Is the UK losing out to the Netherlands as the core of Europe in pharmaceuticals?

The new commissioner of the Netherlands Foreign Investment Agency, Hilde van der Meer, was interviewed in the Nikkei newspaper during her visit to Japan in March 2023. The headline was “becoming the core of Europe with pharmaceuticals” and she outlines in the interview how multinational pharmaceutical companies have opened offices in the Netherlands since the European Medicines Agency moved to Amsterdam after Brexit.

We took a look at our database and can see that one Japanese pharmaceuticals company, JCR, has recently opened an office in the Netherlands. The other, larger, Japanese pharmaceuticals companies were already in the Netherlands long before the EMA move – such as Astellas, Takeda, Eisai, and Daiichi Sankyo. Chugai does not have operations there – its European HQ is still in the UK – but its parent company, Swiss pharmaceuticals company Roche, does have a subsidiary there. Otsuka opened a company in the Netherlands in 2018, which acts as a Marketing Authorization Holder for the EU and in the same year closed its Otsuka Europe Development and Commercialization operation in the UK. Shionogi also opened a subsidiary in the Netherlands in 2018, and the UK subsidiary became a branch of it at the same time, so this may also have been a result of the EMA move. Takeda UK also became a branch in 2018 – but more as a result of the acquisition of Shire, and a subsequent global reorganisation.

This does not seem to have had much impact on the 46 or so Japanese pharmaceuticals and healthcare companies in the UK, however, in terms of numbers employed. We estimate they were employing around 5,000 people in 2022, and this number has grown rather than shrunk since 2016, despite the closure of some smaller companies – Taisho, Anges, Kosei and Summit. Companies which have grown in the UK include Fujifilm Diosynth, now employing over 1,000 people and Eisai, compensating for those which have shrunk their UK presence.

The UK may have lost some influence, but in terms of scale, it is still substantial.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More

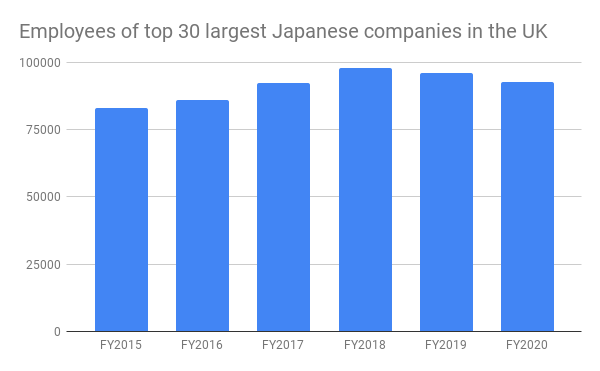

The total number of UK employees of the top 30 Japanese company groups fell 2.6% from 2019/20 to 2020/2021 – a strengthening of the downward trend in employee numbers since 2018/9. The peak of employment by the 30 largest Japanese company groupings in the UK was 97,827 in 2018/9 and this has now fallen by 5,000 to 92,851 employees. The top 30 represent around two thirds of the 137,000 people employed by 1,200+ Japanese companies in the UK.

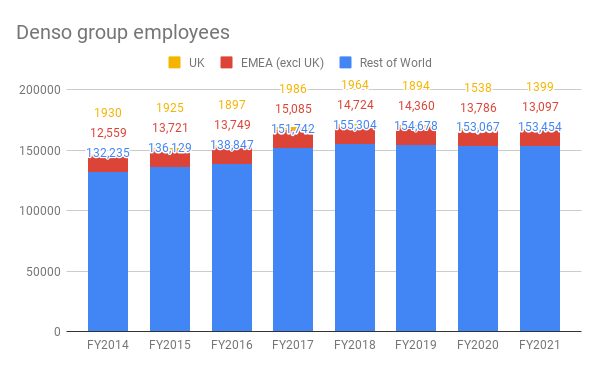

The total number of UK employees of the top 30 Japanese company groups fell 2.6% from 2019/20 to 2020/2021 – a strengthening of the downward trend in employee numbers since 2018/9. The peak of employment by the 30 largest Japanese company groupings in the UK was 97,827 in 2018/9 and this has now fallen by 5,000 to 92,851 employees. The top 30 represent around two thirds of the 137,000 people employed by 1,200+ Japanese companies in the UK. Konica Minolta acquired various UK companies before Brexit, but since Brexit has shrunk down and consolidated its operations in the UK and is focusing more on their European HQ in Germany and also the Czech Republic. The longer term trend of shifting away from manufacturing in the UK, to manufacturing elsewhere in Europe is seen at Denso, the Toyota group automotive parts manufacturer – UK employee numbers peaked in FY2018, and have been falling since, and are now 27.5% below the FY2014 level, whereas employment in the rest of the region is up 4.3% and global employee numbers, excluding UK, have risen 16% since FY2014.

