People rather than shareholding unite Japan’s conglomerates

I sometimes wonder if I am being a bit “old school” in going into detail on the history and influence of Japan’s keiretsu (conglomerates of companies such as Mitsubishi, Mitsui, Sumitomo) in my training sessions. It’s a legacy of working at Mitsubishi Corporation for nearly 10 years, and also my hobby of researching 19th century Japan-UK relations, in which Mitsubishi, Mitsui and Sumitomo played an important part.

A recent article in Diamond magazine is reassuring to me in that it shows that the deep relationships within the keiretsu endure – pointing out that the interrelationships between the different companies in each keiretsu are still going strong, but through the mechanism of people rather than cross shareholdings.

The Mitsubishi power pyramid

For example, Mitsubishi Motors’ new external directors include Takehiko Kakiuchi – former President, now Chairman of Mitsubishi Corporation. He is taking over from Ken Kobayashi, who had also been President and then Chairman of Mitsubishi Corporation before Kakiuchi. Other candidates are Kanetsugu Mike (that’s MEE-kay, not Mike, as his biographies tetchily point out), formerly President, now Chairman of Mitsubishi UFJ Financial Group who will be joining his predecessor as Chairman of MUFG, Kiyoshi Sono on the Mitsubishi Motors board.

Diamond magazine puts the “Gosanke” – three honorable families – of MUFG, Mitsubishi Corporation and Mitsubishi Heavy Industries at the top of the “power pyramid”, then the next tier contains Mitsubishi Trust & Banking, Mitsubishi Material, Mitsubishi Real Estate, Mitsubishi Electric, AGC, NYK, Tokio Marine & Fire, Meiji Yasuda Life, Kirin Holdings.

The tier below that contains Mitsubishi Logistics, ENEOS Holdings, Mitsubishi Chemical Holdings, Mitsubishi Steel, Mitsubishi Paper, Mitsubishi Kakoki, Mitsubishi Gas Chemicals, Nikon, Mitsubishi Motors, Mitsubishi Fuso Truck & Bus, MA Aluminium, PS Mitsubishi, Mitsubishi Research and Mitsubishi UFJ Securities.

The above are all in the Kinyokai – Friday Club – a lunch of the heads of all the member companies – fuel for many conspiracy theorists. These three tiers plus a further fourth tier, containing companies such as Lawson and Mitsubishi HC Capital, form the Mitsubishi Public Affairs Committee, which acts the guardian of the Mitsubishi brand.

Shunichi Miyanaga of Mitsubishi Heavy Industries is an external director of Mitsubishi Corporation, Ken Kobayashi (chairman of Mitsubishi Corporation ) and Nobuyuki Hirano (former chairman of MUFG) are both external directors of Mitsubishi Heavy Industries and Akio Negishi, chairman of Meiji Yasuda and Toshifumi Kitazawa formerly President of Tokio Marine & Fire are both on the board of MUFG. I could go on, and Diamond does.

Mitsui’s loose ties

Diamond magazine show Mitsui’s group interrelations as concentric circles rather than a pyramid. A the heart are Mitsui Real Estate, Mitsui & Co and SMFG. SMFG is a product of the merger of Sumitomo Bank and Mitsui’s Sakura bank, which is one reason why the ties are looser. Their Monday club includes Mitsui Chemical, Mitsui E&S, Toray, Mitsui Kinzoku and Sumitomo Mitsui Trust. The next ring are also members of the public affairs committee with the first two – Denka, Oji, Mitsui Sumitomo Insurance, Mitsui OSK, Sanki, JSW, Mitsui Sumitomo Construction.

Then the outer ring are “companies who keep their distance”, most notably Toyota, who Mitsui love to remind were bailed out by Mitsui in the 1960s, Toshiba, Fujifilm and IHI. It also includes the department store group Mitsukoshi Isetan (who have former Mitsui & Co, Toshiba and SMFG executives on their board). Toyota has a female external director from SMFG on its board and Toyota has its chairman on the board of Mitsui.

