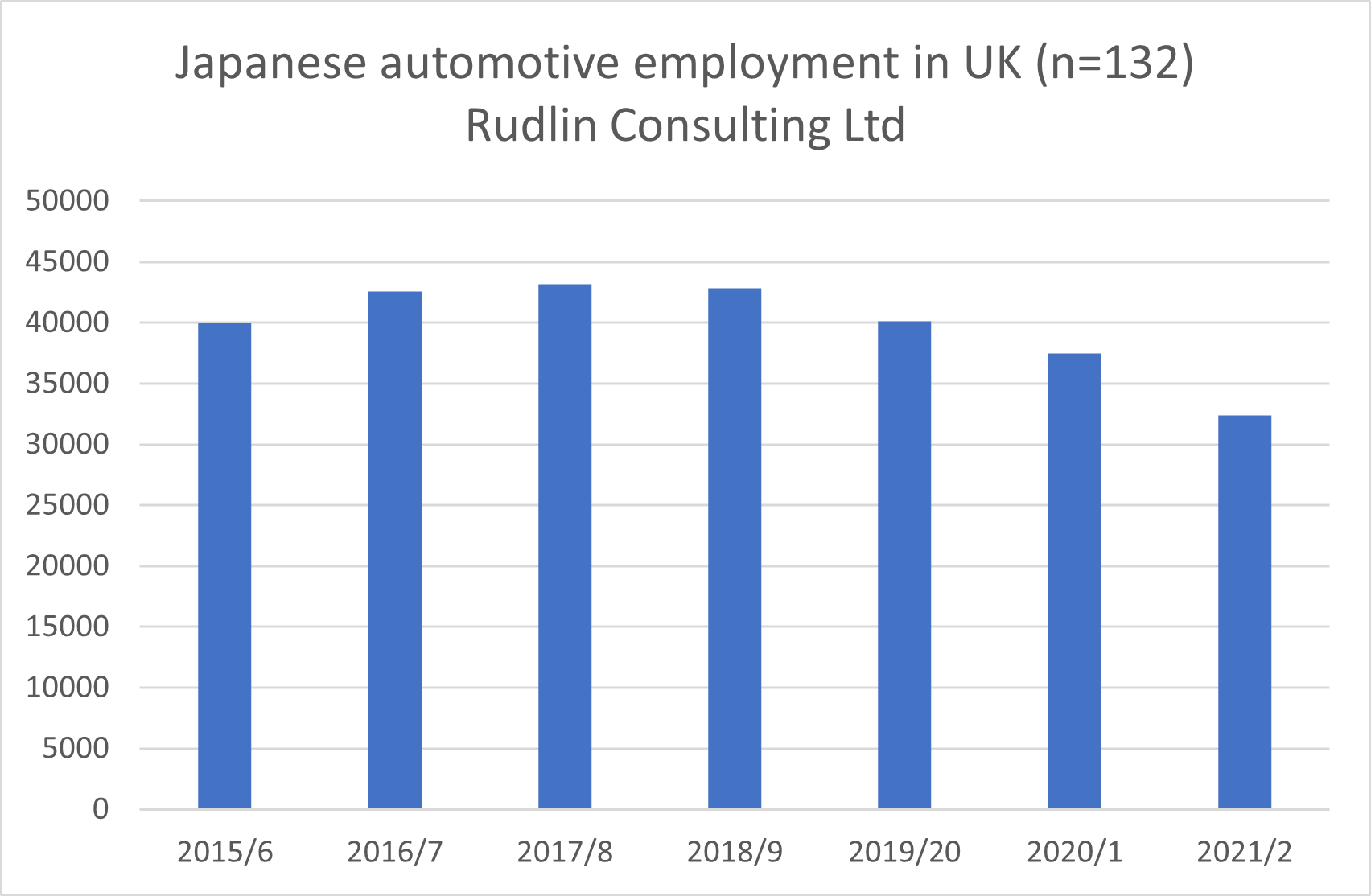

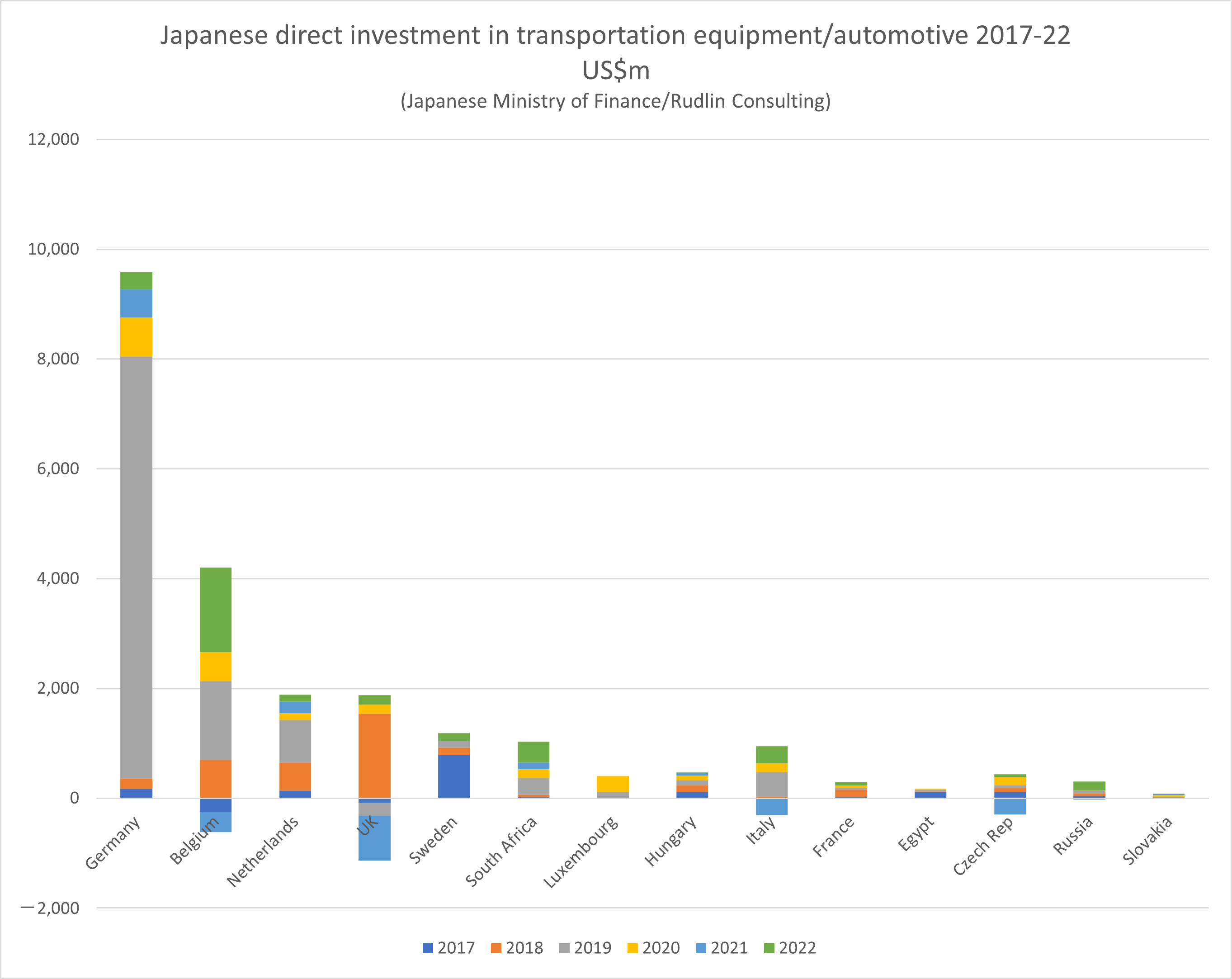

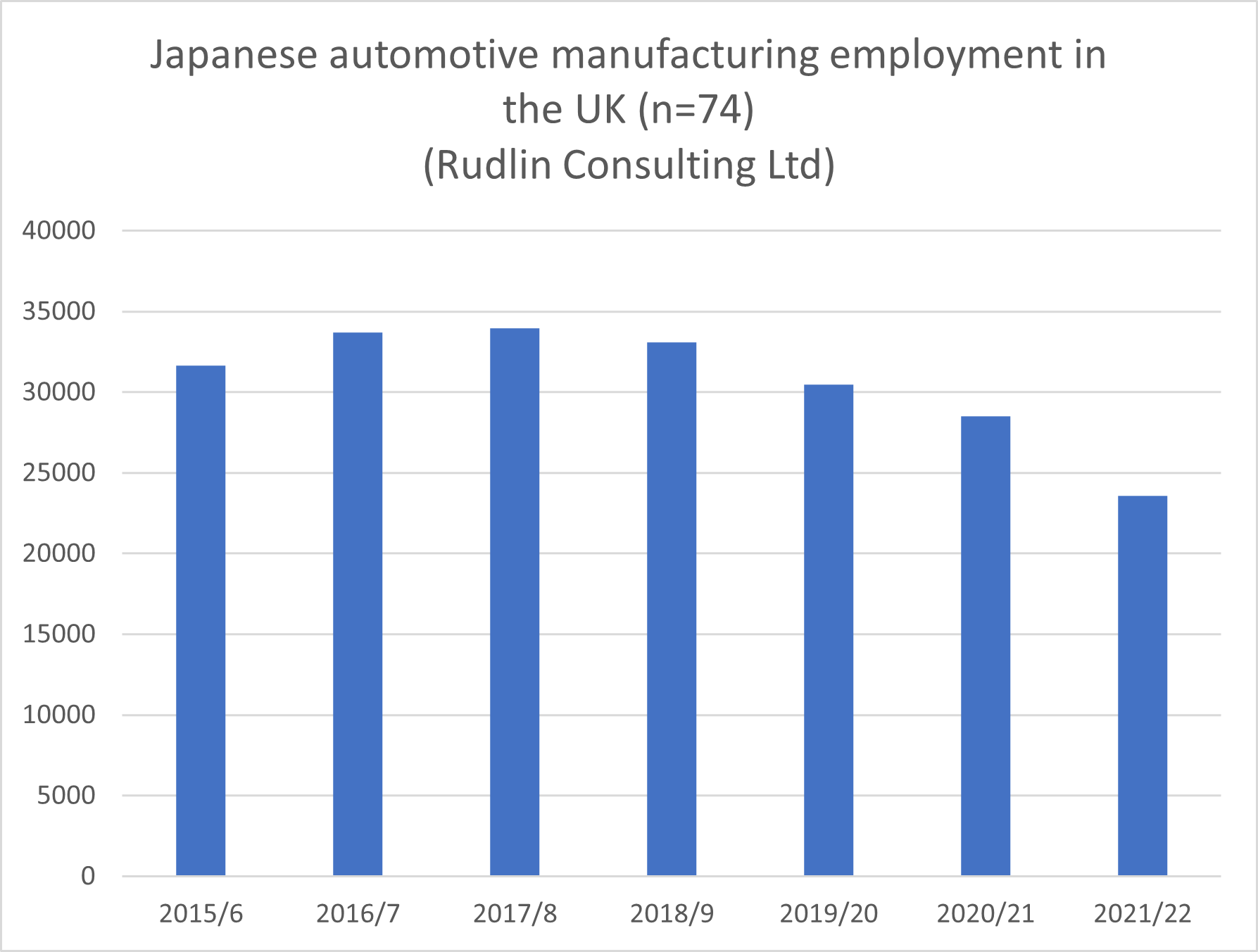

