Top 10 Japanese corporate charity donors in the UK

Japan-owned companies in the UK contributed over £17 million to charity in 2019. £10 million of this, however, was the donation made by First Sentier Investments (formerly First State Investments), owned by Japan’s MUFG Group since 2019.

£8.5m of the £10m went to the Maitri Trust which was established by the Stewart Investors team members (part of First Sentier Investments) in 2006, and helps educational initatives in India, South Africa and Mexico. The other £1.5m was given to the Charities Aid Foundation. 2019’s donation was a substantial increase on the £5.5m First Sentier donated in 2018.

The biggest Japanese corporate donors (>£100,000) increased their charitable budgets over the past two years, but overall the total dropped 3% on a like for like basis (not including First Sentier as they were not Japan owned in 2018/9).

Benchmarking Japanese corporate charitable donations

It’s difficult to benchmark Japanese companies’ charitable activities in the UK against FTSE 100 companies as many of the Japanese companies in the UK operate on a regional or global basis and the charitable donations are on that basis too. Only around 10% of the 1000 or so Japanese companies in the UK put a monetary figure on their charitable donations in their annual reports, or specifically state that they do not donate to charity.

The Charities’ Aid Foundation issued a report in 2018 on FTSE 100 charitable donations, which estimated that the FTSE 100 donated around £1.9bn in 2016. The report uses donations as a percentage of pre tax profit as a benchmark. Unfortunately some of the biggest Japanese companies in the UK such as Toyota, Nomura and Dentsu have been making losses in recent years so this is not a benchmark which can be readily applied to them. However, CAF’s cut off point of “at least 1% of pre-tax profits” as being an indication of commitment to charitable giving means that it is possible to say that JTI, Dentsu (using 2018 figures), Mitsubishi Corporation, Fujitsu Services and Ricoh are all in the “above 1%” category.

The Top 10 Japanese corporate givers

The next biggest donor after First Sentier was Japan Tobacco International through their Gallaher subsidiary in the UK. They donated £3.24m in 2019, a similar level to 2018. Gallaher “works with leading charities to improve the lives of socially isolated older people as well as those who are homeless, disabled or excluded from society in other ways”. They have a UK Community Investment Programme which has been accredited with Business in the Community’s CommunityMark. Employees have an allowance of up to 6 days’ a year to get involved in community fund raising and volunteering.

The third largest Japanese corporate donor was advertising and marketing group Dentsu Aegis Network, (soon to be rebranded as Dentsu International) whose global headquarters are in London. They donated £1m to charity (£0.9m in 2018) – but this is likely to be a worldwide, excluding Japan total. Dentsu announced in 2017 that “Society” was now one of its official stakeholders and announced a new social purpose of a digital economy for all. They are aiming to reach a billion people with sustainable development goal led campaigns and support 100 female founded businesses. They are launching a digital skills initiative to support 100,000 people to improve their skills.

Close behind are Toyota Motor Manufacturing UK, who donated £0.9m in 2019, slightly down on the previous year of £0.95m. It “seeks to support good causes in the areas local to its manufacturing operations” [Burnaston in Derbyshire and Deeside]. It has a charitable trust that makes donations in the areas of road safety, social inclusion and deprivation and health. As well as fund raising it makes in kind donations of cars, parts and volunteering hours (included in the £9.08m). Its nominated charity of the year was the Derbyshire, Leicestershire & Rutland and Wales Air Ambulance Service.

Mitsubishi Corporation donated £267,000 in 2019/20 (up from £140,000 in 2018/19) – to the British Museum , the Earthwatch Fellowship Programme, the University of Cambridge Faculty of East Asian Studies, the UK-Japan Music Society and the Mitsubishi Corporation Fund for Europe and Africa, which engages with partner organisations in environmental conservation.

Hitachi Capital donated £250,000 (up from £200,000 in the previous year) in 2019/20. Their national charity partner is FareShare which redistributes food going to waste to charities and community groups – contributing to the sustainable development goal of “no poverty”. Hitachi Capital staff also volunteer at FareShare. The group also works with Young Enterprise and The Wildlife Trust.

Nomura established The Nomura Charitable Trust in 2009, “supporting disadvantaged young people in the local communities in which it operates through both grant making and employee engagement in the form of volunteering and other engagement initiatives.” It gave £235,659 to 11 charities which aligned with the objectives of the trust and were recommended by Nomura employees in the year ending March 2019.