Sumitomo’s three peaks

Diamond characterises the Sumitomo group as having three peaks – financial, mining & manufacturing and the postwar group. At the top of each peak is SMBC, Sumitomo Metal & Mining/Sumitomo Chemical and Sumitomo Corporation. Sumitomo Metals used to be the third family, but has recently merged with Nippon Steel, and so is no longer seen as part of the group. Within the mining and manufacturing group are NEC (who have external directors from SMFG and Sumitomo Corporation) and NSG (who has an external director from SMBC).

Reflecting on these lists, I realise that the bulk of my work over the years has come from Mitsubishi group companies, although there have been some notable clients from the Sumitomo group. I don’t think I’ve had a single client from the Mitsui group. That is, apart from Mitsui Sumitomo & Aioi Nissay Dowa, the insurance group who acquire Amlin a while back. Even then it was more via Aioi Nissay Dowa. Aioi Nissay is not mentioned in the three peaks, or the Mitsui rings which makes me wonder whether, despite its partnership with Mitsui Sumitomo, it is not regarded as “outside” both Mitsui and Sumitomo. I wonder also if the Mitsubishi group is more active globally than Mitsui, and with the exception of Sumitomo Electric Industries, the Sumitomo group too, but this could be confirmation bias on my part.

As Diamond says, each group has its individuality, but maintains cohesion through people – the “external” directors who are really not “outside” at all. Can these arrangements survive the corporate governance headwinds?