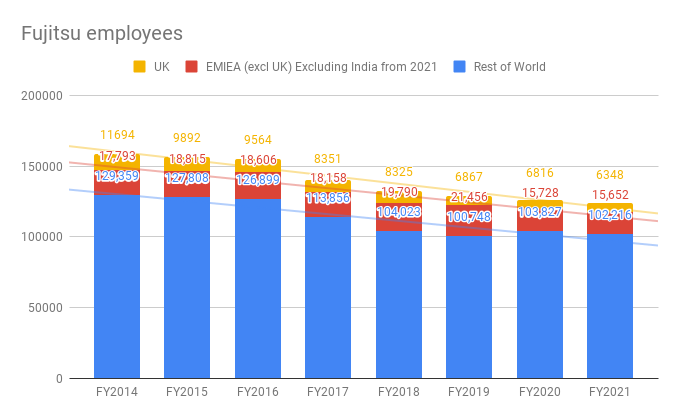

Konica Minolta acquired various UK companies before Brexit, but since Brexit has shrunk down and consolidated its operations in the UK and is focusing more on their European HQ in Germany and also the Czech Republic. The longer term trend of shifting away from manufacturing in the UK, to manufacturing elsewhere in Europe is seen at Denso, the Toyota group automotive parts manufacturer – UK employee numbers peaked in FY2018, and have been falling since, and are now 27.5% below the FY2014 level, whereas employment in the rest of the region is up 4.3% and global employee numbers, excluding UK, have risen 16% since FY2014. Five years’ ago, Fujitsu was the largest Japanese corporate group in the UK, with 9,892 people. It has lost 3,000 employees since, and was the fourth largest Japanese group in the UK in FY2020. As of FY2021, Fujitsu has 6,348 employees in the UK, 45% down on FY2016, compared to a 21% decrease globally, excluding the UK. Growth at Fujitsu has been in India (and Fujitsu’s CTO is Indian) and in its global delivery centres in countries such as Poland and the Philippines.

