Hitachi’s new risk management

Up until now, Hitachi’s risk management team was mainly centered on the legal department – which I suspect is probably the case in most Japanese companies. Now Hitachi’s President Keiji Kojima has added the finance department to it, wanting the company to take a more proactive approach to global risks. The aim is to visualize risks – such as the impact of the economic slowdown in Europe due to the Ukraine crisis and soaring component costs due to inflation – and respond quickly.

When Russia invaded Ukraine, GlobalLogic was empowered to act quickly to evacuate 7,200 local employees in the country – and was told that they could put off contacting Japan HQ until later. By the end of April, remote working and overseas bases had been put in place and the operations were back up to 95% level.

Hitachi’s overseas business has expanded recently thanks to the acquisition of US company GlobalLogic and the power grids business of ABB, now Hitachi Energy.

Strengthening the risk management system is one response to this, along with introducing a global standard job description system to the Japanese organisation, aiming to have 30% women and 30% non-Japanese representation ont he board by 2030, aiming for zero carbon by 2050. Five out of the 9 external directors are non-Japanese.

Hitachi has learnt from past failures in overseas expansion, such as the Horizon Nuclear Power project in the UK, and the failure of a joint venture thermal power project in South Africa.

These changes have impacted the way the board operates. Now, when an executive officer reports that a plan has not been achieved, the non-Japanese directors respond “so?” – by which they mean, don’t just report the result, tell me what you are going to do next. A former external director of Hitachi, Harufumi Mochizuki comments in the Nikkei that “thanks to training by foreign directors, the executive officers have acquired a world class management style, and the ability to action, with a sense of speed.”

The next challenge for Hitachi will be to make the best use of the global human resources that it now has thanks to its acquisitions. Only three of Hitachi’s 34 executive officers are non-Japanese. The Nikkei comments that these changes are very much in line with the vision of Mr Nakanishi, the former President and Chairman who died in 2021, for an organisation with world class leaders who can respond quickly to global risks.

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More LinkedIn

LinkedIn YouTube

YouTube

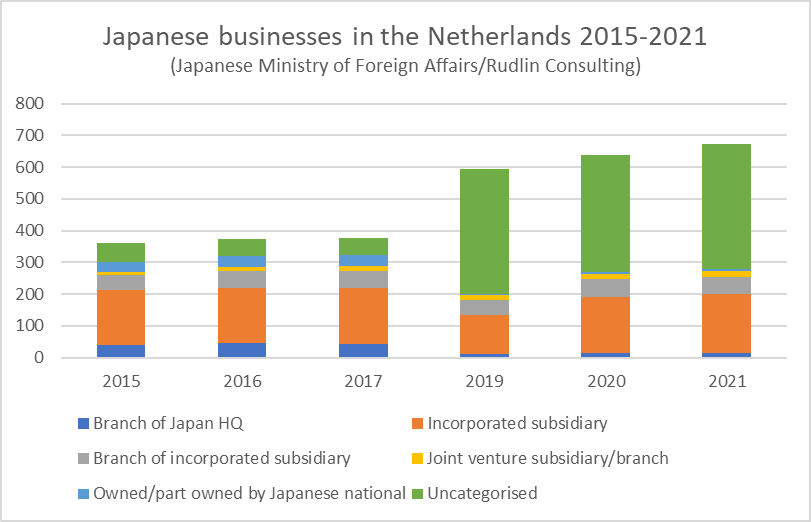

Partly this is due to the large proportion of potentially “brass plate” type Japanese companies, with no employees in the Netherlands – often the regional holding company for a group of companies. Partly it is due to the lack of disclosure – information on companies in the Netherlands does not seem to be as readily available as it is in the UK, where data on

