Optimism for Japanese business in Africa

I recently faced a new challenge for me, to deliver training, online, to a group of Africans who were gathered in the Johannesburg office of their Japanese employer. It was the first time for the company to use their new videoconferencing technology in this way, but everything worked well. We were using Microsoft Teams to present the slides and the livestream video of me talking, with a ceiling microphone so they could talk to me. I also asked the participants to use their smartphones to access a series of polls, via a link to a website or a QR code. All were able to do so.

I was delighted that technology has finally allowed a more inclusive and interactive approach to training. A few years ago, I doubt any operation in Africa would have had the budget to pay for me to travel to Africa to deliver the training in person. We did attempt 15 years ago to find locally based facilitators to deliver our training, but it improved impossible to find anyone who fitted our criteria, even in South Africa.

There were not that many Africans who had experience of Japan then – and those that did were in high demand, and not interested in taking up freelance consulting. This may have changed now – more than half the participants in the training had lived in Japan, studying or working there. As a result, they gave very informed and perceptive responses to the case studies we discussed. A large number already knew all about the nemawashi decision making process, for example.

I realise that recruiting such well qualified people is probably only something that large Japanese companies such as sogo shosha (Japanese trading companies) can do. But even for smaller Japanese companies, this could be a sign that Africa is worth considering as a market, now that there are potential Japanese partners employing such high quality business development employees who are local to the region.

A recent JETRO survey of Japanese companies in Africa concluded that despite the impact of the invasion of Ukraine on African economies – rising costs of logistics, raw materials and exchange rate fluctuations – there are still growth opportunities. 70% of the respondents said they expect the importance of Africa will increase over the next five years. Côte d’Ivoire, Egypt and Kenya were seen as particular bright spots, and the consumer market, resources and energy, particularly solar power were seen as promising sectors. South Africa continues to dominate Japanese companies’ attention and Nigeria also for its large population, as well as Ghana and Tanzania.

The survey conclusions are very similar to the recommendations for investment I saw when I was working in regional corporate planning for a Japanese trading company nearly 30 years ago. But having met, if only virtually, the young African business people from those countries, and been impressed by their understanding of Japan, as well as experienced for myself that information and communication technologies are working effectively, I feel a renewed optimism for the future of Japanese business in Africa.

This article by Pernille Rudlin first appeared in Japanese in the Teikoku Databank News in April 2023

