Top 30 Japanese employers in Russia

Around 35,000 employees in Russia worked for 224 Japan owned companies and operations at the beginning of 2022, according to our calculations. This makes Russia the 11th largest host of Japanese companies in the European region by employee number – if Russia can be included in Europe. Teikoku Databank has identified 347 Japanese companies in Russia, an increase of 60% over the past 13 years.

Russia is Japan’s 17th largest trade partner. Japanese exports to Russia are particularly dominated by vehicles and automotive parts. Localization of the automotive supply chain is not well advanced in Russia. As a consequence, some Japanese suppliers have been re-routing parts which would have come via Ukraine from Hungary to be transported via Belarus. There is concern that Western sanctions may result in the halt of parts exports to Russia.

The largest employer is Japan Tobacco (JTI) which has five production sites in Russia, two making cigarettes, the others making intermediate supply chain products.

The second largest Japanese employer in Russia is Toyota Motor, which has a plant in St Petersburg, manufacturing the Camry and RAV4. Nissan, the fourth largest Japanese employer, also has a plant in St Petersburg, making the X-Trail, Qashqai and Murano for the Russian market. Because of Toyota and Nissan’s presence, there are many other automotive suppliers in the the Top 30 (see below for download) including AGC making automotive glass, Yazaki (wire harnesses), Bridgestone, Marelli (was Calsonic Kansei, a Nissan supplier), Toyota Boshoku, Nippon Sheet Glass (Pilkington) and Denso. Mazda also has a joint venture with Sollers in Russia, manufacturing cross-over cars and engines.

Japanese pharmaceutical companies also feature in the Top 30 – Takeda and Astellas and of course the Japanese trading companies have a substantial presence – Sumitomo Corporation, Sojitz and Mitsubishi Corporation. Itochu seems less prominent, but has signed a memorandum of understanding with Gazprom for an LNG plant in the Baltics, so there may be some behind the scenes investment going on that we have not identified. Mitsui also seems to be taking small stakes and investing in energy projects and Marubeni also seems to be involved in various investments in technology, chemicals, energy and infrastructure.

SBI Holdings, previously a SoftBank company, owner of Shinsei Bank, is at #25, with SBI Bank in Russia, and is the only Japanese financial services company that appears in the Top 30.

And how does this compare to Ukraine? Please see here.

Updates on Japanese companies in Russia (as of 14th December 2022)

- Japan Tobacco: Has suspended marketing activities and launch of new product in Russia. Production is still continuing at its 4 or 5 plants in Russia. It employs around 14,000 people across EMEA, over 3,000 of them are in Russia. 388 were employed by JTI in Ukraine.

- Toyota Motor: Has decided to end production at its St Petersburg plant (announced September 23 2022). Toyota employs over 24,000 in EMEA – around 3,000 are in Russia. 174 people were employed in Ukraine.

- Toyota Tsusho: the trading arm of Toyota group is “buying time” with their Russia operations according to the Yale CELI list. Employs over 2000 people in Russia and over 19,000 in EMEA.

- Uniqlo/Fast Retailing : Initially announced its 50 stores in Russia would continue to operate, then that would shut them. Donating $10 m to the UNHCR. The company also will ship 200,000 items of clothing including blankets, underwear and jackets to Ukrainian refugees in Poland and elsewhere through the UNHCR. Has over 3,300 employees and 117 stores in Europe, which would as a rough estimate mean Uniqlo has around 1,400 staff in Russia – Dun & Bradstreet estimates 2,060.

- Takeda: says it will not start any new clinical trials in Russia, and has stopped making any new investments. Local ongoing trials and supply will continue. It employs around 1,873 people in Russia, out of over 8,500 in EMEA. 138 people were employed by Takeda in Ukraine.

- Nissan: Sold its Russia business for less than a dollar in October 2022 to a Russian state owned company. Had halted production due to “logistical challenges”. Employed 1,557 people in Russia out of nearly 14,000 across the EMEA region. 175 were employed in Ukraine.

- Nippon Sheet Glass/Pilkington: has suspended trading – employs 366 in Russia, out of 12,000 employees in EMEA.

- Toyota Boshoku: has decided to end business in Russia (Sep 2022)– employed around 364 people in Russia, out of over 4,000 in EMEA

- Dentsu: Employs 1,500 people in at least 7 different companies in Russia (including Aaron Lloyd, Amnet, iProspect, Vizeum, Carat, Posterscope). Has announced it is pulling out and selling share to partners. It employed around 450 people in Ukraine and over 14,000 in EMEA.

- AGC: has suspended sales of architectural + automotive glass in Ukraine (24 employees). It will suspend investment including regular repairs of glass manufacturing kilns in Russia + reduce production + shipments to local automotive manufacturers. AGC employs around 17,000 people in the Europe, Middle East and Africa Region, around 10% of them are in Russia.

- Yazaki: no announcements on the status of its operations in Russia, classified as “Digging in” by Yale CELI- employs around 1,700 people in Russia out of over 44,000 in EMEA region. 1,079 were employed in Ukraine.