Eisai, the Japanese pharmaceutical company with a factory in Hatfield donated £212,000 in 2018/9, up from £116,00 in 2017/8. Around half of this was to patient organisations such as Alzheimer’s Research UK and Breast Cancer Now, according to their “Transparency” page on their website.

In 2018/9 Fujitsu raised over £200,000 for its partner charity Macmillan Cancer Support as well as 5,500 volunteer hours spent by employees volunteering and skill sharing.

The Olympus KeyMed group via KeyMed (Medical and Industrial Equipment Ltd) gave £122,621 within the UK, of which £45,905 was to healthcare charities, £40,202 was to “other”, £33,856 was to cancer charities and £2,658 to children’s charities. This represented a 10% decrease on the previous year

Ricoh UK made £110,426 in charitable donations in 2019, a significant increase on the previous year’s £66,285. The sum represents both financial and in kind, providing products and people to support charitable activities.

The others

Many of the larger Japanese companies in the UK not mentioned above do contribute to charities but do not put a price tag on this in their annual reports. Nissan Motor Manufacturing, for example, launched a Days for Change Europe wide programme where employees can take days “off” to volunteer. Kwik Fit, owned by Japanese trading company Itochu announced in 2019 that its charity partner was Children with Cancer UK, and a target of £1m to be raised through its sponsorship of the British Touring Car Championship.

Hitachi Rail says it made no charitable donations in 2019, seemingly leaving this up to its employees, who raised £156,846 for the Railway Children charity “to date.”

Canon UK describes its “social value policy” as comprising “employability skills training, education support, community and charitable activities” but goes into no further detail.

Conclusions

Japanese executives who had lived in the UK have occasionally remarked to me how many charity shops there are in the UK and how often they are approached by their employees to help with fundraising initiatives. According to Charities’ Aid Foundation, the UK is number 6 in the world in terms of individual charitable giving (money and time), after Indonesia, Australia, New Zealand, USA and Ireland. Japan is at 128 but in 6th position in terms of the number of people who volunteer time for charitable causes.

Certainly I remember when living in Japan and working for Mitsubishi Corporation that there were plenty of opportunities to get involved in volunteering via the company. Conversely, to my relief, noone ever asked me to sponsor them to take a charity ramen bath. I have vivid memories of being in a group of employees who took severely disabled people to Tokyo Disneyland. National disasters such as the Fukushima earthquake and tsunami also saw thousands of employees of various companies giving up weeks on end to go to the region to help.

Those Japanese companies who do give substantial amounts of money to charity in the UK tend either to have acquired established British companies and therefore their legacy of charitable activity (JTI, Dentsu, Fujitsu, Olympus KeyMed) or are manufacturers employing large numbers of staff and looking for ways to engage with the local community such as Toyota, Eisai and Ricoh. In many cases, the decision makers will also be local executives looking to raise the brand profile in a globally appealing way, so a specifically “Japanese” flavoured proposition may not be of great interest unless part of their corporate purpose is to represent Japanese interests abroad.

There are plenty of funds in Japan set up by companies such as Toshiba, Honda, Panasonic (Matsushita) but these tend to be educational in orientation and more in the business of awarding prizes, scholarships and research grants. Japanese companies will sometimes endow foundations overseas (Nissan Institute of Japanese Studies at Oxford, Daiwa Anglo-Japanese Foundation) which are also educational and dispense scholarships and grants.

Anyone wishing to approach Japanese companies may need to bear these differences and distinctions in mind. For local giving, it will be necessary to win over the local employees, and for large, prestigious donations, much of the funding available may be controlled from Japan.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More

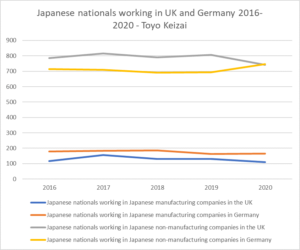

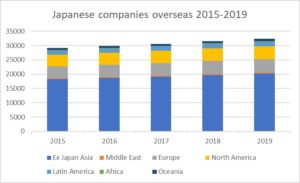

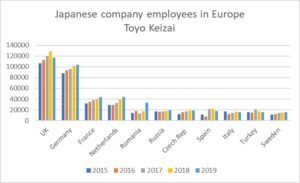

Within Europe, the number of people employed by Japanese companies rose 18% from 2015 to 2019. Those countries where the number of Japanese company employees has fallen are countries where there has been a rise in populism, civic unrest and political risk. UK employee numbers fell 9% 2018-9 (the first decline since at least 2015), Spanish employee numbers fell 19% 2018-9, Hungary’s fell 18%, Turkey’s 10%, Poland and Italy also showed small decreases in employee numbers.