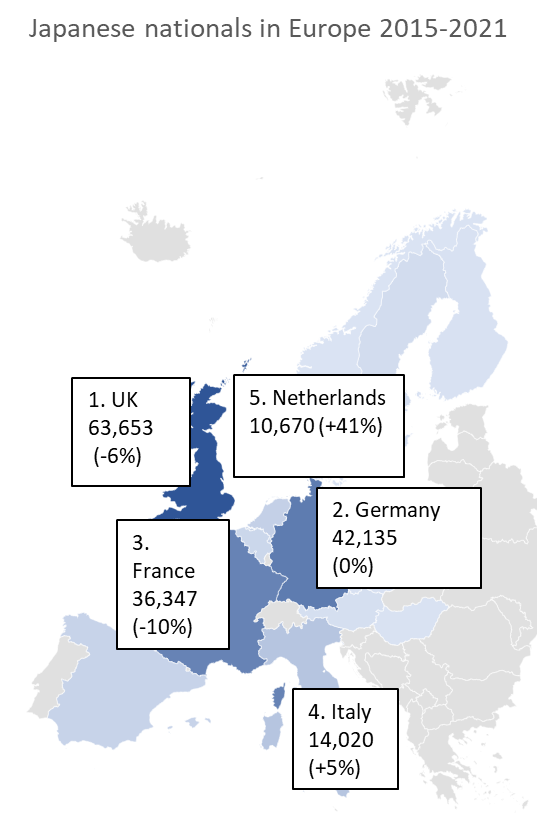

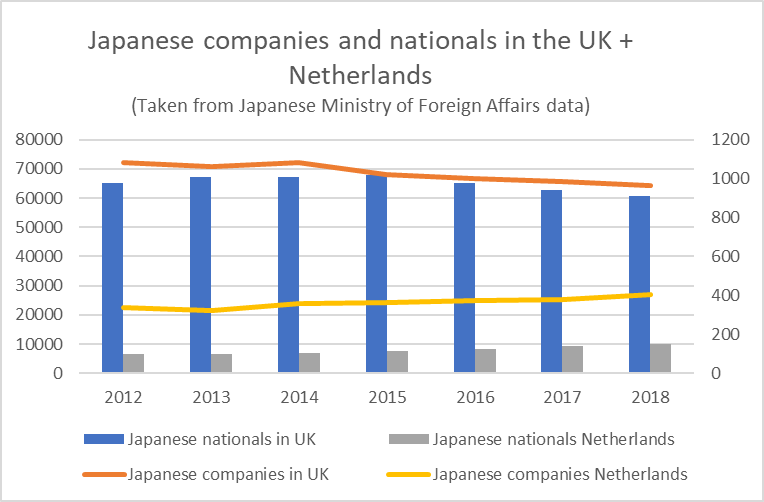

Partly this is due to the large proportion of potentially “brass plate” type Japanese companies, with no employees in the Netherlands – often the regional holding company for a group of companies. Partly it is due to the lack of disclosure – information on companies in the Netherlands does not seem to be as readily available as it is in the UK, where data on  potential customers or employers, it is important to understand this, as the regional headquarters tend to be where the decision makers, big budgets and the most interesting career paths will be based. The number of Japanese expatriates in the country is also an indication of where the decision making influencers are. Although the Netherlands is only the 5th largest host of Japanese nationals in Europe, after the UK, Germany, France and Italy, this number has grown 41% since 2015.

potential customers or employers, it is important to understand this, as the regional headquarters tend to be where the decision makers, big budgets and the most interesting career paths will be based. The number of Japanese expatriates in the country is also an indication of where the decision making influencers are. Although the Netherlands is only the 5th largest host of Japanese nationals in Europe, after the UK, Germany, France and Italy, this number has grown 41% since 2015. The companies we have identified employ around 48,000 people, a 29% increase on 2017/8 – the vast majority (39,000) of whom work for the Top 30 employers in the Netherlands. Japanese companies in the UK, by comparison, employ around 170-180,000 people, and there has been a slight decline in numbers over the past 5 years.

The companies we have identified employ around 48,000 people, a 29% increase on 2017/8 – the vast majority (39,000) of whom work for the Top 30 employers in the Netherlands. Japanese companies in the UK, by comparison, employ around 170-180,000 people, and there has been a slight decline in numbers over the past 5 years.

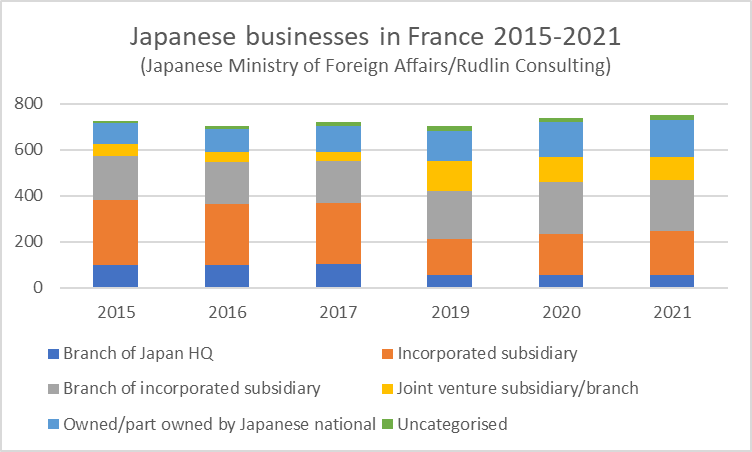

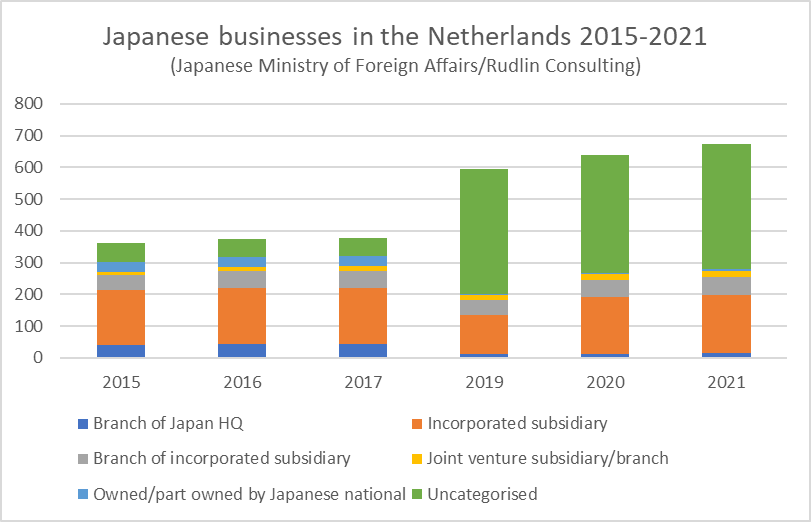

As for the Netherlands, there has been a quintupling of the number of business classified as “uncategorised” from 61 in 2015 to 393 in 2021. These may be brass plate type holding companies. All other categories (incorporated subsidiaries, branches of regional subsidiaries and joint ventures/investments) have increased as well, apart from branches of Japan HQ (which may have now become subsidiaries) and those started by Japanese nationals in the Netherlands. There was an overall rise of 86% of Japanese businesses in the Netherlands since 2015.

As for the Netherlands, there has been a quintupling of the number of business classified as “uncategorised” from 61 in 2015 to 393 in 2021. These may be brass plate type holding companies. All other categories (incorporated subsidiaries, branches of regional subsidiaries and joint ventures/investments) have increased as well, apart from branches of Japan HQ (which may have now become subsidiaries) and those started by Japanese nationals in the Netherlands. There was an overall rise of 86% of Japanese businesses in the Netherlands since 2015.