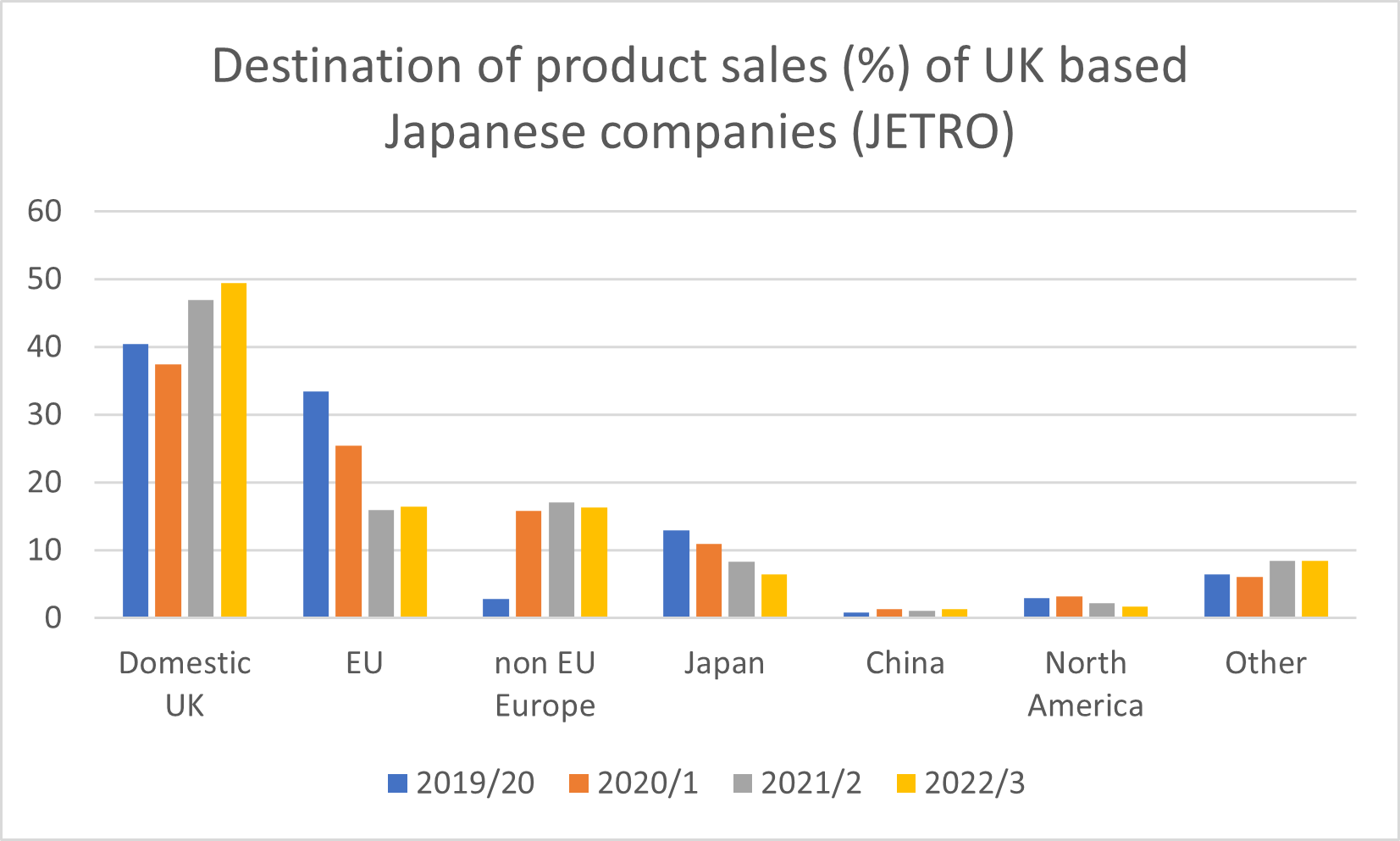

Five years’ ago, Fujitsu was the largest Japanese corporate group in the UK, with 9,892 people. It has lost 3,000 employees since, and was the fourth largest Japanese group in the UK in FY2020. As of FY2021, Fujitsu has 6,348 employees in the UK, 45% down on FY2016, compared to a 21% decrease globally, excluding the UK. Growth at Fujitsu has been in India (and Fujitsu’s CTO is Indian) and in its global delivery centres in countries such as Poland and the Philippines. Japanese companies in the UK are showing an increasing focus on the UK domestic market for their sales, with an average of 49.4% of sales to the UK market, 2.4% up on 2021/2, compared to a European average of domestic sales of 37.7%. UK companies are selling on average 16.5% of sales to EU countries, compared to 37.6% of sales to other EU countries (excluding their own country) for Japanese companies located in the EU. Unsurprisingly, Japanese companies in the UK have become more UK oriented since Brexit, as many of the EU sales and coordination functions have shifted from the UK to the EU – and is now potentially stabilising after the sharp decline over 2019/20 to 2021/2

