Is Sharp still a Japanese treasure?

Sharp Corporation Chairman and President Tai Jeng-wu was the second in command at Taiwan’s Hon Hai when it acquired Sharp in 2016. His cost cutting organisational reforms have turned the company’s results around in a “V” shaped recovery. He is now hurrying ahead with restructuring the business portfolio. In an interview with Nikkei Business he says Sharp is “Japan’s treasure” and is at pains to point out how influenced he has been by Japanese teachers in the past. Japan and Taiwan continue to have good relations (reinforced by a common threat of China, hinted at in this interview with the dig at unfair competition from state owned companies), and many Taiwanese speak excellent Japanese.

He says that unlike Carlos Ghosn, he did not arrive at Sharp with a posse of executives. He feels that the reforms are still only half way but he wants to work alongside Sharp employees – rather than a top down imposed change.

Asked what was the problem at Sharp, he said “it is not for me to say, but I suppose the crisis occurred when there were problems with management in the 2010s – when people who have only had experience in one particular technical area or business become president. You need to have a general overview to be a top executive, so when there was a crisis they were unable to respond. How I fixed the $2.5bn loss was to cut costs by around $1.7bn and then cut back investments and with some transient profits, we were back in the black.”

Don’t be a big fish

“You have to develop people step by step. When I started at Sharp, I said when announcing my strategy that “Sharp should not be a big fish, but should aim to be a fast swimming fish”. So I kept asking every day for things to speed up. I set some rules for developing successors. I lowered the limit requiring presidential approval to Y3m ($27,000). That was to ensure I would be aware of all the company’s problems. I then increased the limit to Y20m ($184,000) in 2018 when I put the CEO structure in place and this year I increased the limit to Y100m.”

“I will stay on as chairman of Sharp until March 2022. My wife and family want me back in Taiwan though. All the time from 2016 I have been looking for a successor. I even asked a Japanese consultant to help, but I cannot find one. I want the successor to be Japanese – it doesn’t matter if it’s an internal or external appointment. Maybe it could be someone from Hon Hai even. They should be able to manage in the current harsh environment, covering a wide range of businesses and find synergy with Hon Hai. It is the second criterion that makes finding the right person difficult.”

Japanese managers became bureaucrats

“It used to be that Japanese management of factories and businesses were strong, and my teachers were all Japanese. But then Japan went into a recession and the founder managers all disappeared, and managers became bureaucrats. That is why management strength declined. Japan is now only strong in parts and materials. ”

Sharp’s employee levels are back to the same as before the management crisis. “There were two early retirement drives during the crisis, and a lot of good people left. Those who remained when I joined the company in 2016 were one of three types – highly capable and loyal, those who couldn’t find another place to go and those where were waiting to be pushed. I actually never cut employees. In fact we need to increase our employees – we had some influxes from when we took over Toshiba’s PC business and other M&A.”

“I am not a god, I just improved everything step by step”

“I renegotiated the contracts for solar battery procurement and saved around $100m. I have also brought the Sharp brand back in house for the US TV production business. A brand is like a person’s name. Selling it is wrong. During the crisis Sharp sold off its precious buildings for $188m and then spent $30m on out of date computing. I am not a god, I just improved everything step by step. I was taught to do Horenso (keeping bosses in the loop) and check everything thoroughly, not just sign off easily by Japanese teachers.”

I am now promoting management based on data, and a shift to B2B (business to business). B2C (consumer) business is currently 65% of our turnover, I want to make it 50/50. The structure of trade in B2C is unfair – companies like ours in a free trade country have to compete with state owned companies who don’t have to invest or write off so much. That is why Japan’s IT/electronic companies’ share is falling – it’s a structural problem. In B2B it is a fairer fight. W have built a good ecosysytem over many years, so we have a good chance.

A Rising Sun Alliance of Japanese electronics companies

“I think there should be a Rising Sun Alliance of Japanese companies. There are a lot of Japanese electronics manufacturers but I don’t see that they will merge -t here is too much pride. I do have to be careful as Hon Hai is not a Japanese company. I am reflecting every day on how to manage employees. If I am criticised, it is not just my, but Taiwan’s pride at stake.”

“Sharp will last over 100 years. It is a treasure of Japan. I would like the brand to last another 100 years. I come to the office every day before 7:00am and give a bow to the statues of the founders in the front entrance. Sharp is a treasure to me too.”

