Japan’s Nippon Express acquires Austrian logistics company Cargo Partner

It has been confirmed that Nippon Express will acquire Austria’s Cargo-Partner (subject to regulatory approvals) for around $743m, according to the Nikkei. For Nippon Express, this is their biggest acquisition ever, and yet another Japanese corporate originated M&A drive for international diversification and growth, in reaction to Japan’s ageing and shrinking economy.

Cargo-Partner has 4,000 employees in 40 countries including Europe, USA and Asia, and a turnover of over €2bn. Nippon Express’s turnover is around US$13bn, of which 6.4% is in Europe. Nippon Express has 73,350 employees in 49 countries, of whom 3,480 are in Europe. It is the only Japanese company to rank in the top 10 largest global freight forwarders. The combined entity will be the fifth largest air cargo carrier in the world.

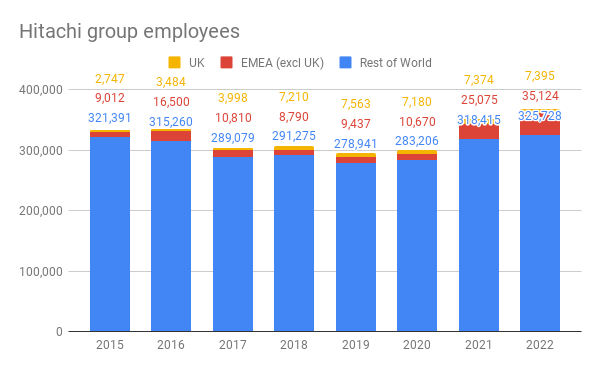

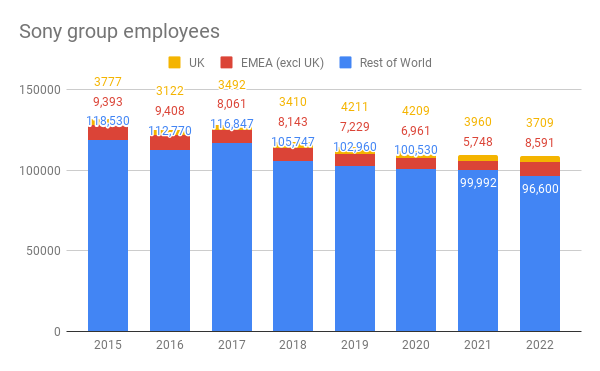

The acquisition of Cargo-Partner will particularly expand Nippon Express’s presence in Central and Eastern Europe. Rival NYK Group, which includes Yusen Logistics, is actually larger than Nippon Express in Europe, with 8,360 employees based in the region out of 35,165 globally, 25% of its employees. The total number of NYK Group employees in EMEA grew over 1,000 in the past three years, particularly in countries such as Romania. Nippon Express clearly felt it was underweight in the EMEA region for some time, and has recently expanded its network here to include Slovakia, Serbia, Morocco and Kenya.

The founder of Cargo-Partner Stefan Krauter will stay on to help with the transition, sitting on the Corporate Supervisory Board and as an advisor to the Corporate Executive Board. He says he “will be focusing on smart partial integration with the new owners as well as on other matters regarding strategy, M&A and ESG.” I am not sure what “smart partial integration” means, but if it’s anything to do with integrating IT systems, unless Nippon Express is the exception to the rule in the Japanese corporate world, this will be prove to be a very long project, and it might even be worth binning any legacy Japanese systems for whatever Cargo-Partner already has.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More LinkedIn

LinkedIn YouTube

YouTube

Many other Japanese companies may be adopting similar systems, or just relying more on local managers to run things –

