Exporting Omotenashi

It’s been a very tough few months for high street retail in the UK and elsewhere. Supermarkets, clothing brands and electronics have all had casualties in the UK. As always the disruptive effect of e-commerce is blamed. Rumours are swirling that even the UK upmarket supermarket chain Waitrose has been approached by Amazon as an acquisition prospect.

So maybe this is a good moment for Japanese retail and e-commerce companies to make another attempt to expand overseas, after the relative failure of Rakuten. Clearly Mercari thinks so, having just announced that it will enter the US market.

But rather than go down the disruptive route of simply undercutting prices online, I wonder whether Japanese companies could be more innovative in the service they provide, and find ways to bring the famous Japanese value of omotenashi to the world.

I shopped at the Cos (a Swedish mid market brand from the same company as H&M) flagship store in Regent’s Street in London recently. It was full of Chinese tourists but also local people, trying on piles of clothes. It was not a pleasant experience and most of the clothes had cosmetics stains on them. I wondered why anyone would buy anything and then realised that what the local people were doing was trying, and then buying the clothes online.

This makes it difficult to incentivise the shop assistants to give good service or keep the shop environment pleasant either through commission or through positive feedback, as there is little direct sense of achievement or impact on sales. But of course the physical customer experience has become even more crucial now if retailers with high street presence are to compete with pure online retailers.

This point was reinforced by the speaker at my local business women’s network. She has started an upmarket women’s fashion brand – £500 for vibrantly coloured tailor made dresses in Italian wool. It is a highly personal service and she says that she has also discovered that customers are willing to pay for her simply to spend an hour and a half with her.

We did wonder why she had made the effort to travel 2 hours to talk to us for free, considering we might not be rich enough to afford her dresses. And she was also kind enough to give me some free careers advice afterwards. I suppose it links back to what she said in her speech about one of her core values being to give, without expecting to receive anything back, at least at first. This is the deeper meaning of omotenashi. Not just the usual translation of “hospitality” but a selfless giving, which is why Japanese customer service is world famous.

I know some Japanese clothing companies like Start Today are trying to replicate excellent personalised service online. It would be great if Japanese companies in other sectors could do this physically as well as online outside of Japan. The UK certainly has plenty of empty shops available.

This article was originally published in Japanese in the Teikoku Databank News in 2018 and also appears in Pernille Rudlin’s latest book “Shinrai: Japanese Corporate Integrity in a Disintegrating Europe” available as a paperback and Kindle ebook on Amazon.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More

The report on Sky News about the

The report on Sky News about the

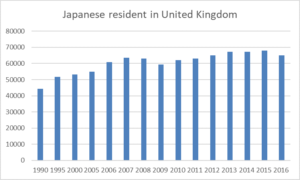

The number of Japanese nationals resident in the UK fell by 4.5% in 2016, from 67,997 in 2015 to 64,968 – the first time since 2008-9, when the Lehman Shock hit and numbers dropped from 63,526 to 59,431.

The number of Japanese nationals resident in the UK fell by 4.5% in 2016, from 67,997 in 2015 to 64,968 – the first time since 2008-9, when the Lehman Shock hit and numbers dropped from 63,526 to 59,431.