“We will stick with the UK as a global supply base, despite Brexit” says Honda President

“Europe is the heart of global car culture” says Takahiro Hachigo, Honda’s President since 2015. Although Honda has less than 1% market share in Europe, it competes with European car brands in its main markets of the USA and China. The UK factory has been streamlined, and production lines consolidated as a global production centre, exporting Civics to Europe and the USA. Hachigo says that they are therefore committed to the Swindon factory as a global supply base, regardless of Brexit. “If there is a no deal Brexit, there will be temporary disruption, so I am very much hoping that this disruption will be avoided and outstanding issues resolved”, says Hachigo.

However, as the Nikkei points out in their interview with Hachigo, if there is a no deal Brexit, without a transition period to 2020, Honda’s exports to Europe will be affected immediately and supply chain issues may make it difficult to export so easily to the USA too.

Honda has committed to a 30 year plan with a goal of “pursuit of quality” – to develop cars that will still sell at a high price, in an age of car sharing and electric vehicles. Hachigo also seems very keen in the interview to keep participating in Formula 1 (another UK strength). UK has that “luxury car maker” image, with Rolls Royce and Bentley, so it is understandable that Honda still wants to keep a base there, but as the Nikkei says “difficult management decisions will be needed in the future” to realise this strategy. I also wonder whether Honda’s current brand image, in Europe at least, really is convincing as a luxury, higher price positioning.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More

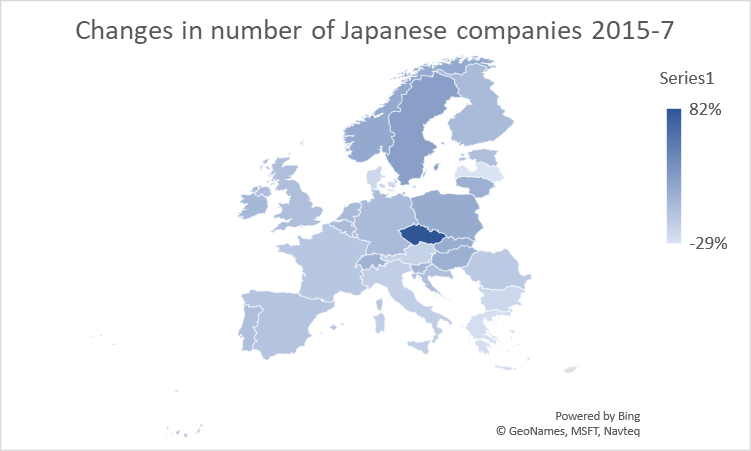

On the face of it, it looks to have been a good couple of years’ for

On the face of it, it looks to have been a good couple of years’ for