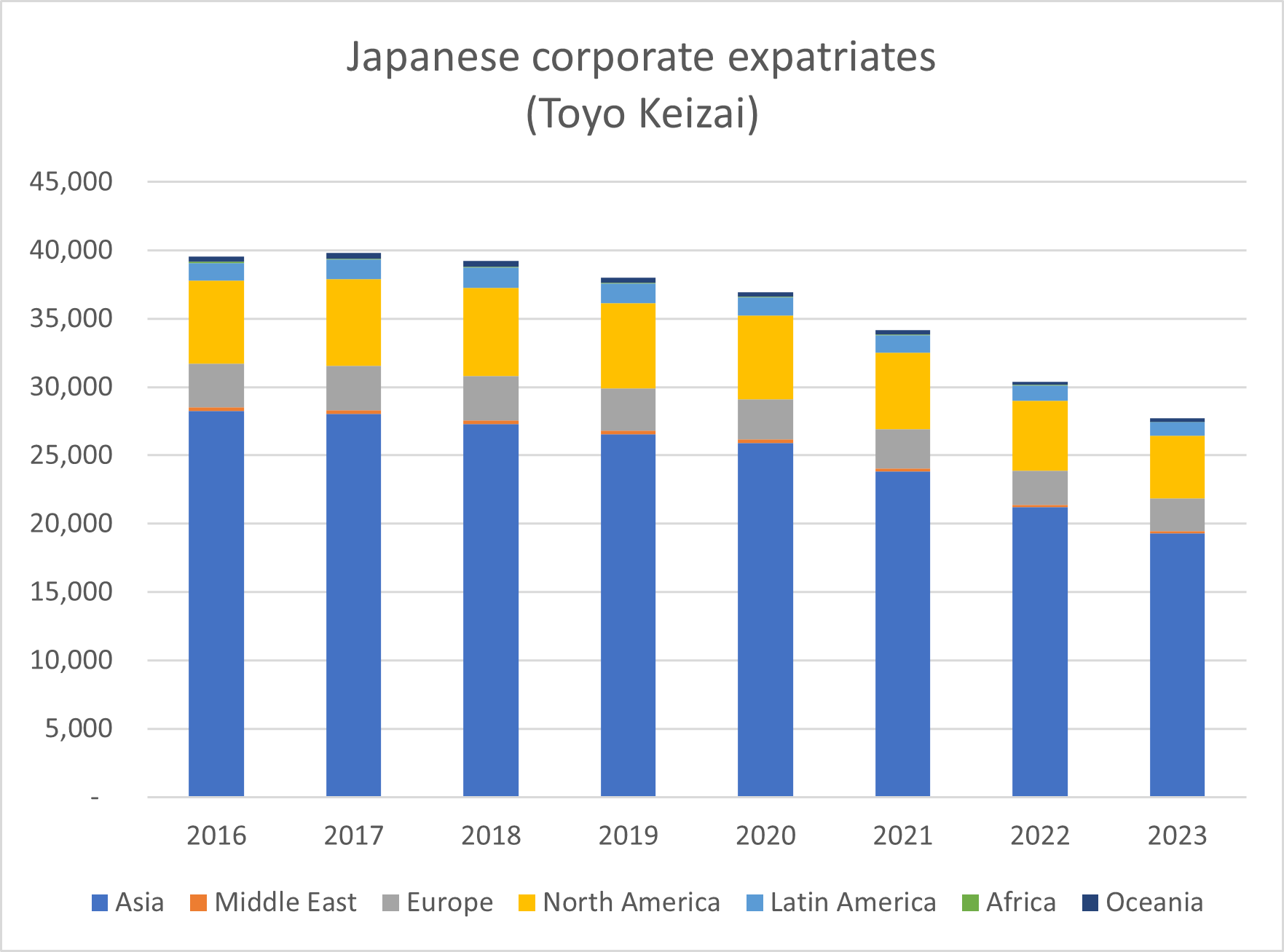

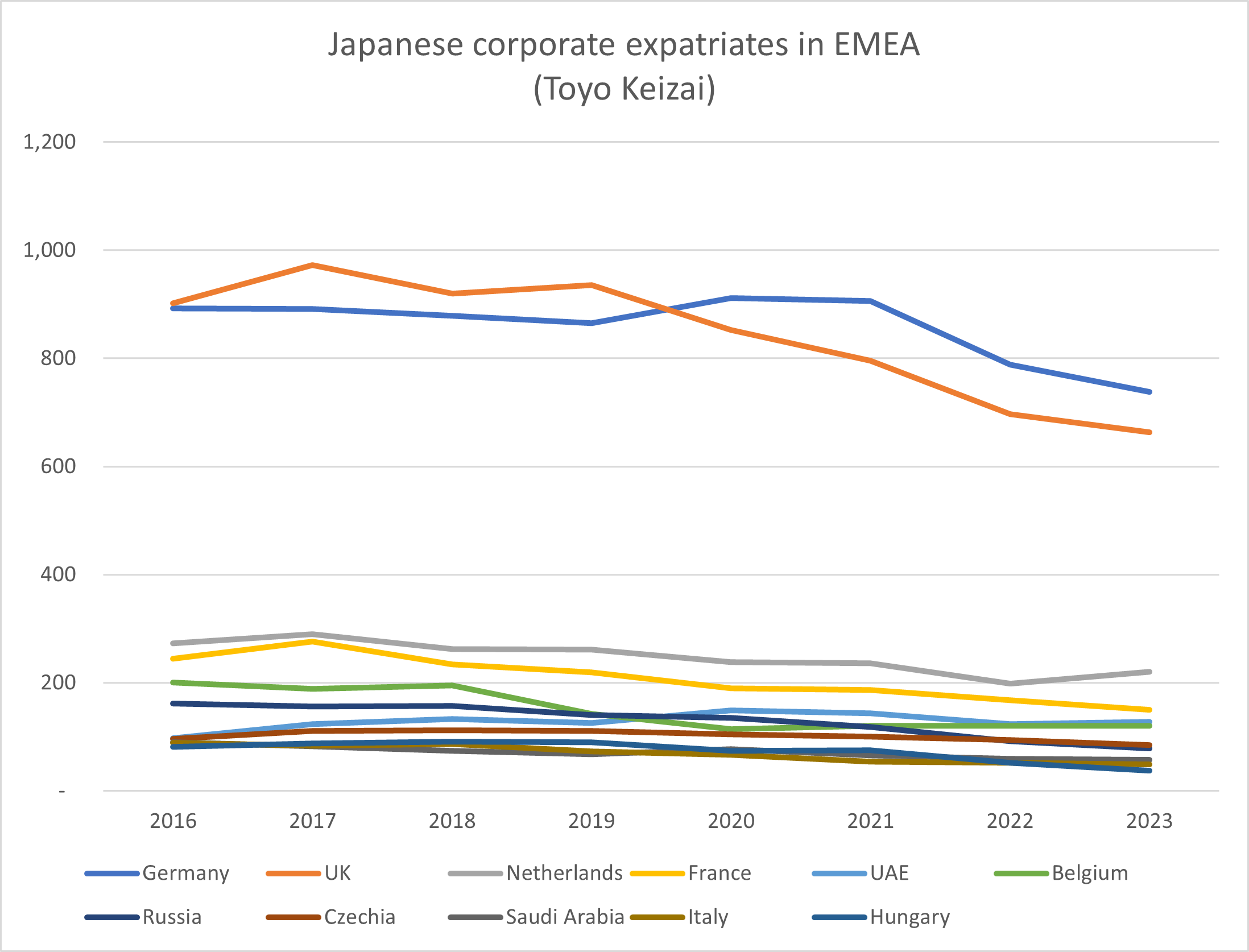

Many other Japanese companies may be adopting similar systems, or just relying more on local managers to run things –  Looking at the Toyo Keizai data for individual countries in Europe and the Middle East shows that the only country to show any positive growth in Japanese corporate expatriate numbers since 2016 is the United Arab Emirates. The fall in Japanese expats in the Netherlands (-19%) was not as steep as elsewhere in EMEA (-27% average, -26% for UK, -40% for Belgium ) and seems to be recovering a bit since the pandemic. The number of expats in Germany also fell by only 17% since 2016, having grown and surpassed the UK in 2019/20, but falling steeply since the pandemic began, with no signs of recovery yet.

Looking at the Toyo Keizai data for individual countries in Europe and the Middle East shows that the only country to show any positive growth in Japanese corporate expatriate numbers since 2016 is the United Arab Emirates. The fall in Japanese expats in the Netherlands (-19%) was not as steep as elsewhere in EMEA (-27% average, -26% for UK, -40% for Belgium ) and seems to be recovering a bit since the pandemic. The number of expats in Germany also fell by only 17% since 2016, having grown and surpassed the UK in 2019/20, but falling steeply since the pandemic began, with no signs of recovery yet. .

.