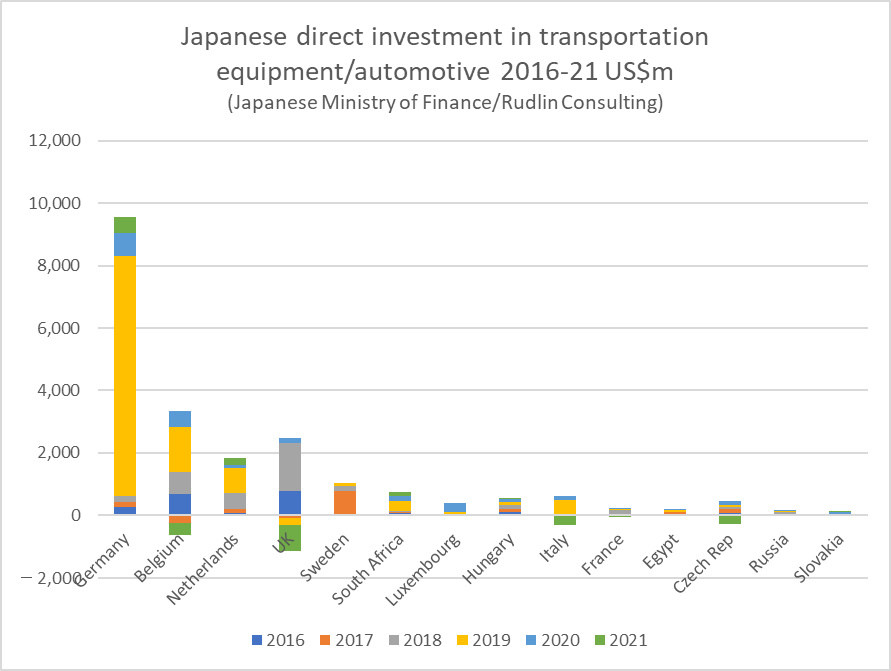

If we just focus on Japanese companies with production in the UK, there was a 26% decline in employment over 2018-2022 – unsurprisingly close to the overall trend – as around 74% of all Japanese automotive employees in the UK are employed in manufacturing operations.