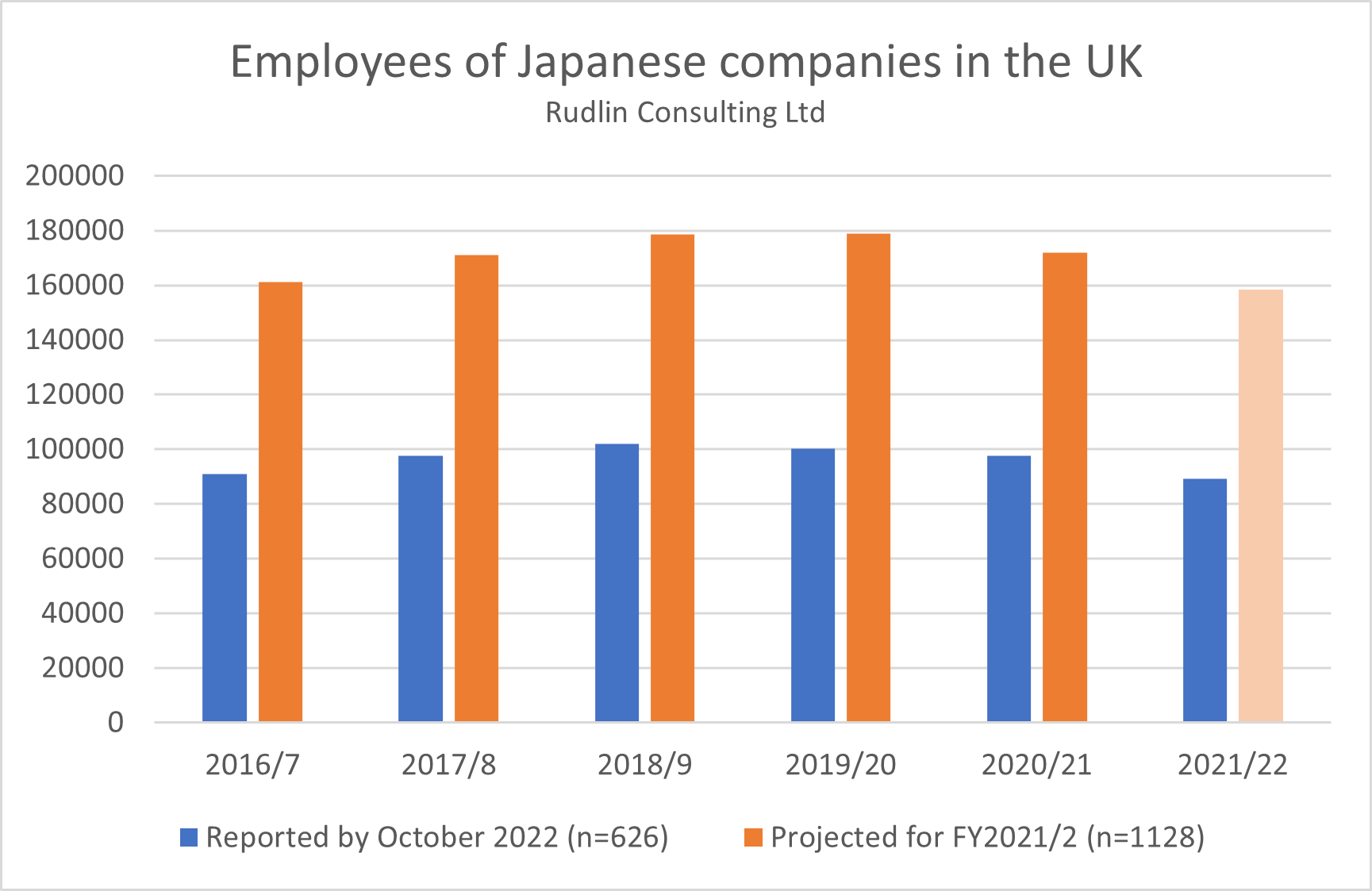

Japanese companies in the UK are showing an increasing focus on the UK domestic market for their sales, with an average of 49.4% of sales to the UK market, 2.4% up on 2021/2, compared to a European average of domestic sales of 37.7%. UK companies are selling on average 16.5% of sales to EU countries, compared to 37.6% of sales to other EU countries (excluding their own country) for Japanese companies located in the EU. Unsurprisingly, Japanese companies in the UK have become more UK oriented since Brexit, as many of the EU sales and coordination functions have shifted from the UK to the EU – and is now potentially stabilising after the sharp decline over 2019/20 to 2021/2 Overall, the total number employed by those Japanese companies in the UK who have reported their results has fallen by 8% over the past year. This is an acceleration of a decline which started three years ago – employee numbers had fallen 3% the previous year, and 2% the year before that. This was preceded by a couple of years of growth from 2016/7 to 2018/9. Projected, this suggests that the number of people employed by Japanese companies in the UK will fall to 158,000 by the end of the financial year 2021/2, below the 161,000 that were employed by Japanese companies in 2016/7 and a 14,000 drop on the numbers employed in 2020/1.