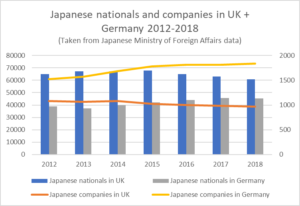

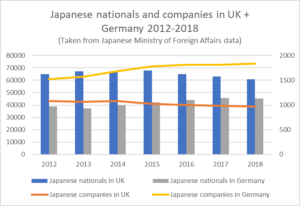

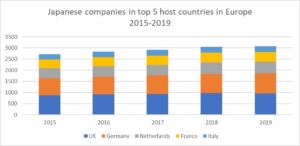

Within Europe, the number of people employed by Japanese companies rose 18% from 2015 to 2019. Those countries where the number of Japanese company employees has fallen are countries where there has been a rise in populism, civic unrest and political risk. UK employee numbers fell 9% 2018-9 (the first decline since at least 2015), Spanish employee numbers fell 19% 2018-9, Hungary’s fell 18%, Turkey’s 10%, Poland and Italy also showed small decreases in employee numbers. The number of Japanese companies in the UK has fallen by 1% 2018-9, from 972 to 966, the first drop since at least 2015, having risen 11% 2015-2018. France also saw a 2% drop in the number of Japanese companies, even though employee numbers are up. Germany attracted a 4% increase in Japanese companies from 2018-9, having risen 13% 2015-8. Netherlands had a 1% increase 2018-9 (13.5% 2015-8) and Italy had a 2% rise in Japanese companies 2018-9, and an increase of 11.8% 2015-8.

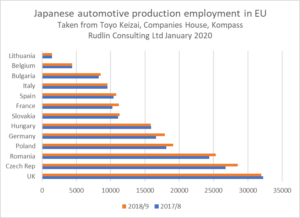

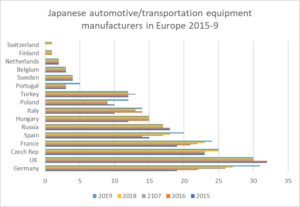

The number of Japanese companies in the UK has fallen by 1% 2018-9, from 972 to 966, the first drop since at least 2015, having risen 11% 2015-2018. France also saw a 2% drop in the number of Japanese companies, even though employee numbers are up. Germany attracted a 4% increase in Japanese companies from 2018-9, having risen 13% 2015-8. Netherlands had a 1% increase 2018-9 (13.5% 2015-8) and Italy had a 2% rise in Japanese companies 2018-9, and an increase of 11.8% 2015-8. The Japanese automotive sector is of course the sector being most carefully watched for Brexit impact. Japanese automotive manufacturers are continuing to set up overseas – the total number globally has increased 10% in 2019 on 2015. And “despite” the EU-Japan EPA, 15 more Japanese transportation equipment manufacturers set up in Europe in 2019, a 20% cumulative increase on 2015. Of the 15 new companies, 4 are in Germany, 3 in Poland, 2 in Spain, 2 in Portugal, 1 in France, 1 in Italy, 1 in Slovakia and 1 mystery one. This means Germany now hosts more automotive/transportation equipment companies than the UK – 31 to the UK’s 30.

The Japanese automotive sector is of course the sector being most carefully watched for Brexit impact. Japanese automotive manufacturers are continuing to set up overseas – the total number globally has increased 10% in 2019 on 2015. And “despite” the EU-Japan EPA, 15 more Japanese transportation equipment manufacturers set up in Europe in 2019, a 20% cumulative increase on 2015. Of the 15 new companies, 4 are in Germany, 3 in Poland, 2 in Spain, 2 in Portugal, 1 in France, 1 in Italy, 1 in Slovakia and 1 mystery one. This means Germany now hosts more automotive/transportation equipment companies than the UK – 31 to the UK’s 30.