Pernille Rudlin interviewed on the history of Japanese companies in the UK and Brexit

Pernille Rudlin is in conversation with Tom Hayes of BEERG (Brussels European Employee Relations Group) on how Japanese companies have responded to Brexit, tracing the progress of UK/EU/Japanese trade relations from Margaret Thatcher’s promotion of Britain as a Japanese gateway to the EU in the early 1980’s, through to the present day.

The video and podcast links are as below

BEERG Byte #32 from Derek Mooney on Vimeo.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More

The recent news about Nissan and its Chinese battery manufacturing partner Envision deciding to go ahead with expanding the battery plant in Sunderland, to supply a new electric vehicle model, led me to revisit my researches on trends on the Japanese automotive sector in the Europe, Middle East and Africa region. I

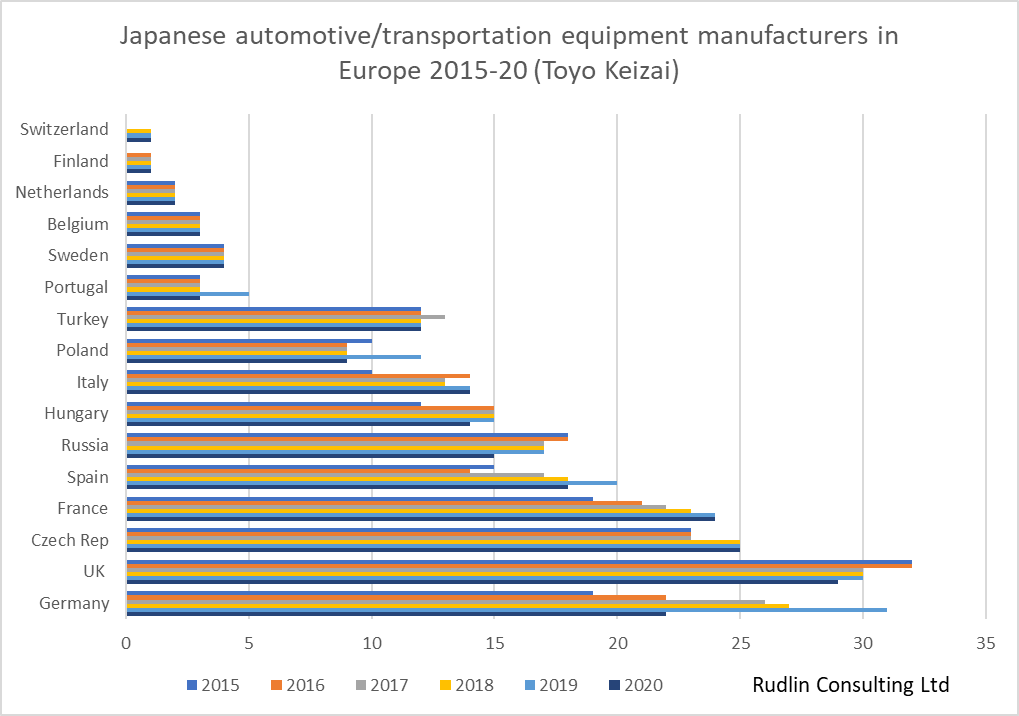

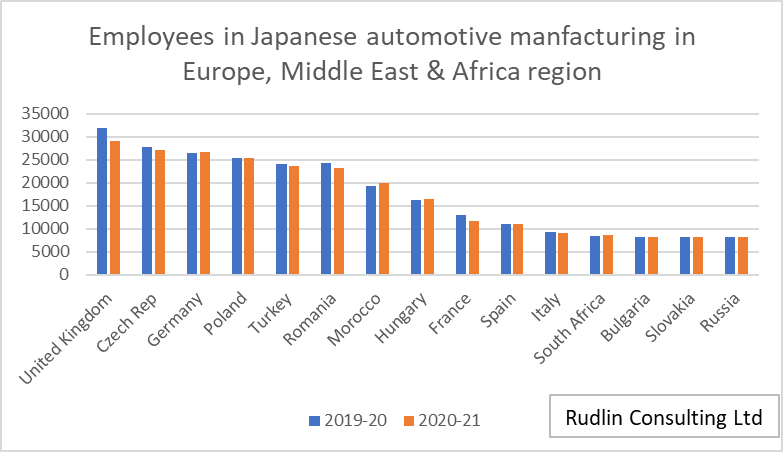

The recent news about Nissan and its Chinese battery manufacturing partner Envision deciding to go ahead with expanding the battery plant in Sunderland, to supply a new electric vehicle model, led me to revisit my researches on trends on the Japanese automotive sector in the Europe, Middle East and Africa region. I  So the UK still has the most employees of Japanese automotive manufacturers in the region, but the number of employees has dropped below 30,000 for the first time in five years. The Czech Republic, Germany and Poland are not far behind in terms of employee numbers, and it’s possible Germany still does have more Japanese automotive related manufacturers than the UK, it’s just that they have chosen not to classify themselves as being in the automotive sector. The closure of Honda Swindon and other suppliers to the Swindon plant this month will probably result in the UK losing its top spot both in terms of employees and companies hosted.

So the UK still has the most employees of Japanese automotive manufacturers in the region, but the number of employees has dropped below 30,000 for the first time in five years. The Czech Republic, Germany and Poland are not far behind in terms of employee numbers, and it’s possible Germany still does have more Japanese automotive related manufacturers than the UK, it’s just that they have chosen not to classify themselves as being in the automotive sector. The closure of Honda Swindon and other suppliers to the Swindon plant this month will probably result in the UK losing its top spot both in terms of employees and companies hosted.