- Sumitomo Corporation: SMBC Aviation Capital, jointly owned with SMBC, to terminate leases of aircraft to Russia. Owns Summit Motors, Sumitec International in Russia (around 1,000 employees) and has minority shares in Terneyles, Russian Quartz and PTS Hardwood, STS Technowood (another 2,700 employees). Has 7,650 employees in EMEA. Says “currently, we are suspending or scaling-back any Russian-related businesses.” 768 people were employed in Ukraine in Sumitomo Corporation owned companies.

- Sato Holdings: acquired Russian packaging and labelling firms Okil and Okil Sato X Pack in 2014 have ceased sales to Russia and are looking at all possible alternatives – they employ around 760 people in Russia, around $58m sales.

- Bridgestone: will suspend production in Russia and also exports to Russia. Will continue to pay employees. Russia represents about 2% of its turnover. Is donating Y500m to supporting Ukrainian refugee relief. Employs over 700 people in Russia, out of 12,000 in EMEA.

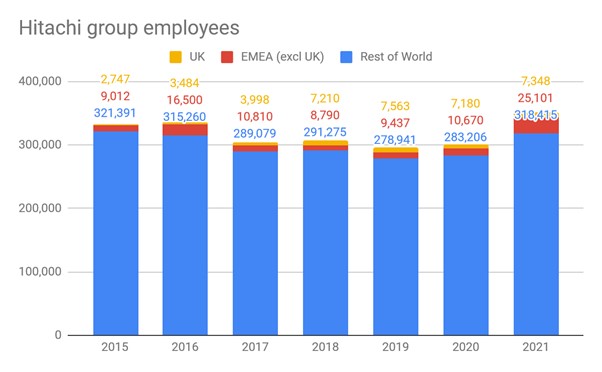

- Hitachi: Hitachi group is to suspend exports to Russia “apart from products, services and support for electrical power equipment indispensable to the daily lives of people.” Hitachi Construction Machinery has made decisions to gradually suspend production at Hitachi Construction Machinery Eurasia (300 employees). Over 650 employees in Russia, including Hitachi Energy, Hitachi Vantara and Vantec. Russian revenues account for approx 0.5% of Hitachi’s consolidated revenues. Hitachi apparently had over 7,000 employees in Ukraine, via its US acquisition GlobalLogic. Over 32,000 people work for Hitachi group companies in EMEA.

- Sojitz: Joint venture plant with Isuzu will cease operations. Over 650 employees in Russia, in Center Sunrise, U Service Sunrise car dealerships and Subaru Motors.

- Astellas: Donated Y10m to UNICEF. Has stopped recruiting new patients to participate in clinical trials in Russia and Ukraine. It employs around 635 people in Russia (this figure is 3 years’ old) out of around 4,000 in EMEA. 244 people were employed in Ukraine.

- Mazda: will stop exporting components to factory in Russia, but factory will continue to operate (7th March) – factory (50% owned by Mazda) employs over 550.

- Mitsui: – employs around 500 people in Russia, in own operation and Komek Machinery. Classifed as “digging in” by Yale CELI list.

- Komatsu: has suspended all shipments to Russia, employs around 487 people there, including in manufacturing, out of over 5,000 people in EMEA.

- Mitsubishi Corporation: Will continue investment in Sakhalin 2 LNG project, along with Mitsui. As of 2015, MC had made over $1.17bn of investments in Russia. Employs over 450 people in Russia in MC Bank, MC Logistics, MMC Rus, MC Intermark Auto and Autospot, out of over 8,800 employees in EMEA.

- Daido Metal: has over 450 employees in Russia manufacturing automotive bearings. No announcement has been made.

- Yokogawa Electric: has around 400 employees in Russia. Has an international innovation center in Russia, in collaboration with Gazprom. No announcement has been made

- IHI: 340 employees in Russia at its Alpha Automotive Technologies joint venture, has announced suspension of production.

- Isuzu: announced suspension of production at its Russian joint venture plant with Sojitz. 280 employees in Russia.

- Canon: Has suspended shipments to Russia. Has over 200 employees in Russia, including Canon Medical Systems, out of over 22,500 in EMEA.

- SMC: 200 employees in Russia selling pneumatic tools, out of 3,300 in EMEA. No announcement.

- Marelli: no announcement – employs around 123 people in Russia, out of 1700 in EMEA.

- Denso: said on March 8th that were looking at pulling out their 2 expatriate Japanese staff from Russia, classified as “digging in” by Yale CELI – only has 27 employees at a sales company out of over 15,000 in EMEA.

- Itochu: Will continue investment in Sakhalin 1 LNG project, along with Marubeni. Classifed as “digging in” by Yale CELI list. Has 174 employees in Ukraine.

- Marubeni: Has offices in Russia and Marubeni Rubber. Less than 50 employees. Classified as “scaling back” by Yale CELI list

- SBI Holdings, Mizuho, SMFG, MUFG have all pulled their Japanese expatriate staff out of Russia and have ceased transactions with Russian banks but are continuing operations with local staff. Yale CELI classified Mizuho as “digging in”, SMFG as “buying time” and MUFG as “withdrawal”

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More

around 15,000 employees joining Hitachi in the Europe, Middle East and Africa region, but did not have so much of an impact on HItachi’s presence in the UK, where its European headquarters is based.

around 15,000 employees joining Hitachi in the Europe, Middle East and Africa region, but did not have so much of an impact on HItachi’s presence in the UK, where its European headquarters is based.