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More LinkedIn

LinkedIn YouTube

YouTube

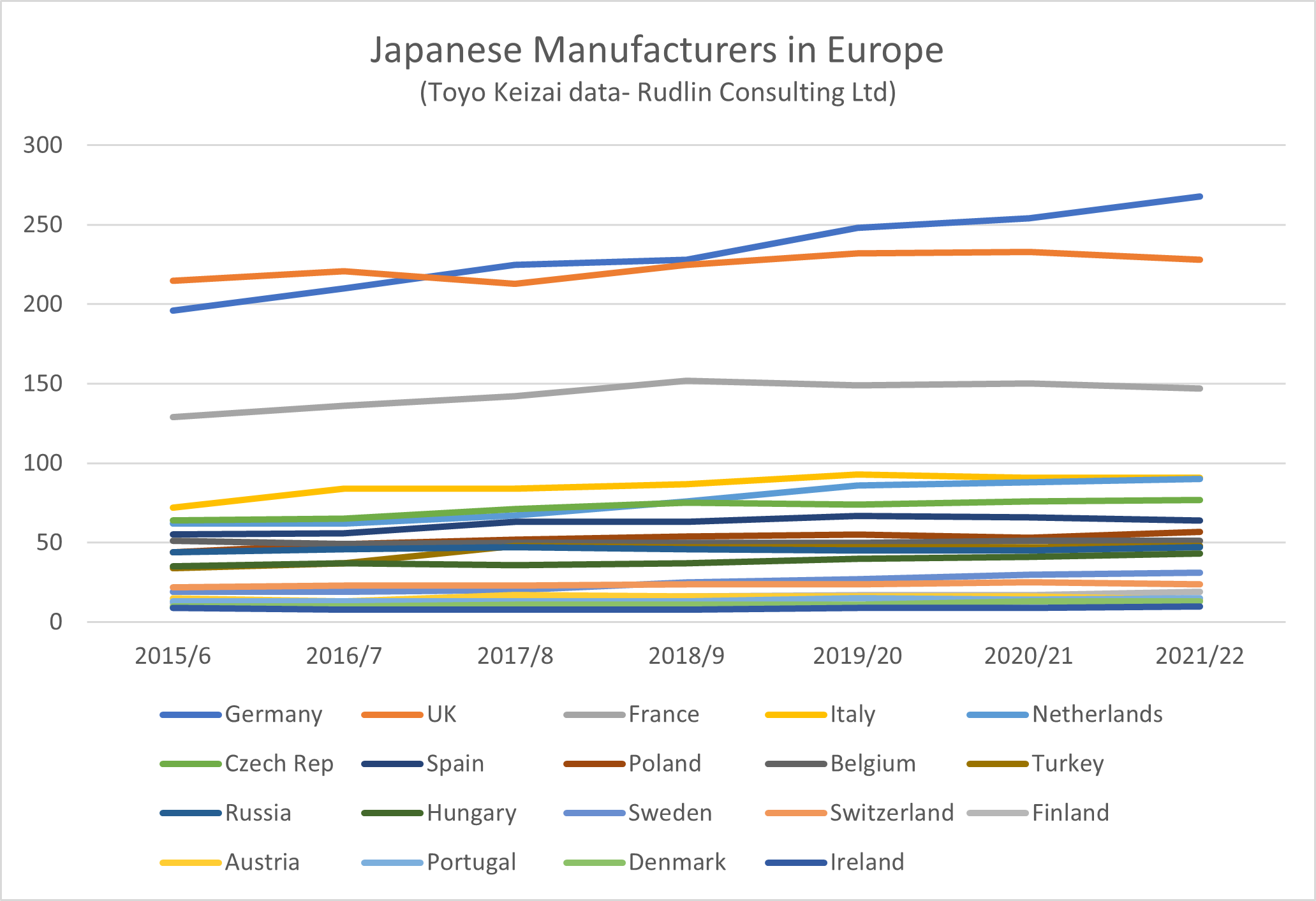

How this compares with other European countries can be seen in the chart on the left – which shows the numbers of all manufacturing companies in Europe, including automotive. According to Toyo Keizai, the number of Japanese manufacturers in the UK dipped around 2017/8, but recovered, with another more recent fall. But there was growth overall since 2015/6, with 228 companies in 2021/2 compared to 215 in 2015/6 – a 6% increase. This is much lower than the overall 20% growth in Europe, and as a consequence the UK is no longer the largest host of Japanese manufacturers.

