Top 30 Japanese employers in Italy 2021

We’ve just compiled our first ever Top 30 for Japanese employers in Italy (see below for updated 2022 version). We’ve thought for a while that Tōyō Keizai underreported the number of employees in Italy, and that it probably ranked fourth after the UK, Germany and France in terms of numbers employed. Tōyō Keizai records 16,500 employees at 270 companies. We estimate it’s more like 50,000 employees at 350 or so companies. We were also wondering what might be behind the Japanese Ministry of Foreign Affairs data showing a sudden rise from 300 Japanese companies in Italy in 2018 to 425 to 2019.

The answer to both puzzles might lie in the fact that the Hitachi group, which was the largest Japanese employer in Italy, acquired various rail businesses from Ansaldo in 2019 and one of its subsidiaries, Hitachi Chemical, acquired FIAMM in 2020. Hitachi has now dropped one rank, to the second largest Japanese employer in Italy, behind the NTT group, as Hitachi Chemical was acquired by Showa Denko in 2020. Another factor is that the NTT group has also grown substantially in Italy recently, mainly thanks to acquisitions by NTT Data.

Other large Japanese employers in Italy are the result of earlier acquisitions: Denso has some of its major manufacturing operations in Italy, deriving from acquisitions from Magneti Marelli more than 20 years’ ago. Denso Thermal Systems S.p.A. is now the regional headquarters for the air conditioning manufacturing business.

Mitsubishi Electric at #5 acquired Italian firm Climaveneta in 2015. Nidec, the 6th largest Japanese employer in Italy, acquired Ansaldo Sistemi Industriali S.p.A. in 2012. Sumitomo Heavy Industries acquired Lafert (electric motors and drives) in 2018.

So it seems likely the underestimation of Italy lies more in acquisitions unaccounted for than a sudden influx of Japanese greenfield investment.

Half of the Top 30 Japanese employers in Italy are also in the EMEA region top 30, so would be expected to have substantial presence in Italy too. The acquisitions detailed above show that Italy’s strengths, as far as Japanese companies are concerned, are in engineering – particularly rail and air conditioning. Judging by the companies that are only in the Italy Top 30, textiles (Toray) and pharmaceuticals (CBC and Takeda) are still attractive sectors for Japanese investment – and of course food – such as the Princes tomato processing plant, owned by Mitsubishi Corporation.

New 2022 edition

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More LinkedIn

LinkedIn YouTube

YouTube

The recent news about Nissan and its Chinese battery manufacturing partner Envision deciding to go ahead with expanding the battery plant in Sunderland, to supply a new electric vehicle model, led me to revisit my researches on trends on the Japanese automotive sector in the Europe, Middle East and Africa region. I

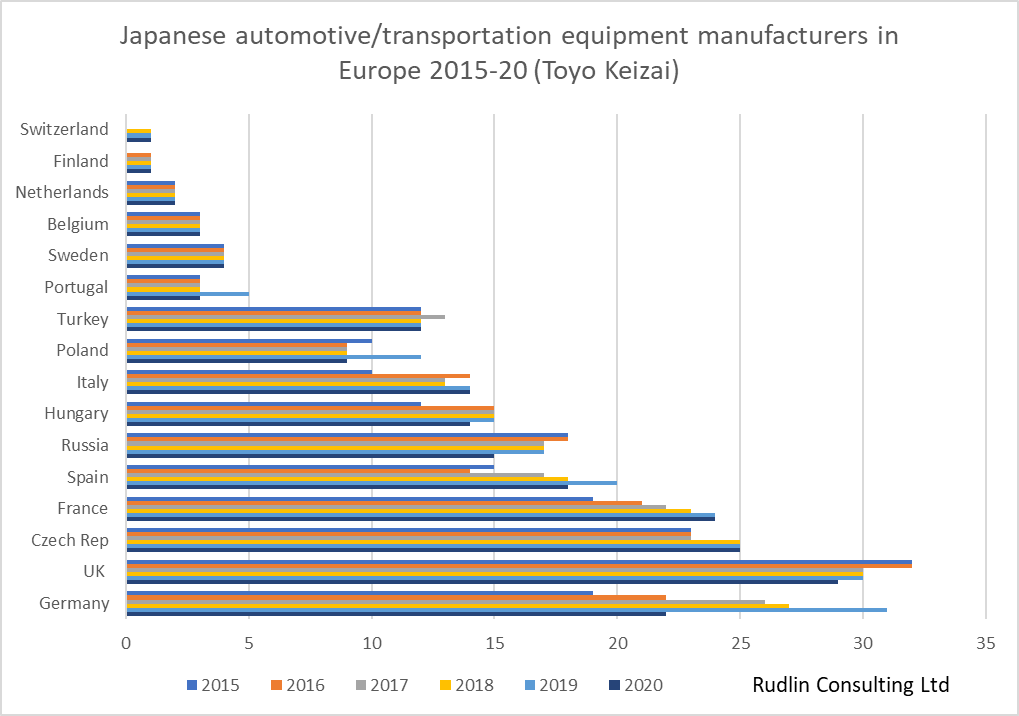

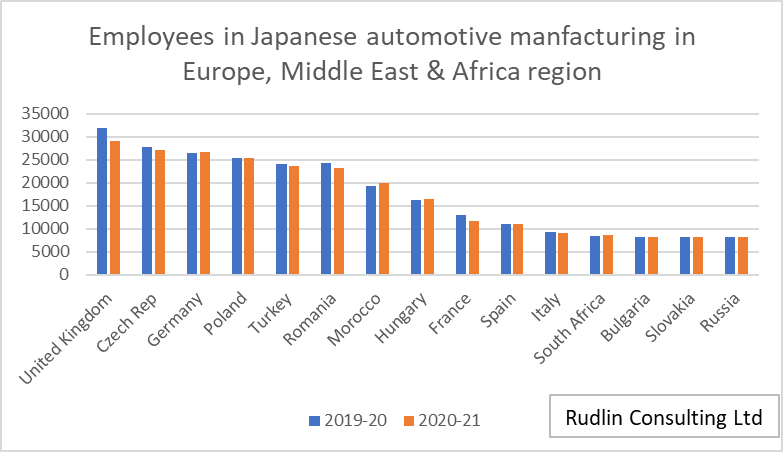

The recent news about Nissan and its Chinese battery manufacturing partner Envision deciding to go ahead with expanding the battery plant in Sunderland, to supply a new electric vehicle model, led me to revisit my researches on trends on the Japanese automotive sector in the Europe, Middle East and Africa region. I  So the UK still has the most employees of Japanese automotive manufacturers in the region, but the number of employees has dropped below 30,000 for the first time in five years. The Czech Republic, Germany and Poland are not far behind in terms of employee numbers, and it’s possible Germany still does have more Japanese automotive related manufacturers than the UK, it’s just that they have chosen not to classify themselves as being in the automotive sector. The closure of Honda Swindon and other suppliers to the Swindon plant this month will probably result in the UK losing its top spot both in terms of employees and companies hosted.

So the UK still has the most employees of Japanese automotive manufacturers in the region, but the number of employees has dropped below 30,000 for the first time in five years. The Czech Republic, Germany and Poland are not far behind in terms of employee numbers, and it’s possible Germany still does have more Japanese automotive related manufacturers than the UK, it’s just that they have chosen not to classify themselves as being in the automotive sector. The closure of Honda Swindon and other suppliers to the Swindon plant this month will probably result in the UK losing its top spot both in terms of employees and companies hosted.