5 types of Japanese colleagues who are “workstyle reform” blockers

I was surprised to see this explanation of five generations of “workstyle reform” blockers in the Nikkei Business magazine came with a big red caution notice to readers not to take offence. The categories are not to be taken as hurtful stereotypes but based in research, and do not apply to all people of a particular age group, they explain.

So with that in mind, here’s a precis of the 5 types identified. Even though I’m not Japanese, I’m afraid I do recognise aspects of myself in the “middle manager” category, and am trying not to take offence. Although some of the characteristics are obviously derived from each age group’s experiences of the Japanese domestic economy and society, I am also reminded that there is plenty of evidence each generation around the world has complained about the other generation for the past thousand years or more.

1. The Veteran

Born between 1947-1951, so 66-71 years’ old

- Work comes first

- Believes in the virtue of hardship

- Over strong sense of competition

- Clings to past experiences of success

- No intention of changing how they work

- Gets angry if their way of working is rejected

- Will oppose competitors’ opinions regardless of content

- Caught up with “how things were” in the past.

2. The Executive

Born between 1952-1960 so 57-66 years’ old

- Don’t rock the boat – doesn’t want to challenge

- Laissez-faire

- Always talks about “ideally”

- People are people, I am what I am

- Rather than change workstyle, is interested in what happens after retirement

- Uninterested in reform, regardless of content

- Just wants results, doesn’t make concrete proposals

- Won’t listen, as retiring soon anyway

3. The middle manager

Born between 1961 and 1970, so 47 to 57 years’ old

- Superficial

- Thinks too highly of self

- Extremely hedonistic

- Sees everything in cost/benefit, mercenary terms

- Reform should be done cheerfully, enjoyably without trying too hard

- Won’t do it if not fun

- Will oppose anything which increases own workload

- Tells everyone to do their best and doesn’t do anything themselves

- Will change the content of any reforms on a whim

4. The shop floor leader

Born between 1971 and 1986, so 31-47 years’ old

- Pessimistic

- Not good at interacting with other people

- Prioritize risk avoidance

- Strong sense of resignation – “they won’t understand”

- “If this reform fails, there is no future for me”

- Won’t promote reform if don’t trust the company

- Too busy watching others’ reactions to say own conclusions

5. The staff member

Born between 1987 and 1994, so 23 to 31 years’ old.

- Little sense of crisis

- Not good at making an extra effort

- Prioritizes personal life

- Everything in moderation

- “Is reform really necessary?” Won’t do it unless feels it’s necessary

- Let other people take up new challenges or jobs requiring some thought

- No empathy with the reasons behind the reforms

- Doesn’t take the company so seriously, ignores directions

For more content like this, subscribe to the free Rudlin Consulting Newsletter. 最新の在欧日系企業の状況については無料の月刊Rudlin Consulting ニューズレターにご登録ください。

Read More LinkedIn

LinkedIn YouTube

YouTube

“We don’t have any room to store increased stocks” says Hiroshi Seko, the UK MD of G-TEKT, a Japanese automotive supplier.

“We don’t have any room to store increased stocks” says Hiroshi Seko, the UK MD of G-TEKT, a Japanese automotive supplier.

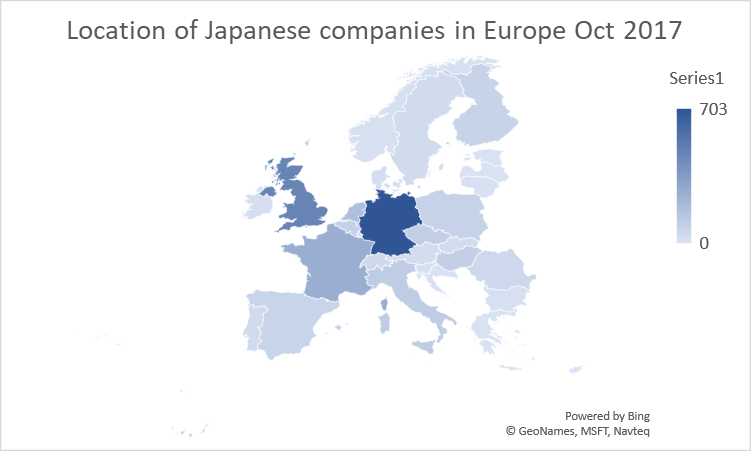

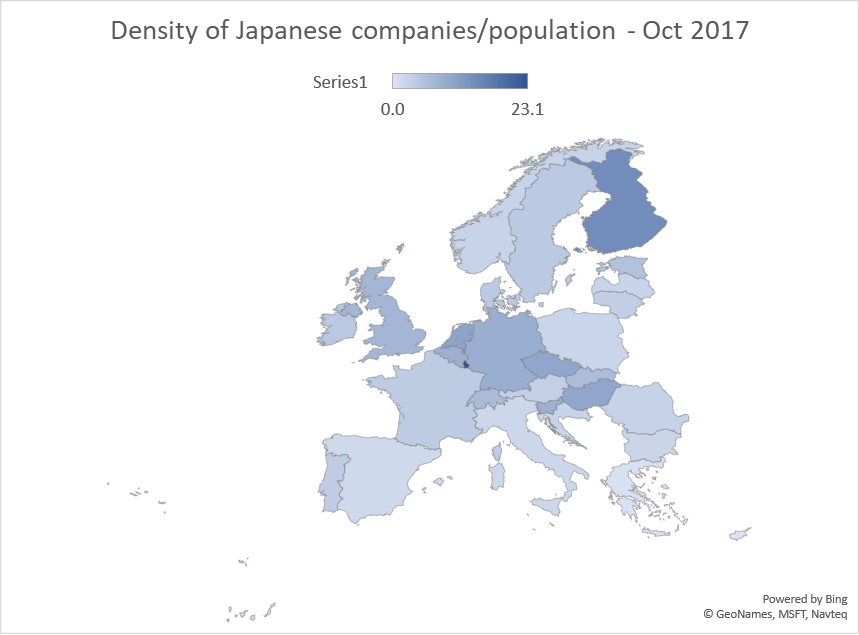

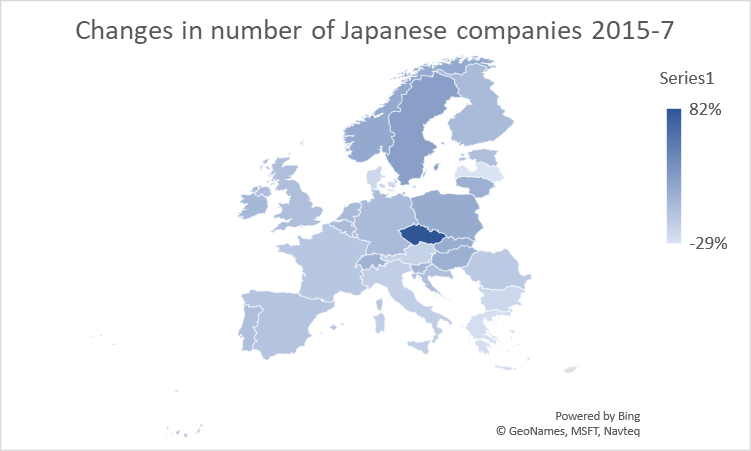

On the face of it, it looks to have been a good couple of years’ for

On the face of it, it looks to have been a good couple of years’ for