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More LinkedIn

LinkedIn YouTube

YouTube

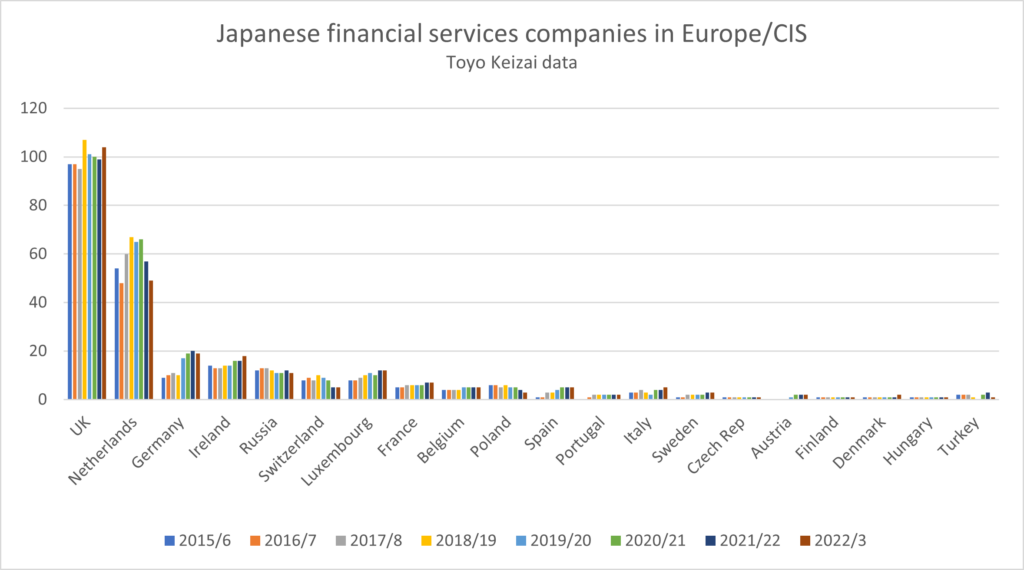

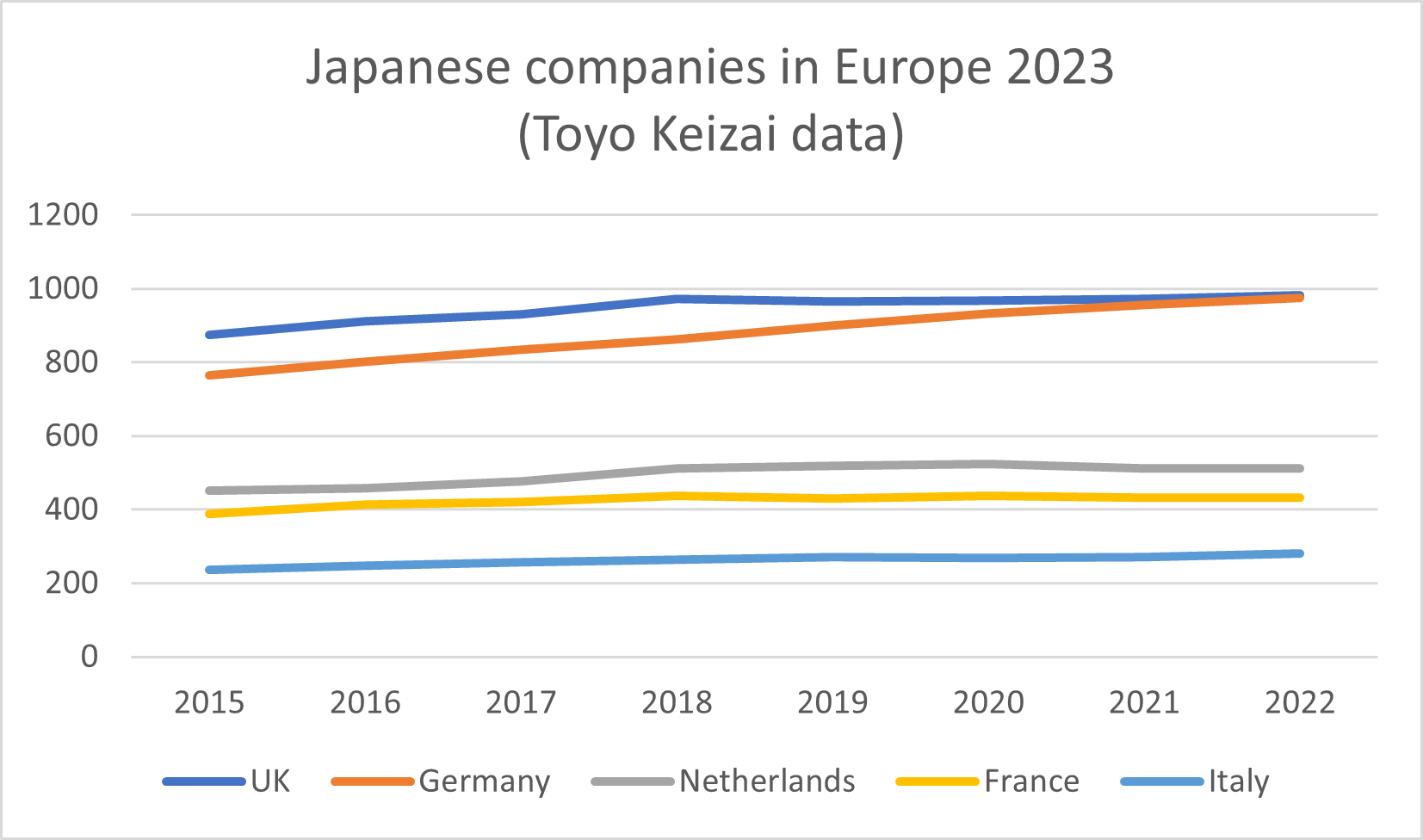

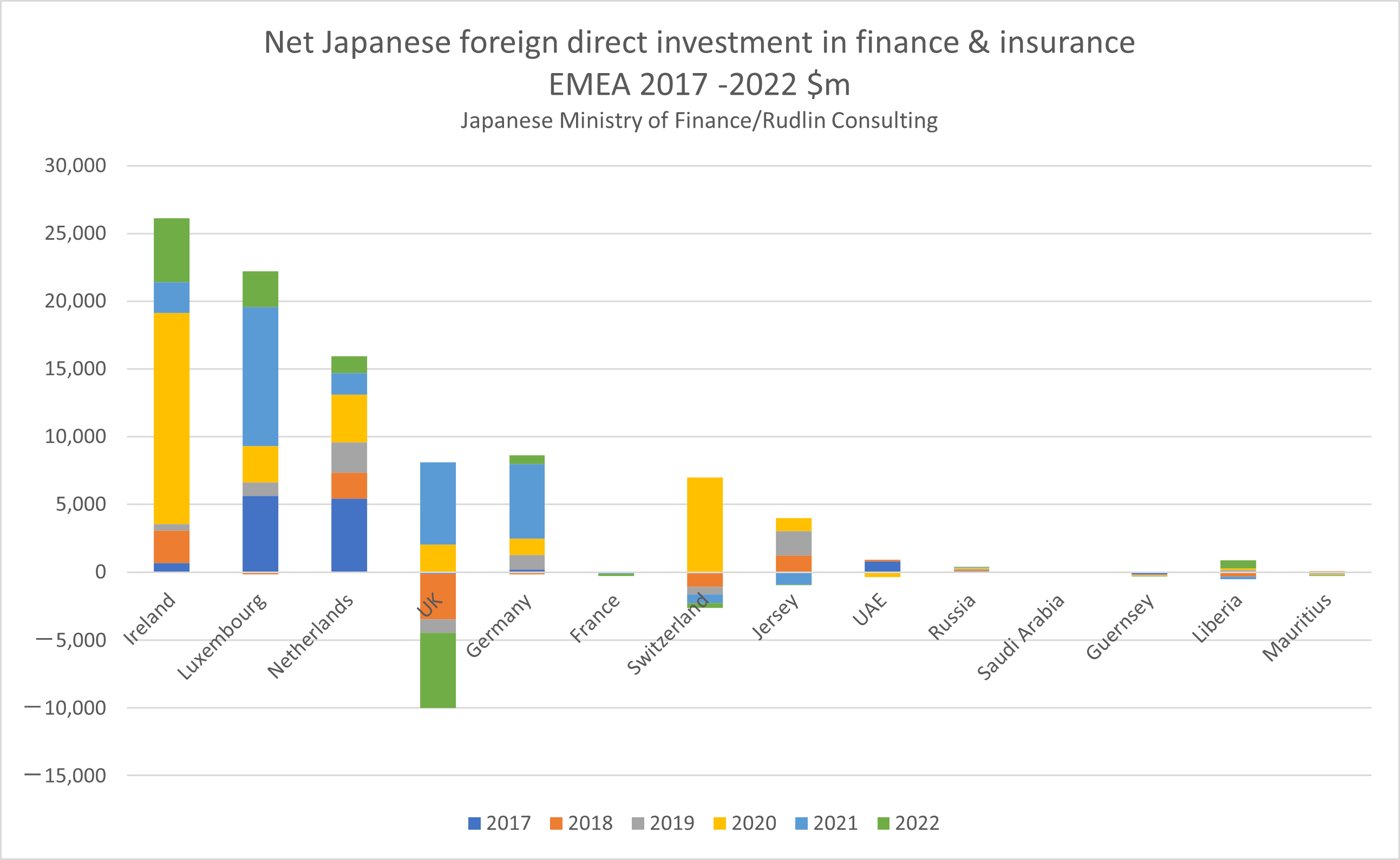

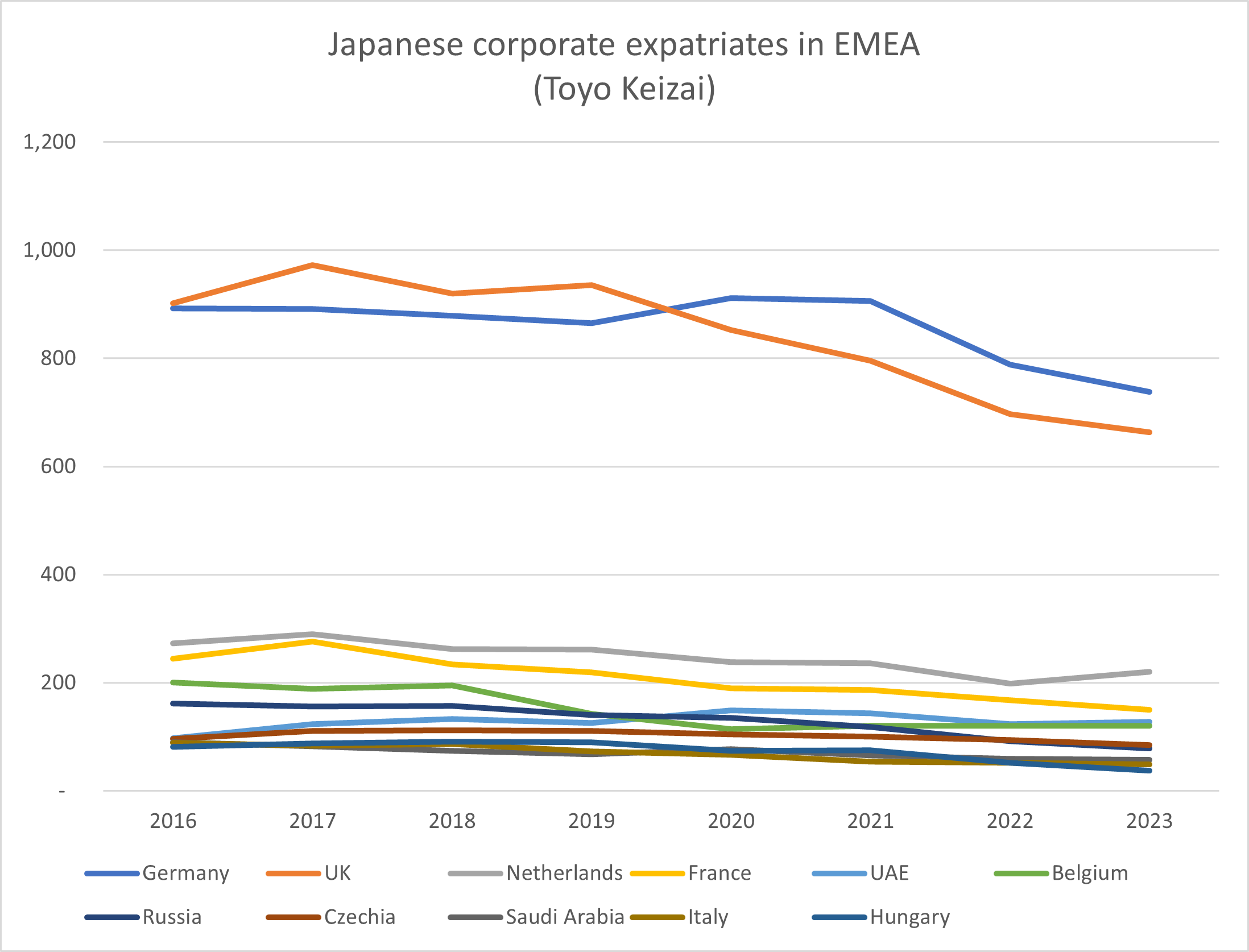

The other issue raised by the two pieces of research are whether other EU cities have benefited from any additional growth, which the UK has missed out on. As can be seen from the chart, Toyo Keizai data shows that there was an overall upward trend in the number of Japanese financial services companies in the European region, of around 12% from 2015/6 to 2022/23. The UK still dominates as a host, and the numbers of companies hosted rose 7% – so below trend. Germany doubled the number of Japanese financial services companies it hosted over the period. The numbers rose sharply in the Netherlands and then dropped. Just as Dr Hall’s research suggests, Ireland, Luxembourg and France seem to have benefited, albeit from a much smaller base.