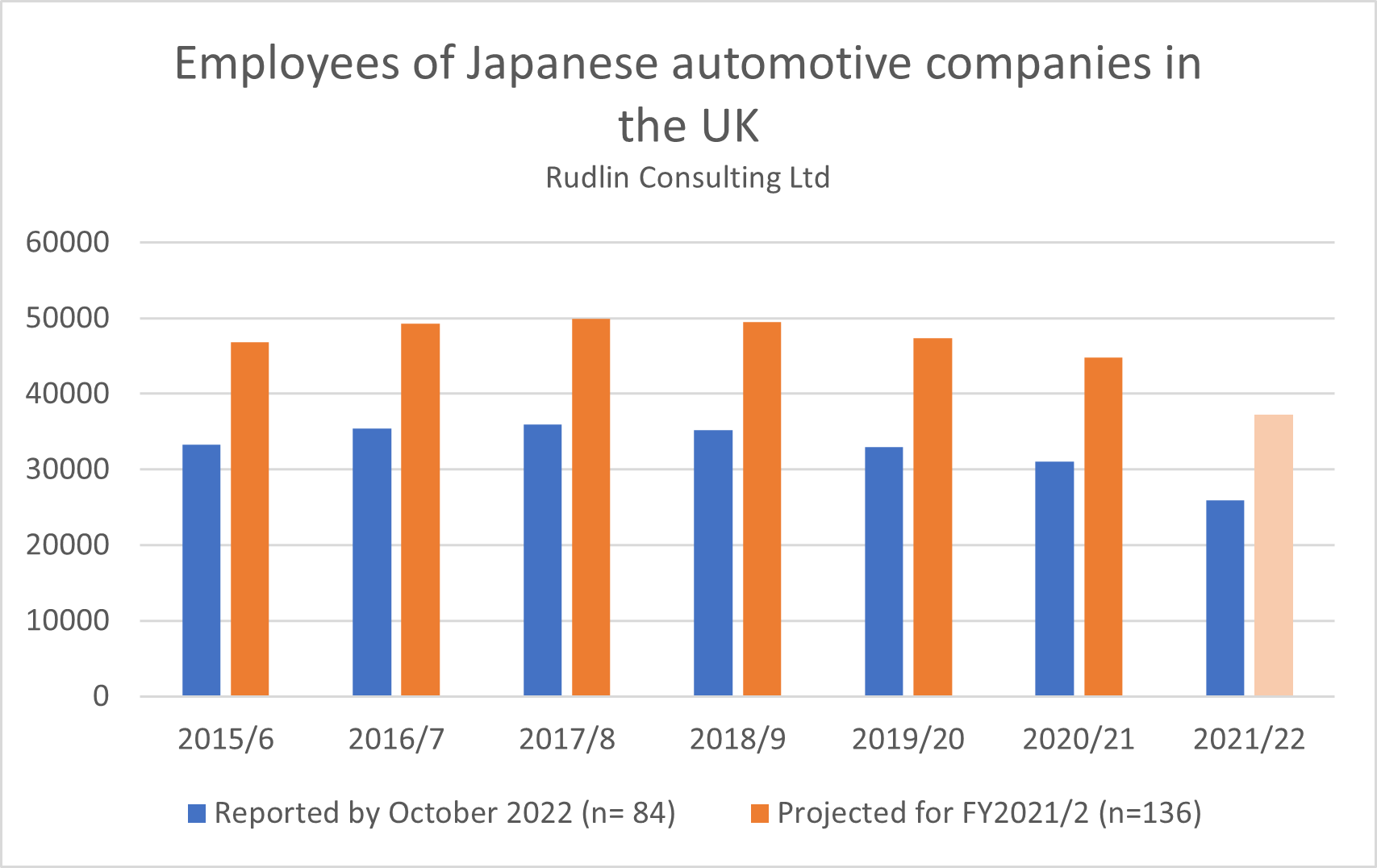

Overall, the total number employed by those Japanese companies in the UK who have reported their results has fallen by 8% over the past year. This is an acceleration of a decline which started three years ago – employee numbers had fallen 3% the previous year, and 2% the year before that. This was preceded by a couple of years of growth from 2016/7 to 2018/9. Projected, this suggests that the number of people employed by Japanese companies in the UK will fall to 158,000 by the end of the financial year 2021/2, below the 161,000 that were employed by Japanese companies in 2016/7 and a 14,000 drop on the numbers employed in 2020/1. It is certainly partly due to the impact of Honda closing its Swindon factory in July 2021. That meant the loss of nearly 3,000 jobs and it looks likely a further 5,000 jobs will have been lost in the automotive sector over the past year – many of which were dependent on Honda. The decline in employment in the automotive sector began in 2018/9, a year or two before other sectors began to lose jobs.