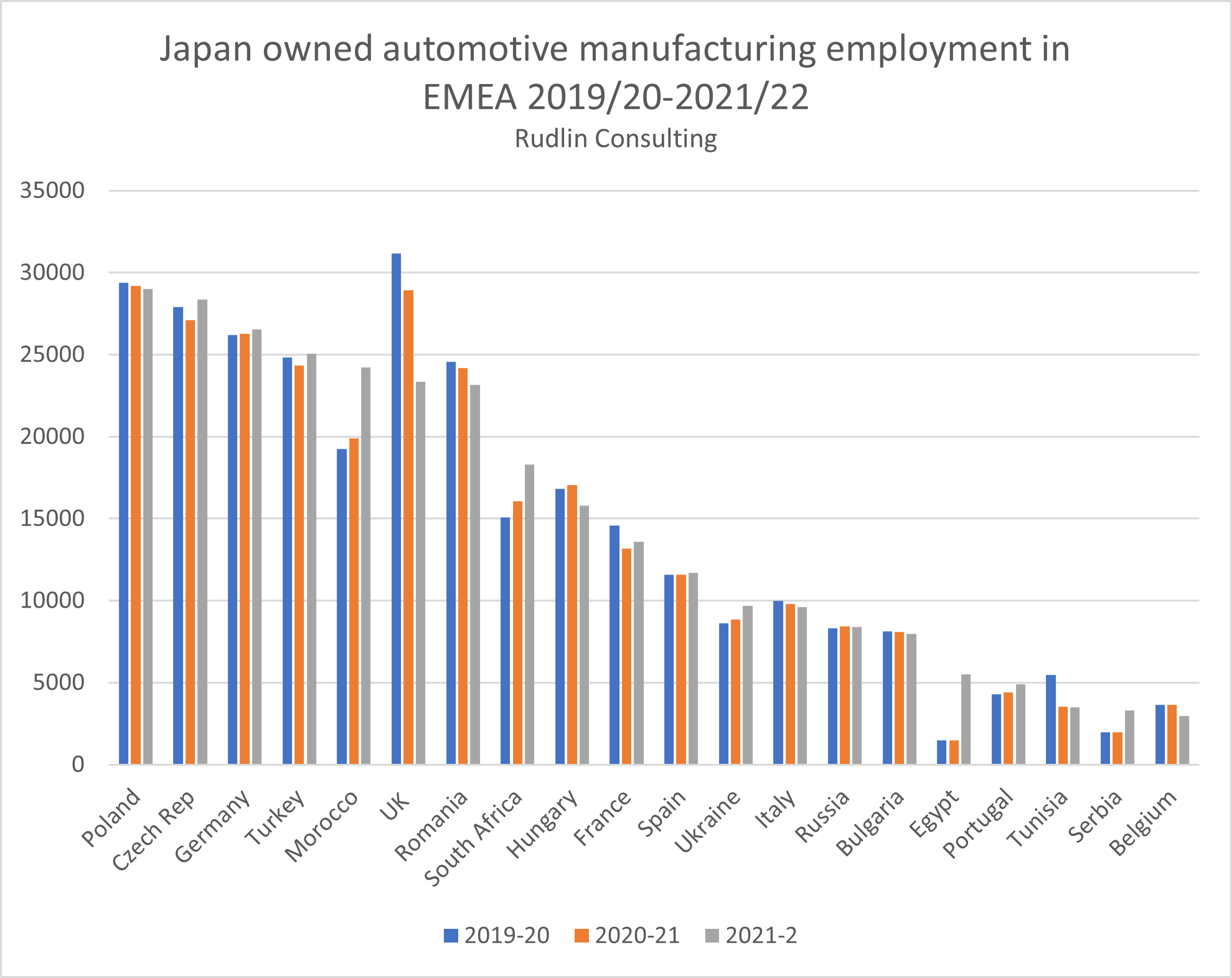

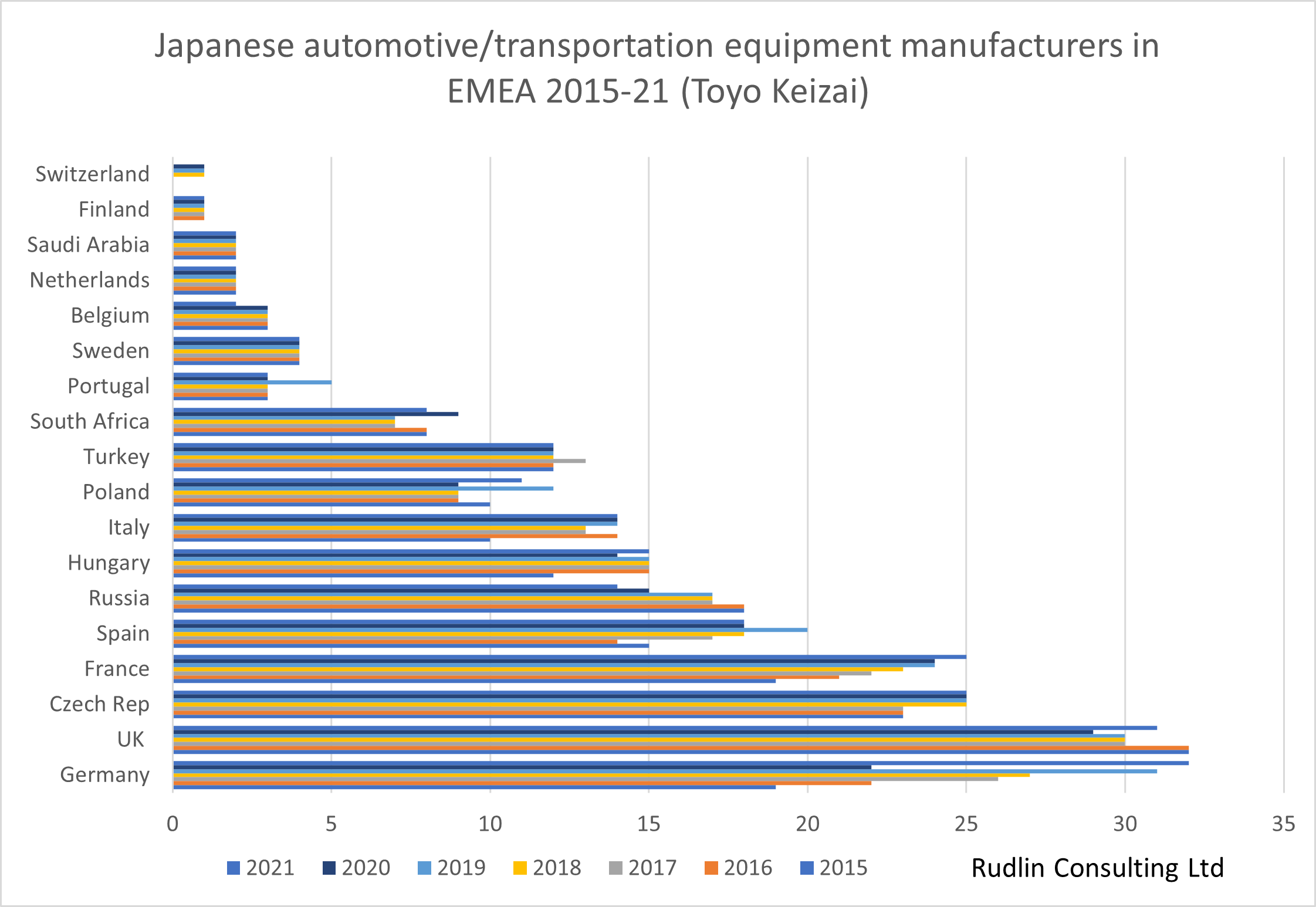

How this compares with other European countries can be seen in the chart on the left – which shows the numbers of all manufacturing companies in Europe, including automotive. According to Toyo Keizai, the number of Japanese manufacturers in the UK dipped around 2017/8, but recovered, with another more recent fall. But there was growth overall since 2015/6, with 228 companies in 2021/2 compared to 215 in 2015/6 – a 6% increase. This is much lower than the overall 20% growth in Europe, and as a consequence the UK is no longer the largest host of Japanese manufacturers. numbers of Japanese automotive manufacturing employees in the EMEA region. According to our estimates, the UK will slip to 6th position in 2021-2022, due to the closure of Honda‘s Swindon plant, along with many of its suppliers shutting down operations. It will be overtaken by Czech Republic, Germany, Turkey and Morocco.

numbers of Japanese automotive manufacturing employees in the EMEA region. According to our estimates, the UK will slip to 6th position in 2021-2022, due to the closure of Honda‘s Swindon plant, along with many of its suppliers shutting down operations. It will be overtaken by Czech Republic, Germany, Turkey and Morocco.