The other issue raised by the two pieces of research are whether other EU cities have benefited from any additional growth, which the UK has missed out on. As can be seen from the chart, Toyo Keizai data shows that there was an overall upward trend in the number of Japanese financial services companies in the European region, of around 12% from 2015/6 to 2022/23. The UK still dominates as a host, and the numbers of companies hosted rose 7% – so below trend. Germany doubled the number of Japanese financial services companies it hosted over the period. The numbers rose sharply in the Netherlands and then dropped. Just as Dr Hall’s research suggests, Ireland, Luxembourg and France seem to have benefited, albeit from a much smaller base.

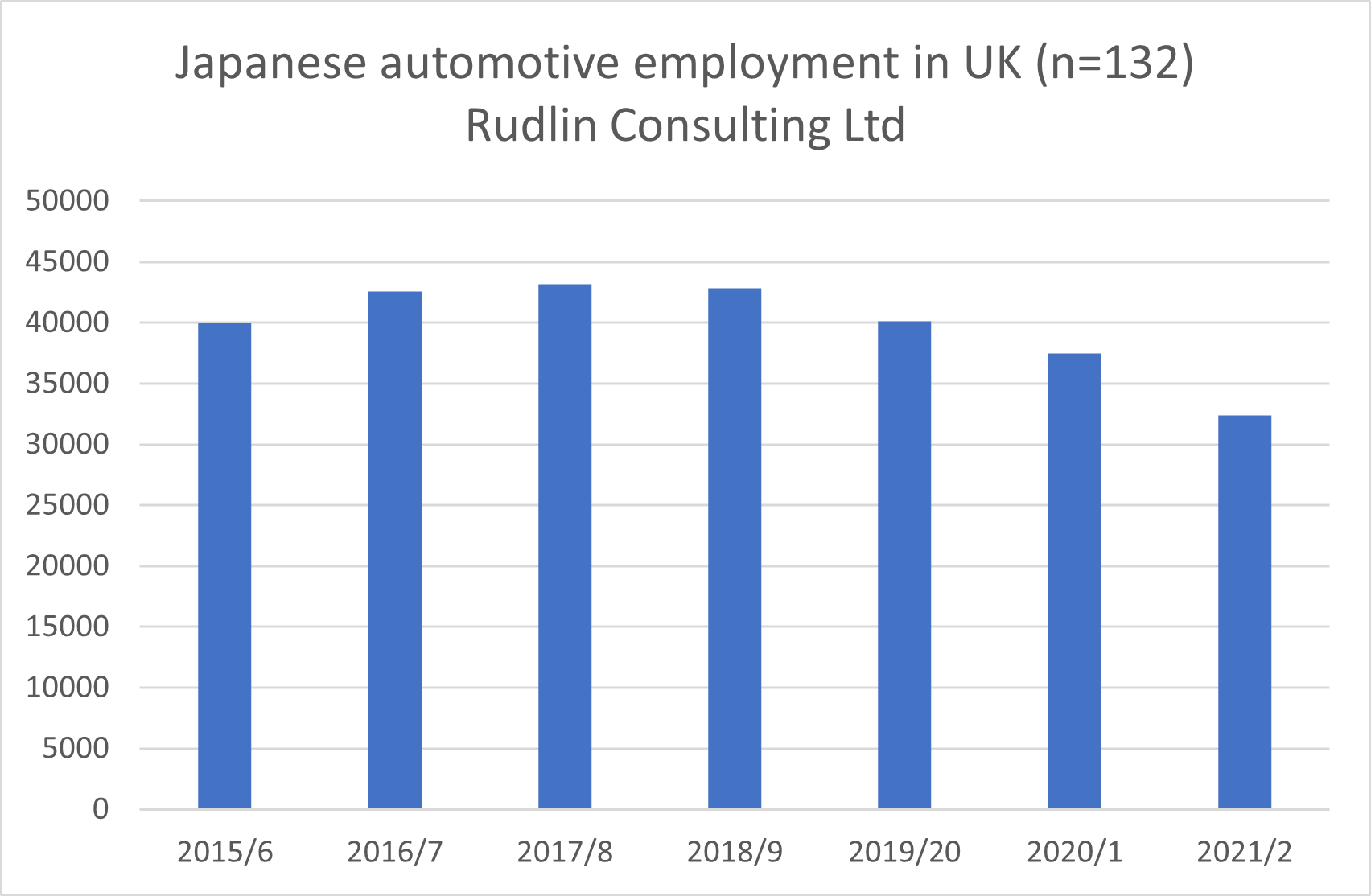

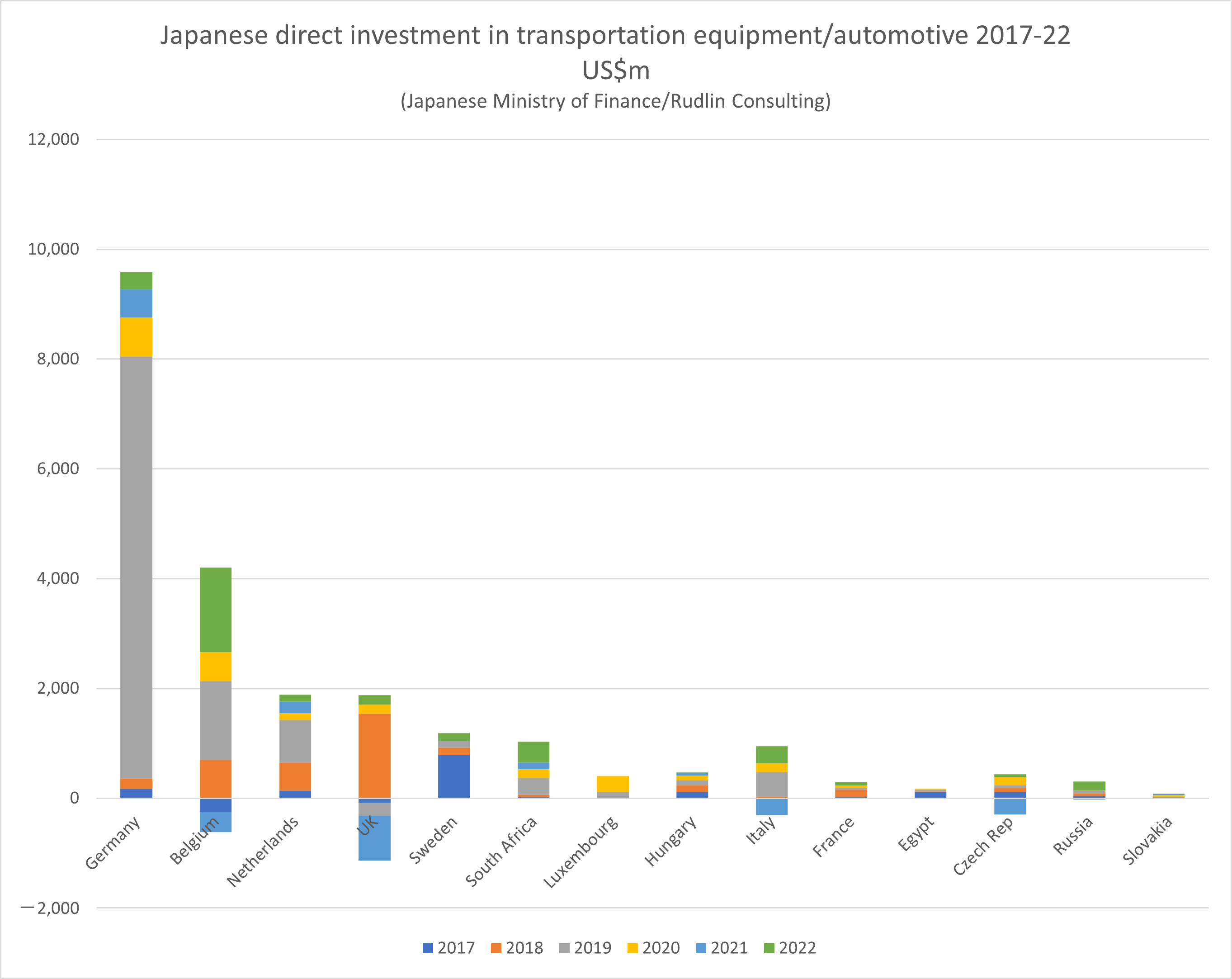

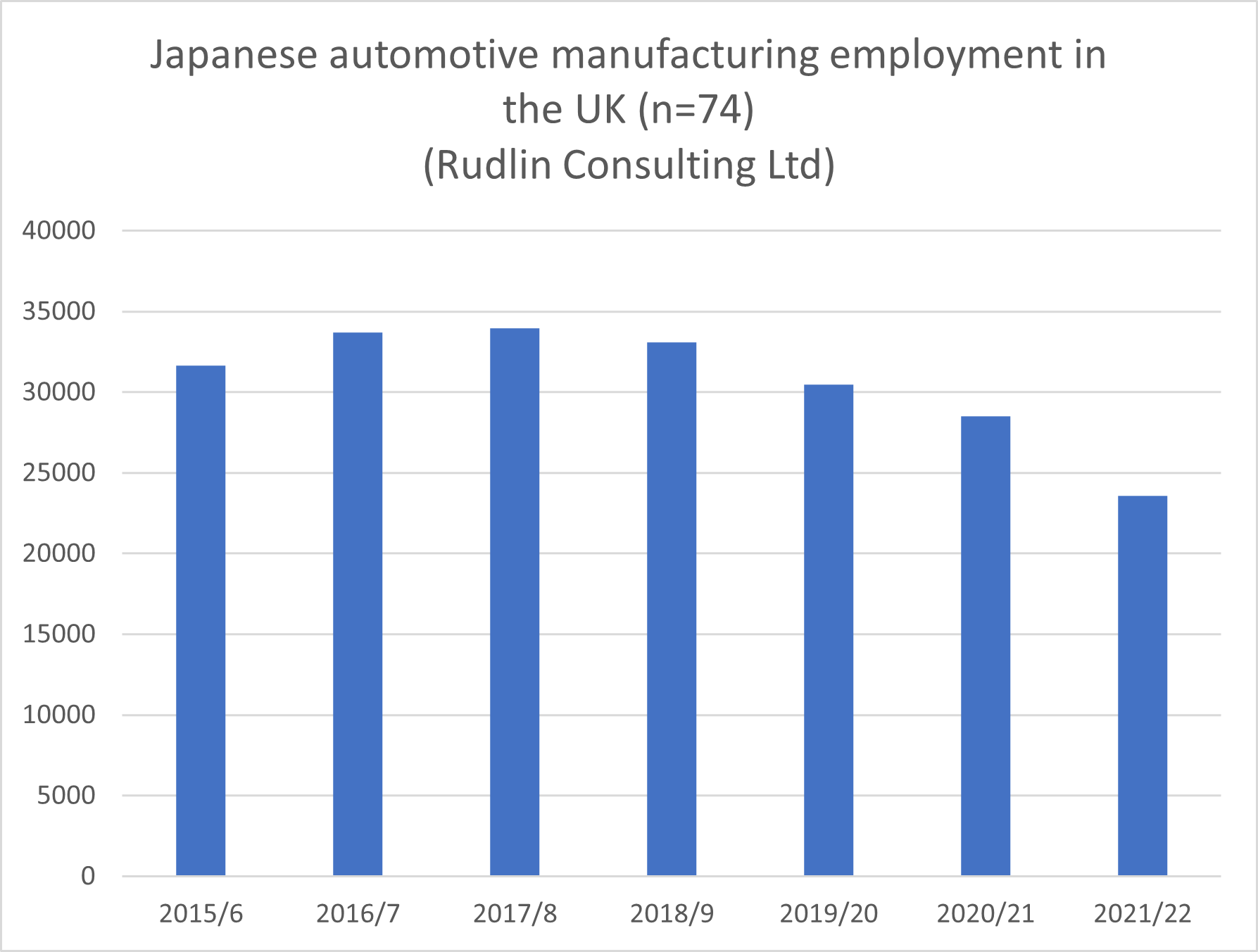

If we just focus on Japanese companies with production in the UK, there was a 26% decline in employment over 2018-2022 – unsurprisingly close to the overall trend – as around 74% of all Japanese automotive employees in the UK are employed in manufacturing operations.

If we just focus on Japanese companies with production in the UK, there was a 26% decline in employment over 2018-2022 – unsurprisingly close to the overall trend – as around 74% of all Japanese automotive employees in the UK are employed in manufacturing operations.