Nikkei Business comments that there is no doubting his sincerity and dedication – apparently he lives in a single man’s dormitory and walks round the factory at 5am in the morning thinking about Sharp. He is at pains to seem almost more Japanese than the Japanese in this. But, the Nikkei wonders, will this be enough to succeed in the new territory for him and Sharp of B2B platform business.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More

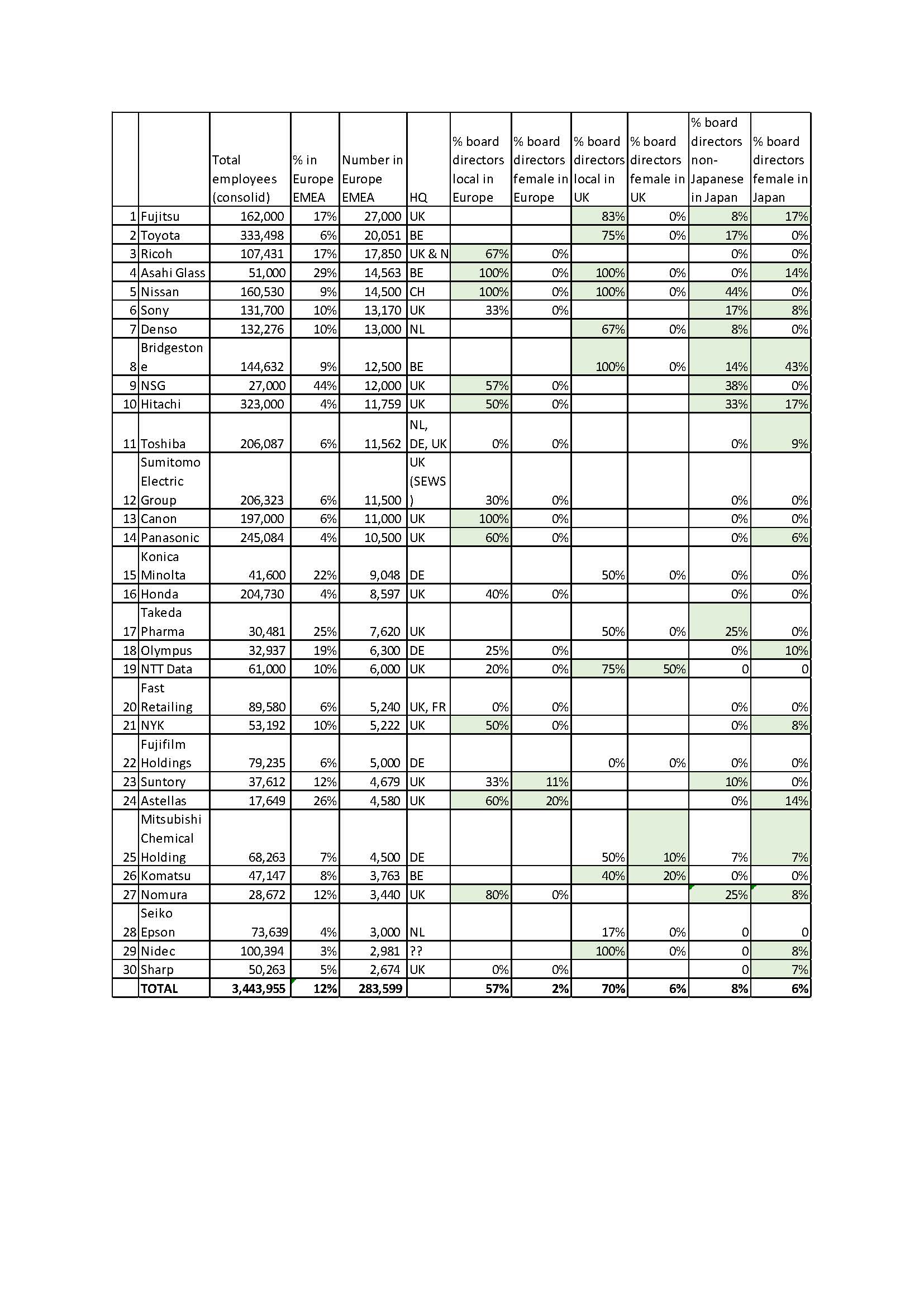

Although around 10,000 manufacturing jobs in Japanese electronics companies in the UK were lost in the 1990s-2000s, about the same number have been added, either created by Hitachi Rail or in the automotive or air conditioning sectors. Japanese electronics companies such as Sony, Fujitsu, Panasonic, NEC, Mitsubishi Electric and Hitachi still all employ thousands of people in the UK.

Although around 10,000 manufacturing jobs in Japanese electronics companies in the UK were lost in the 1990s-2000s, about the same number have been added, either created by Hitachi Rail or in the automotive or air conditioning sectors. Japanese electronics companies such as Sony, Fujitsu, Panasonic, NEC, Mitsubishi Electric and Hitachi still all employ thousands of people in the UK.