A very timely introduction of a new trade compliance diploma from the International Trade Institute

We thought the new trade compliance diploma from the recently-established International Trade Institute would be of interest to Japanese companies operating in Europe, struggling with additional complications post-Brexit. Now that various sanctions are being introduced against Russia, it seems even more timely.

It is the first University-recognised diploma that is international in scope – recognised as a qualification not only in the UK but also Ireland and at the EU level. The facilitators are trade experts themselves, with many years of consulting on trade compliance around the world. The course is a programme of seven modules of a high level but practical curriculum, spread over three months at times convenient to participants, with online modules and live sessions.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More

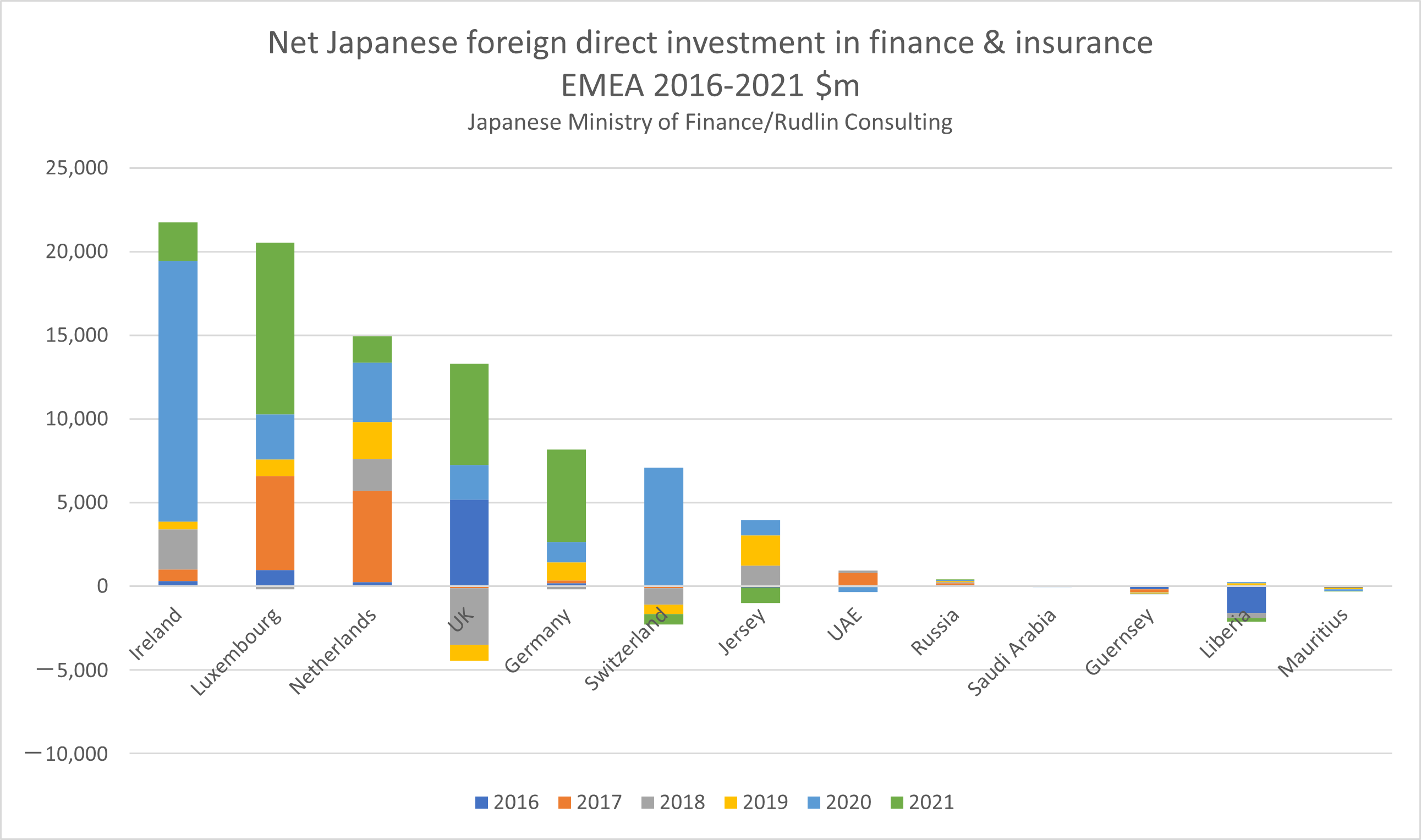

Examining the statistics from Japan’s Ministry of Finance on direct investment flows, it seems the UK benefitted from a big inward investment from Japan into the finance and insurance sector in 2016, then there was net disinvestment in 2017-2019, and then increasing net investment in 2020-21. Conversely, there was little investment into Ireland, Luxembourg or the Netherlands in 2016, but major investments into their finance and insurance sectors in 2017, 2018 and 2020-21.

Examining the statistics from Japan’s Ministry of Finance on direct investment flows, it seems the UK benefitted from a big inward investment from Japan into the finance and insurance sector in 2016, then there was net disinvestment in 2017-2019, and then increasing net investment in 2020-21. Conversely, there was little investment into Ireland, Luxembourg or the Netherlands in 2016, but major investments into their finance and insurance sectors in 2017, 2018 and 2020-21.