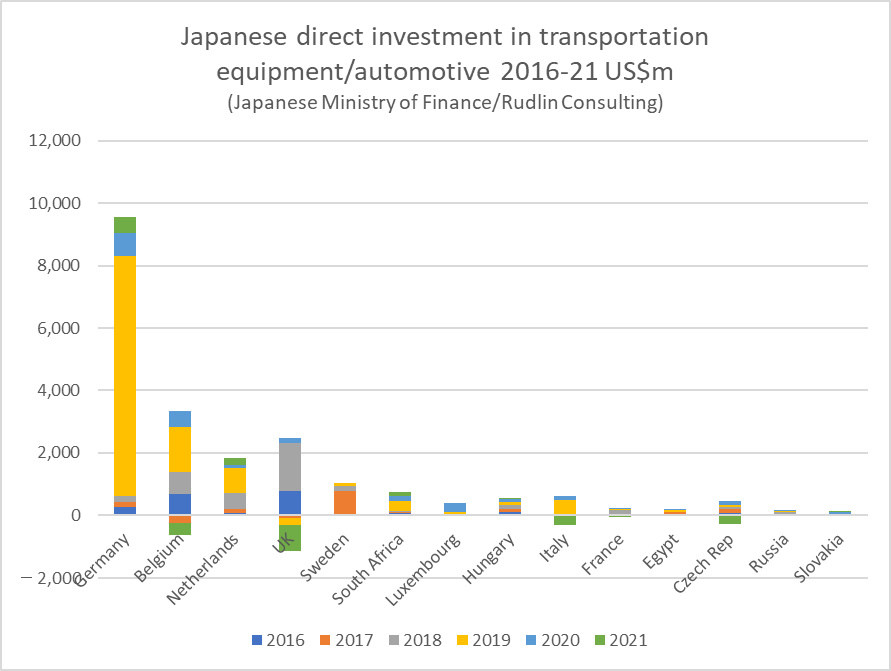

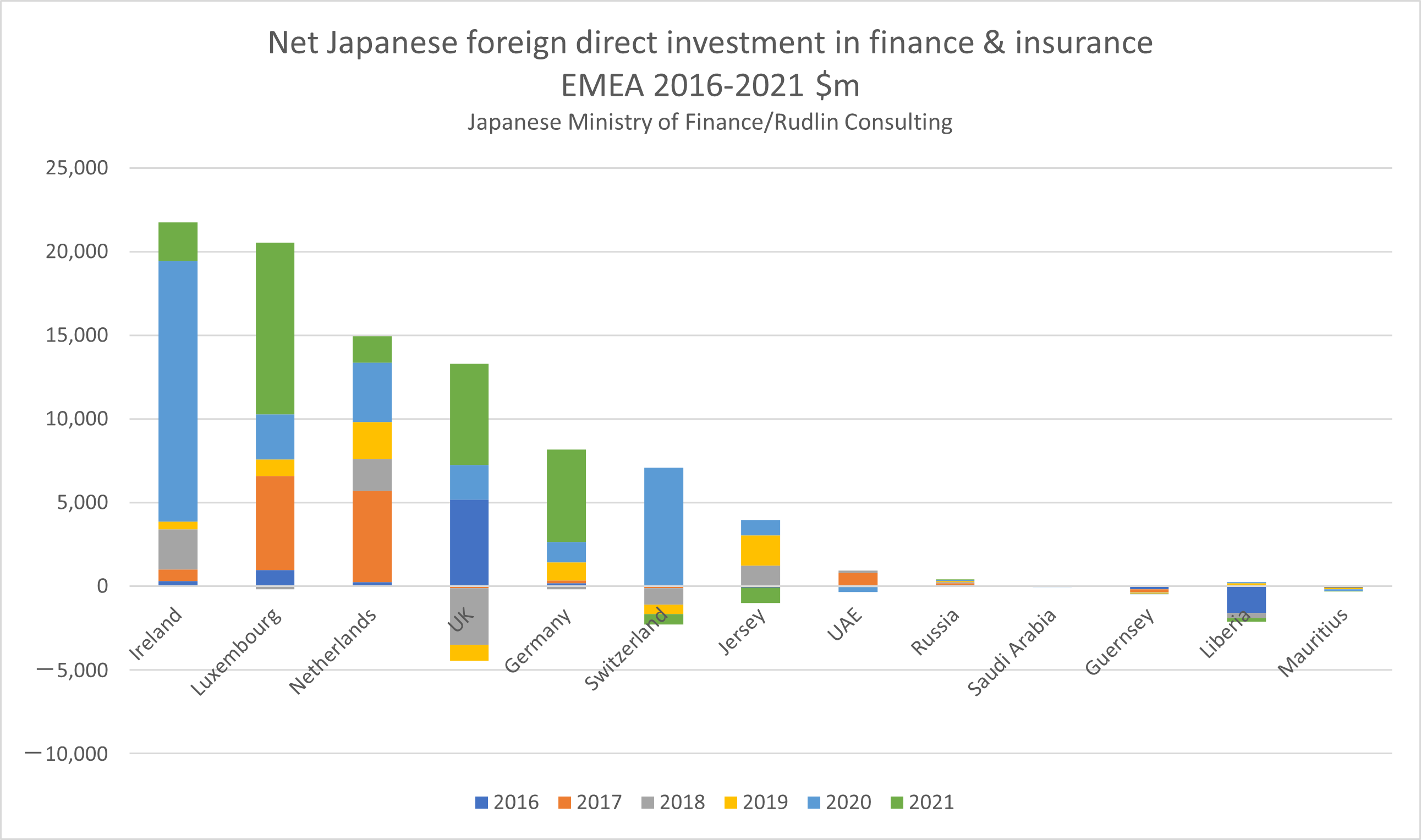

Examining the statistics from Japan’s Ministry of Finance on direct investment flows, it seems the UK benefitted from a big inward investment from Japan into the finance and insurance sector in 2016, then there was net disinvestment in 2017-2019, and then increasing net investment in 2020-21. Conversely, there was little investment into Ireland, Luxembourg or the Netherlands in 2016, but major investments into their finance and insurance sectors in 2017, 2018 and 2020-21.

Examining the statistics from Japan’s Ministry of Finance on direct investment flows, it seems the UK benefitted from a big inward investment from Japan into the finance and insurance sector in 2016, then there was net disinvestment in 2017-2019, and then increasing net investment in 2020-21. Conversely, there was little investment into Ireland, Luxembourg or the Netherlands in 2016, but major investments into their finance and insurance sectors in 2017, 2018 and 2020-21.