It is certainly partly due to the impact of Honda closing its Swindon factory in July 2021. That meant the loss of nearly 3,000 jobs and it looks likely a further 5,000 jobs will have been lost in the automotive sector over the past year – many of which were dependent on Honda. The decline in employment in the automotive sector began in 2018/9, a year or two before other sectors began to lose jobs.

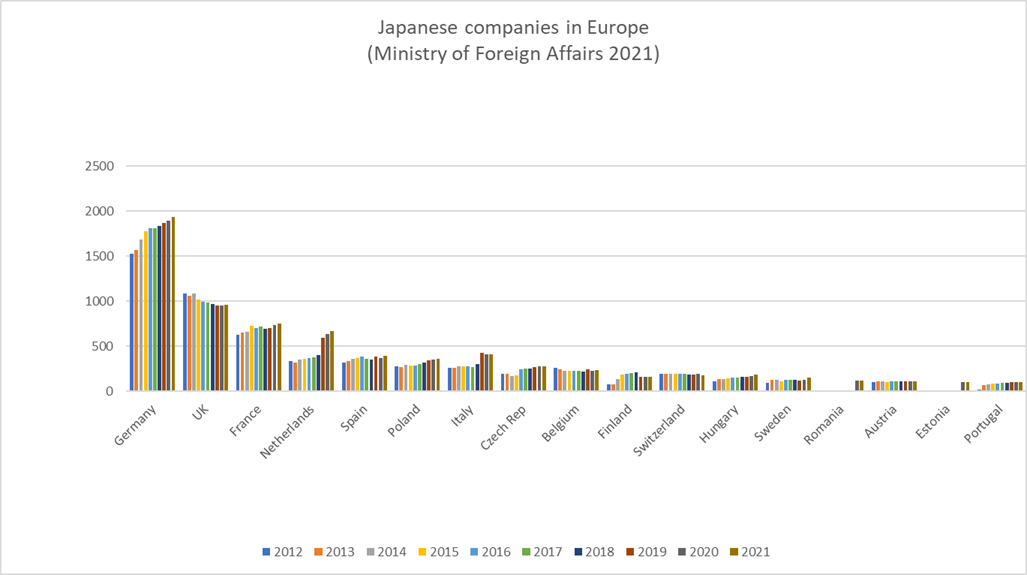

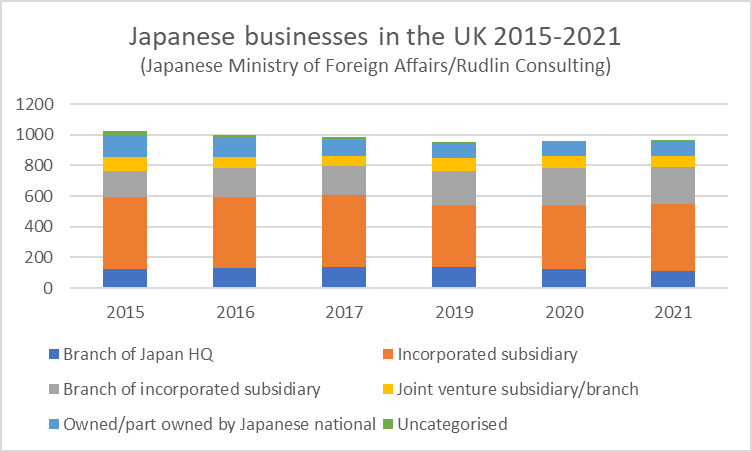

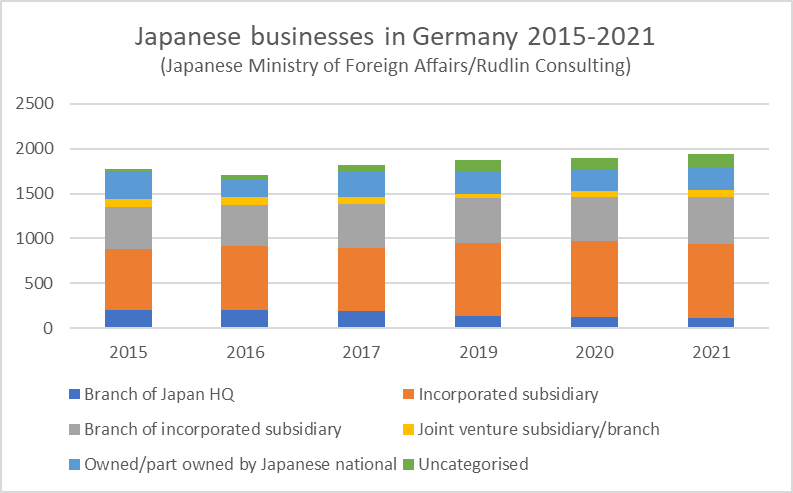

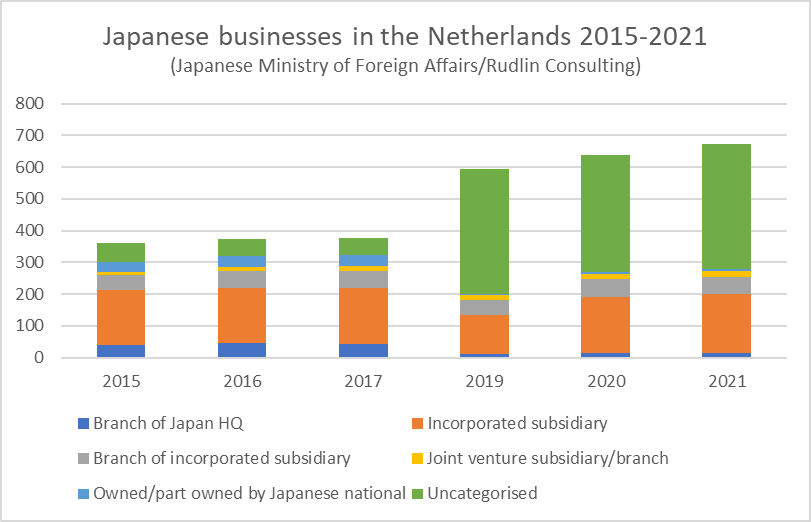

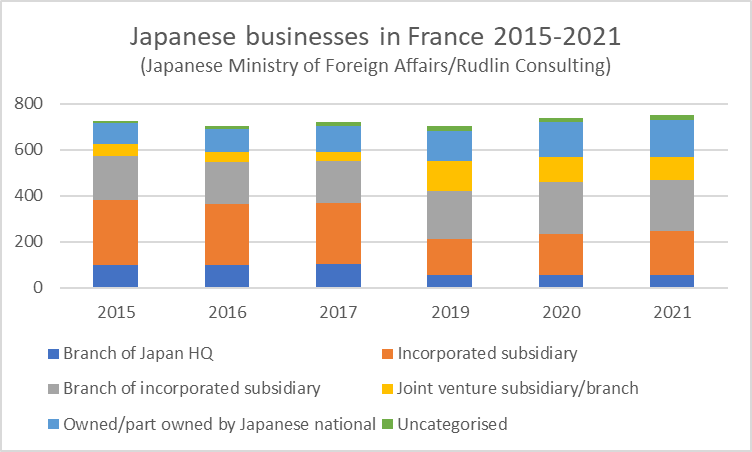

As for the Netherlands, there has been a quintupling of the number of business classified as “uncategorised” from 61 in 2015 to 393 in 2021. These may be brass plate type holding companies. All other categories (incorporated subsidiaries, branches of regional subsidiaries and joint ventures/investments) have increased as well, apart from branches of Japan HQ (which may have now become subsidiaries) and those started by Japanese nationals in the Netherlands. There was an overall rise of 86% of Japanese businesses in the Netherlands since 2015.

As for the Netherlands, there has been a quintupling of the number of business classified as “uncategorised” from 61 in 2015 to 393 in 2021. These may be brass plate type holding companies. All other categories (incorporated subsidiaries, branches of regional subsidiaries and joint ventures/investments) have increased as well, apart from branches of Japan HQ (which may have now become subsidiaries) and those started by Japanese nationals in the Netherlands. There was an overall rise of 86% of Japanese businesses in the Netherlands since 2015.