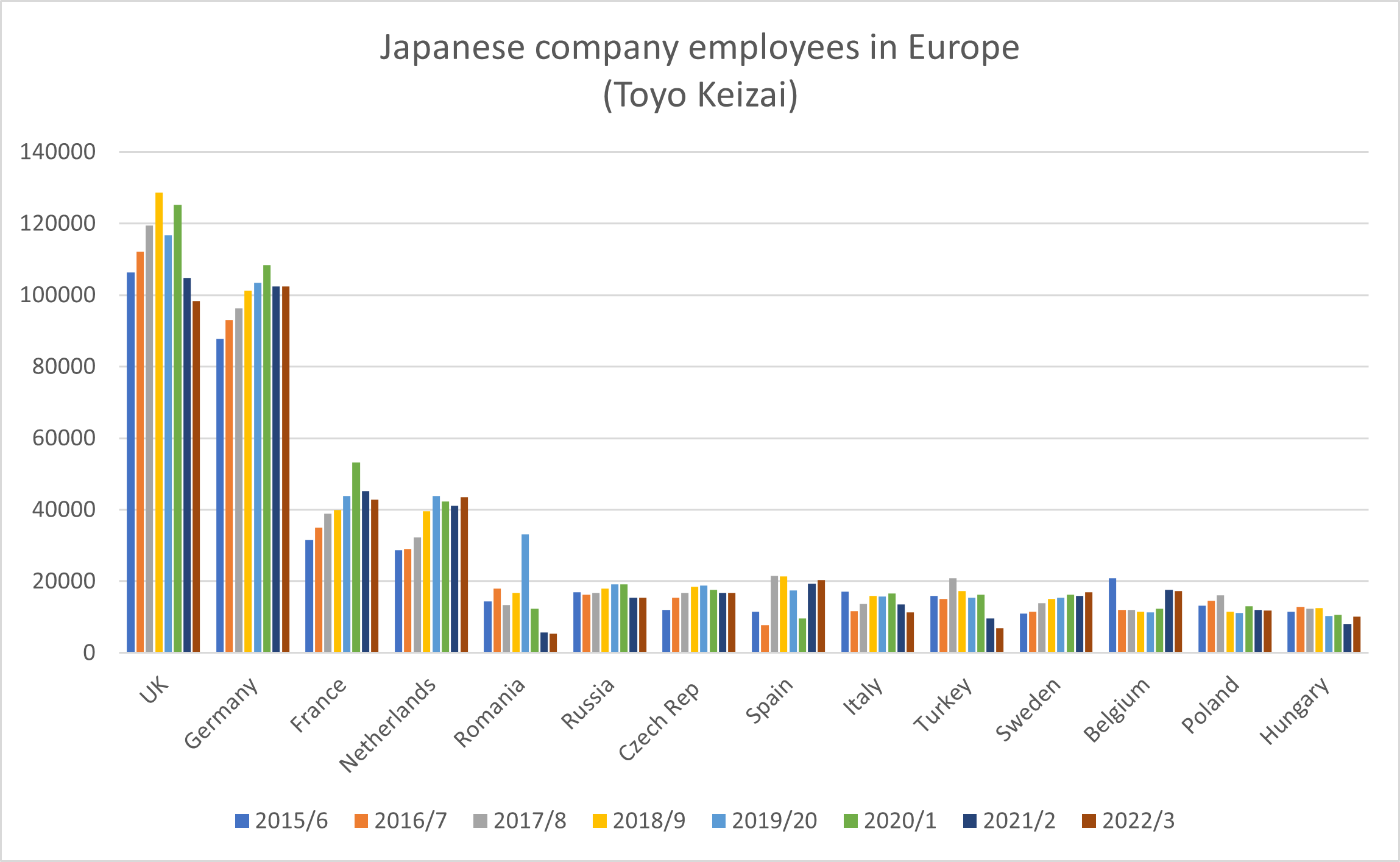

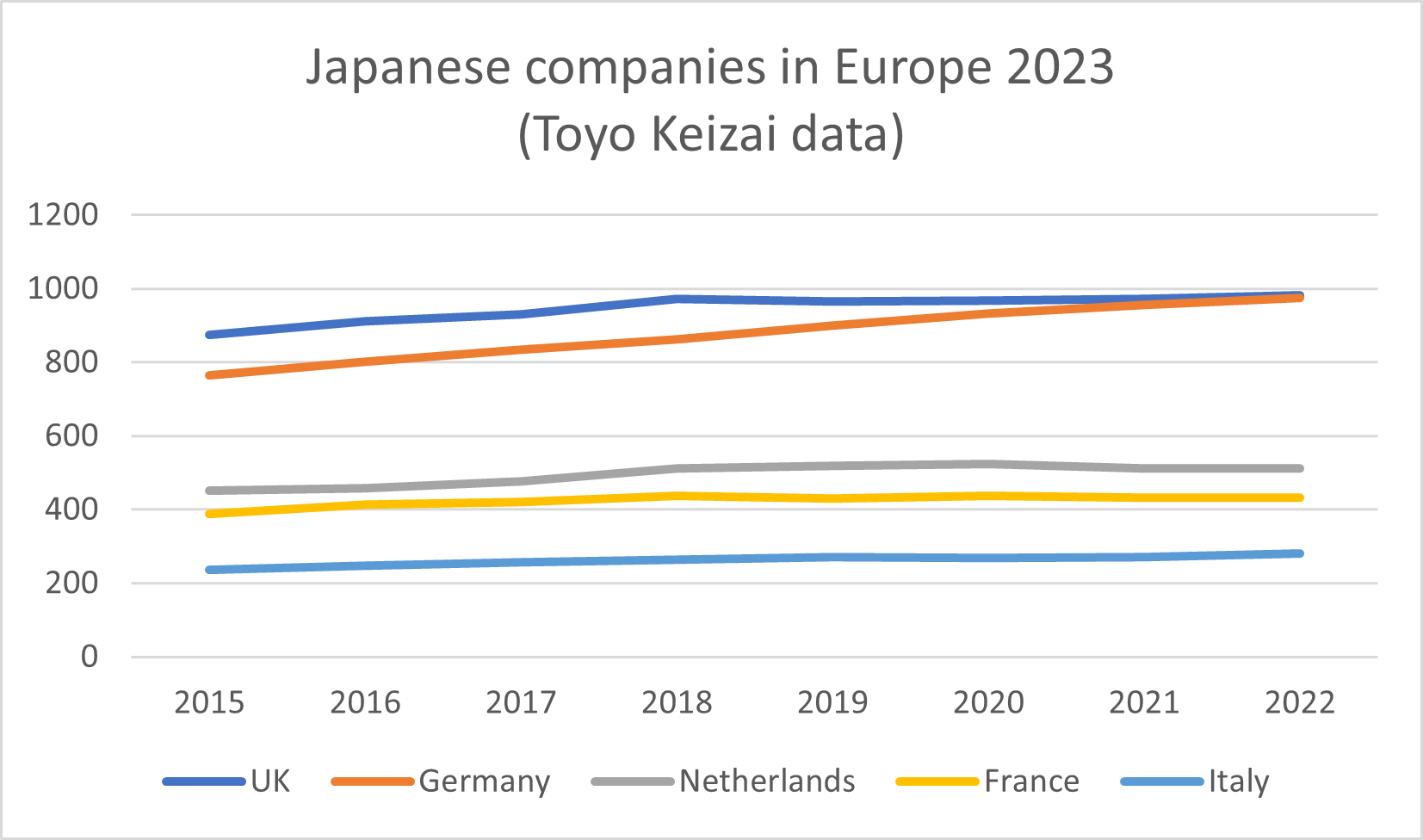

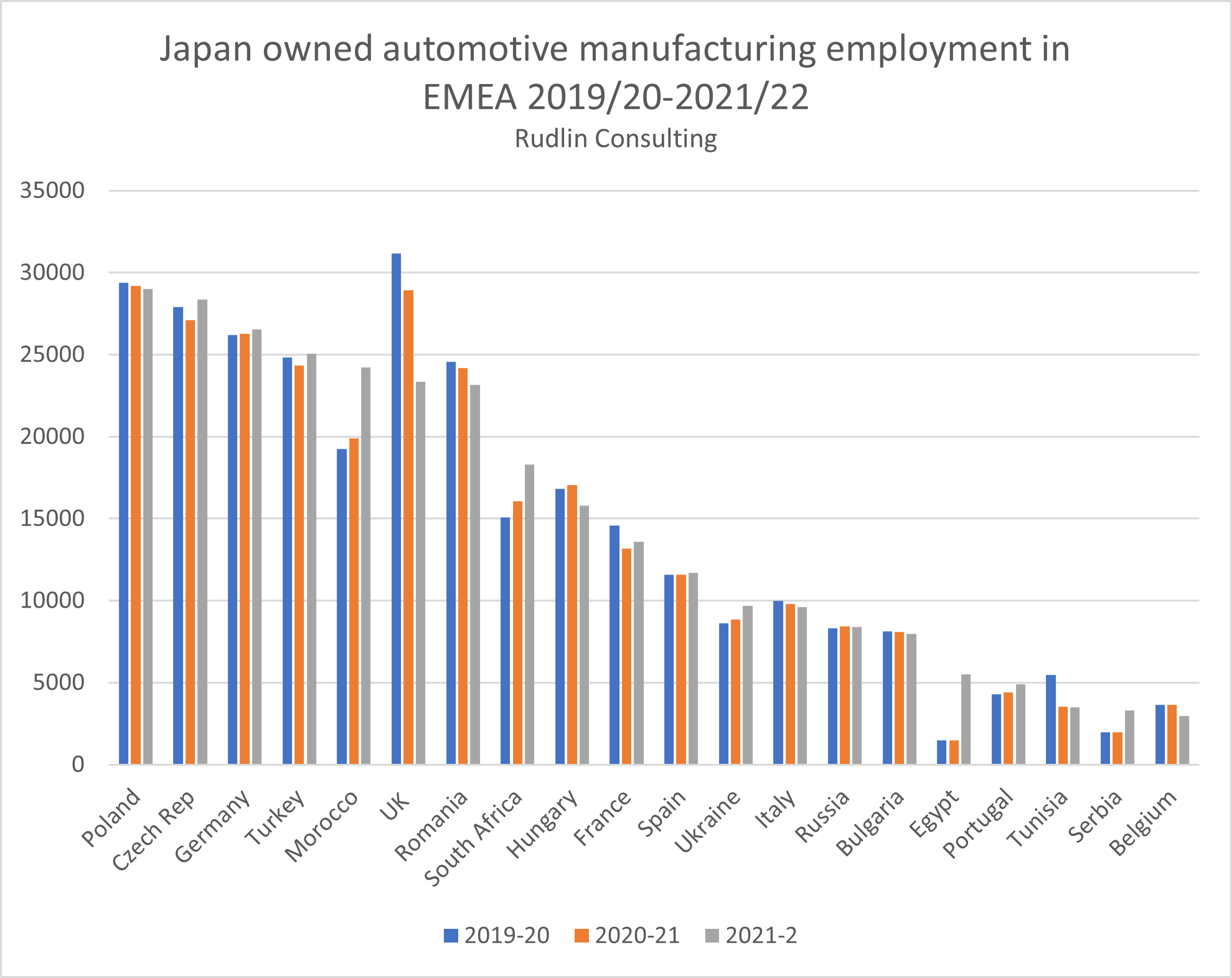

If we just focus on Japanese companies with production in the UK, there was a 26% decline in employment over 2018-2022 – unsurprisingly close to the overall trend – as around 74% of all Japanese automotive employees in the UK are employed in manufacturing operations. numbers of Japanese automotive manufacturing employees in the EMEA region. According to our estimates, the UK will slip to 6th position in 2021-2022, due to the closure of Honda‘s Swindon plant, along with many of its suppliers shutting down operations. It will be overtaken by Czech Republic, Germany, Turkey and Morocco.

numbers of Japanese automotive manufacturing employees in the EMEA region. According to our estimates, the UK will slip to 6th position in 2021-2022, due to the closure of Honda‘s Swindon plant, along with many of its suppliers shutting down operations. It will be overtaken by Czech Republic, Germany, Turkey and Morocco.

rudlin

rudlin rudlinconsulting

rudlinconsulting