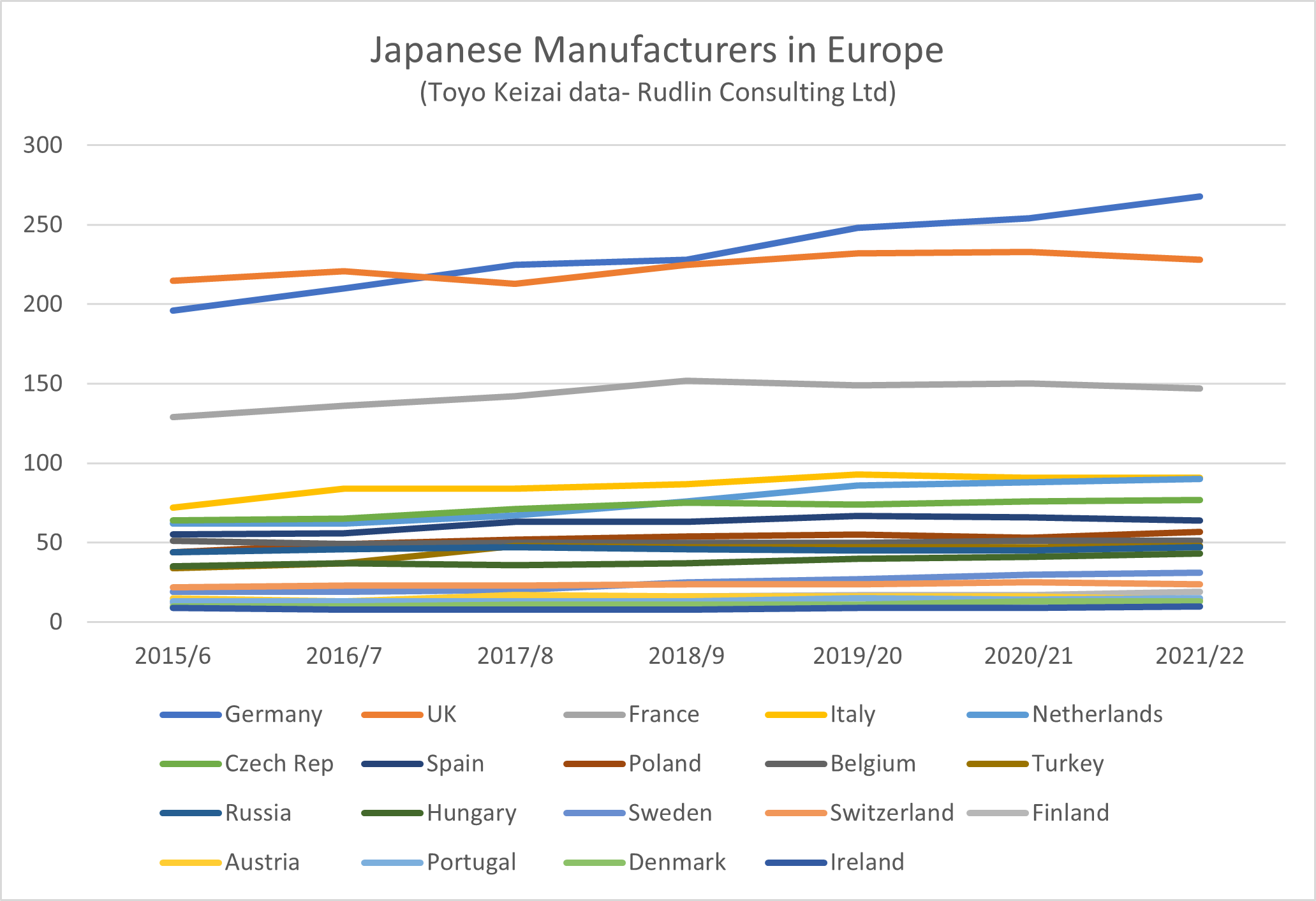

How this compares with other European countries can be seen in the chart on the left – which shows the numbers of all manufacturing companies in Europe, including automotive. According to Toyo Keizai, the number of Japanese manufacturers in the UK dipped around 2017/8, but recovered, with another more recent fall. But there was growth overall since 2015/6, with 228 companies in 2021/2 compared to 215 in 2015/6 – a 6% increase. This is much lower than the overall 20% growth in Europe, and as a consequence the UK is no longer the largest host of Japanese manufacturers.

How this compares with other European countries can be seen in the chart on the left – which shows the numbers of all manufacturing companies in Europe, including automotive. According to Toyo Keizai, the number of Japanese manufacturers in the UK dipped around 2017/8, but recovered, with another more recent fall. But there was growth overall since 2015/6, with 228 companies in 2021/2 compared to 215 in 2015/6 – a 6% increase. This is much lower than the overall 20% growth in Europe, and as a consequence the UK is no longer the largest host of Japanese manufacturers.